Voracious actors, ready to do anything to recover the sums due, even if it means using harassment and putting the consumer's head.

This is the portrait of collection companies depicted by a study, published this Thursday by UFC-Que Choisir.

According to 400 files studied by the consumer association, reports concerning the actions of collection companies increased by 15%.

“French households are thrown into the pasture of these companies with scandalous practices.

All because of the recklessness of the banks!

»Denounces Matthieu Robin, project manager at the UFC-Que Choisir.

Nearly 1,700 euros per borrowing household

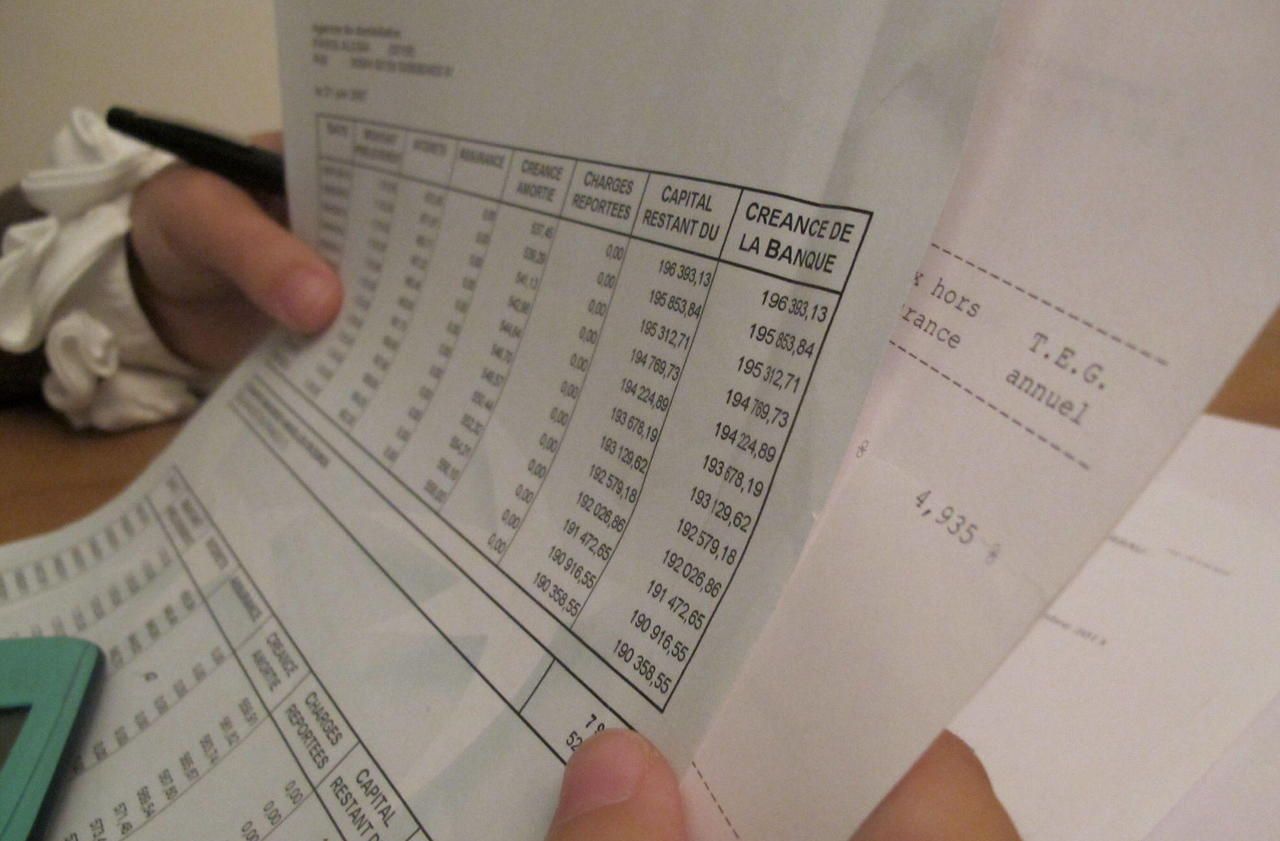

This increase in litigation finds its source, according to the study, in the explosion of unpaid credits.

As of June 2020, they reached 22 billion in France, according to the European Banking Authority (EBA), all credits combined (consumption and real estate).

This is 1.6% more than in December 2019. This represents nearly 1,700 euros per borrowing household, or nine times more than in Germany (191 euros).

“It's no wonder.

With the impact of the economic crisis, individuals are finding it difficult to repay their loans taken out before the Covid, ”explains Estelle Brack, founder of the KiraliT strategy firm and economist specializing in banks.

READ ALSO>

Consumer loans: with the crisis, the UFC fears an "explosion" of unpaid bills

Faced with this shortfall, and the costs it generates, the banking networks resell these so-called “rotten” credits at a ridiculous price to outside companies, most often collection companies.

"Banks prefer to free themselves from internal procedures which involve mobilizing human resources", explains Thierry Gingembre, president of the National Union of Collection and Commercial Information Firms (ANCR).

Free up bank balance sheets for the recovery

This practice, legal and current, is set to increase in the months to come.

Last December, in fact, the European Central Bank (ECB) issued a directive on these “non-performing loans”

(Editor's note: non-performing loans)

to encourage banking establishments to resell them to third parties.

"This aims to clear the balance sheet of banks so that they are able, in the coming months, to issue loans to businesses to revive the economy," Estelle Brack analyzes.

This new “market” for debt purchasing companies could weigh up to 7 billion euros in 2021. “It's a godsend for them!

They do not hesitate to put pressure, or to offer repayments impossible to assume by the borrower.

The sector must be cleaned up to avoid abuses, ”argues Michel Guillaud, president of France Conso Banque, a consumer association specializing in relations with banks.

READ ALSO>

Purchasing power: the health crisis deepens inequalities

This is precisely the subject of negotiations conducted at European level with all the players.

In the future, debt repurchase companies could be forced to attach the deed of assignment when they come into contact with the borrower.

They should also be obliged to ensure that the household is able to meet the repayment of the proposed deadlines.

Better support for borrowers in difficulty

“In practice, this is already the case since we have no interest in proposing a schedule that the individual cannot reimburse, otherwise we are not remunerated, underlines Thierry Gingembre.

We are not stalkers.

If there are drifts, they are individual.

It is better to deal with us, than with justice after a procedure initiated by a bank.

"

In the eyes of the UFC-What to Choose, it's best to avoid both.

Matthieu Robin calls on the banking networks to “better support” borrowers in difficulty.

The project manager points out that "only 30%" of banks offer credit restructuring.

For its part, the French Banking Federation affirms that the mobilization of banks "is not weakening" to help their customers overcome "the difficulties resulting from the health crisis".