Business

Insurance

Following the banks: When will the insurance companies defer premium payments?

Like the banks that make it possible to defer mortgage payments, there is also a call for insurance companies to allow the deferral of payments of the various insurance premiums to insured persons who have gone out to the IDF.

Tags

Insurance

Dr. Udi Frishman

Wednesday, 23 September 2020, 14:32

Share on Facebook

Share on WhatsApp

Share on general

Share on general

Share on Twitter

Share on Email

0 comments

Honeysuckle Cohen Experis Information Security

Actress and Israel Prize winner Lia Koenig Stolper at the ceremony ...

Israel signs peace agreement between the United Arab Emirates and Bahrain: ...

Closing of the holidays: Schools and kindergartens are closed, learning ...

The restaurateurs break plates in protest against the closure: "We are broken" ...

Video of the Australian recycling industry angle

State Comptroller: Various and unemployed data do not receive a grant ...

Orit Yehezkel - Manpower - Placement Companies

Donated bone marrow donation from Zion

In the video: Restrictions on prayers during the holiday closure (Photo: Reuters)

These days, when hundreds of thousands are sent to the IDF and tens of thousands have been fired from their jobs, the public is forced to significantly tighten their belts and adjust the management of the family cell economy to the new flow or more precisely, to stop the flow. In the second stage, when there is no choice, the meat is also cut.

One of the family expenses that is sometimes perceived as 'whipped cream' is the health insurance.

Although in the event of termination of employment for any reason, in most policies, the insured is entitled to continue the insurance privately without underwriting and without a health declaration and even reduced cost, but as mentioned, many are unaware of this and we witness a phenomenon

Although

it

is not yet absolute numbers that indicate the extent of the cancellation, but the cases are piling up, and this is a very problematic phenomenon, which can take a very heavy toll on the public who need to understand in depth the necessary need for continuity of health insurance. And allow policyholders to defer payment of the premium for a limited period of time without compromising their eligibility.In the

meantime, it is likely that quite a few readers are debating whether to hoist the ax on the private insurance expense component.Here are all the information you need to know when considering this option.

More on Walla!

NEWS

The most fun / interesting / original activities to spend a perfect summer with the grandchildren

In collaboration with Beit Balev

To the full article

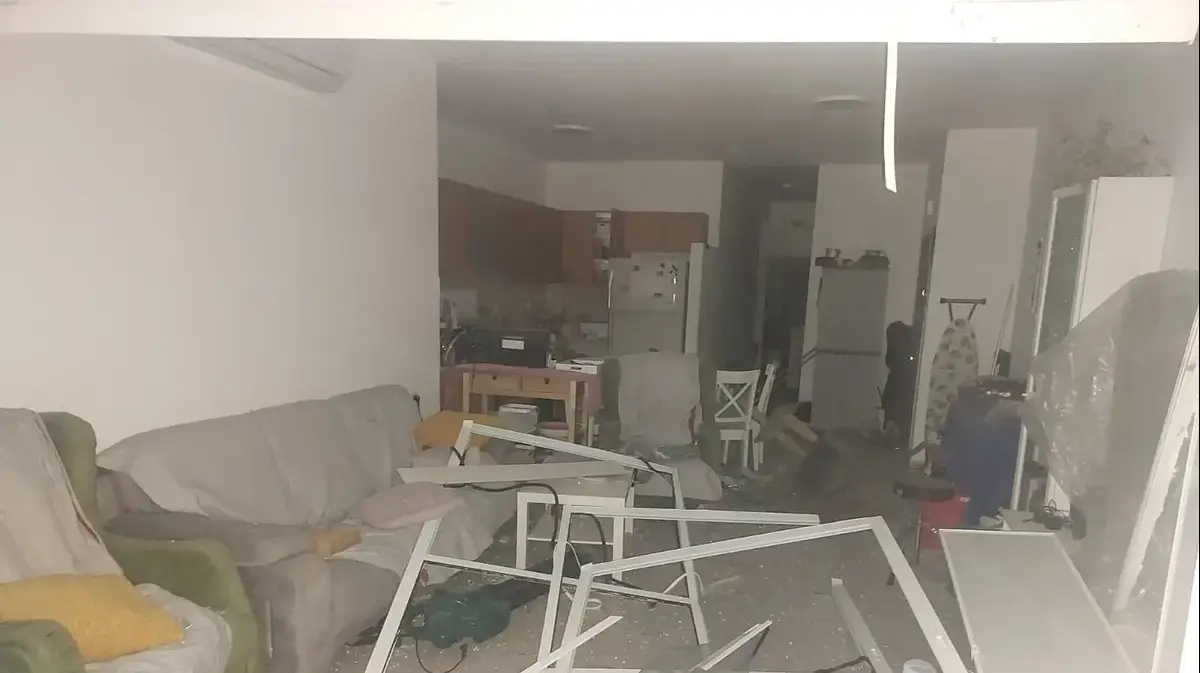

If there is no money, how do we pay hundreds of shekels a month for insurance?

(Photo: Reuven Castro)

A couple of parents have difficulty financing the purchase of school shirts for the three children.

One of the proposals is to cancel health insurance and channel the money saved for this purpose.

What effective solution exists for them?

The economic situation for many Israelis is certainly sleep deprived, but the particular difficulty now dealing with reducing cell revenue is immeasurably smaller than it would be in the event that one family member became ill and needed to fund a medical procedure or life-saving treatment.

In such a case, it is not tens or hundreds of shekels, but tens or hundreds of thousands of shekels.

It is possible to dig into the depth of the expense flow and find more items that can be cut, but it is not advisable to touch health insurance.

It is possible, for example, to temporarily reduce the cost of the policy and offset 50% of the amount of the premium, by notifying the insurer of the need for the most essential coverages.

In any case, my advice is by no means to give up coverage for drugs that are not included in the health basket and for coverage for treatment with expensive medical technologies that cannot be performed in Israel.

Ok, you convinced, but some of the public have additional sources of income and they can deal with a steep and temporary drop in cash flow, so maybe the demon is not so terrible?

True, many have savings, but when it comes to a large heroic expense of a drug that is not included in the health basket or a complex surgery overseas few are the families whose savings can fund that expense.

And what happens to the group health insurance of those who go to the IDF?

As far as the insurance company is concerned, it will not stop the employee's entitlement to health insurance because of the sick leave. However, vigilance must be exercised. For this in the workplace and not to find out that in the moment of truth you were left without insurance.

The policy does not cover corona, but covers other complications of the disease (Photo: Reuters)

If I have coverage for serious illnesses, can I activate it in case I got sick in Corona?

A critical illness policy does not cover corona per se, but can certainly cover corona complications.

If because of the corona I went through, for example, a stroke or a heart attack or any other illness that is covered by the policy and was caused to me as a complication of the corona - it will be covered.

In practice, an amount is determined in each and every policy {according to the amount of the premium to be paid to the insured for disease controls defined in the policy.

There is still no study linking corona to the outbreak of other diseases.

Is there no attempt here to intimidate the insured public?

This is inaccurate to say the least.

More and more studies are showing that corona has long-term effects on our health.

Patients who have recovered from corona may suffer from various and varied complications both medically and mentally.

According to a study conducted in the UK, about 55% of the 1,261 patients examined suffered from a decrease in heart function after the disease, there are quite a few descriptions of a significant decrease in lung function and more.

In Corona the hidden prevails over the visible but unfortunately even after the outbreak of the plague many will have to deal with its consequences.

Let's talk about a cure or vaccine for corona.

Is there any possibility that they will not enter the health basket?

On the face of it, the likelihood of this is low.

What will probably happen is that the vaccines will not enter the basket en masse for the general public in the first wave.

In addition there are two variables that are still unclear: when will the vaccine or drug development procedure be completed and what will be their price.

Even if they are fully covered, a period of time will pass from the moment the vaccine or drug is marketed until they enter the basket for the general public in Israel.

Dr. Udi Frishman

I recovered from Corona and I want to buy health insurance but the insurance company refuses to insure me.

Is there a chance she will change her mind?

There is no reason not to insure a corona patient who has recovered from the disease and has not suffered from any complications.

It is true that the long-term effects of the disease are not yet fully known, but it is an actuarial risk that can be assessed and priced.

However, the condition of those who recovered from corona after suffering from complications of the disease is more complex and therefore one can understand the reluctance of insurance companies to insure such patients.

But here, too, there is room to examine each case on its own merits.

As the insurance company becomes hesitant it can be provided with an external expert opinion regarding the nature and level of the risk.

Can the insurance companies ask me questions about Corona?

Insurance companies may ask questions about any subject except genetics. The insurance companies take a risk, and in order to be able to manage it and price it and pay the insured one day, they must receive information. Insurance companies are not gambling companies but companies that consciously take a risk that can be calculated and financed and therefore have the right to ask questions. However it is still too early to know what the long-term effects of the corona will be and as a result what the underwriting bureaus of the disease will be.

The author is an expert in health insurance and health policy who previously served as vice president of the Phoenix Insurance Company and as deputy director of Assuta Hospital, currently chairman of Peresh Concept.

Share on Facebook

Share on WhatsApp

Share on general

Share on general

Share on Twitter

Share on Email

0 comments