Euronext wins against its Swiss and German rivals to buy the Milan Stock Exchange.

The London Stock Exchange (LSE), owner of Borsa Italiana, has entered into

“exclusive negotiations”

with the pan-European stock exchange operator which manages the Paris, Brussels, Amsterdam, Lisbon, Dublin and Oslo stock exchanges.

The amount of the transaction, kept secret, would be between 3.5 and 4 billion euros according to Bloomberg.

To increase the odds on its side, Euronext has joined forces with Italian players, Cassa Depositi e Prestiti (Caisse des Dépôts) and Intesa Sanpaolo bank.

These establishments will also acquire a stake in Euronext.

“This is the culmination of a fairly competitive auction process against very powerful and determined competitors

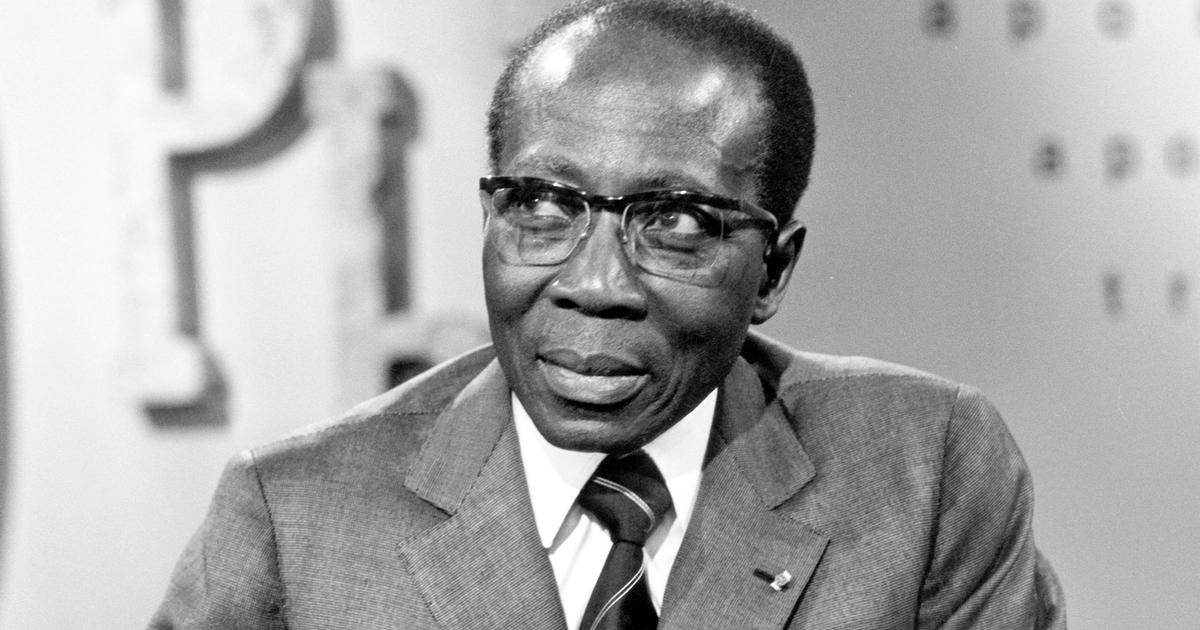

,” explains Stéphane Boujnah, CEO of Euronext.

Our project is, moreover, natural because we have a federal system. ”

The battle to get their hands on Borsa Italiana was particularly hotly contested, with Swiss operator SIX Group and

This article is for subscribers only.

You still have 54% to discover.

Subscribe: 1 € the first month

Can be canceled at any time

Enter your email

Already subscribed?

Log in