Thematic visits

Written by: Hu Xueneng, Kuang Yueting, He Jingxi, Huang Jie

2020-04-06 07:00

Last update date: 2020-04-06 07:00At the request of the British regulatory authorities, many British banks such as HSBC Holdings (0005), Standard Chartered Group (2888) and others suddenly canceled their dividend payments. Among them, many retail investors rely on the "earnings-earning" of HSBC. Because of the "lost interest" for the first time in history, the stock price plummeted by more than 10%, reproducing the tsunami price.

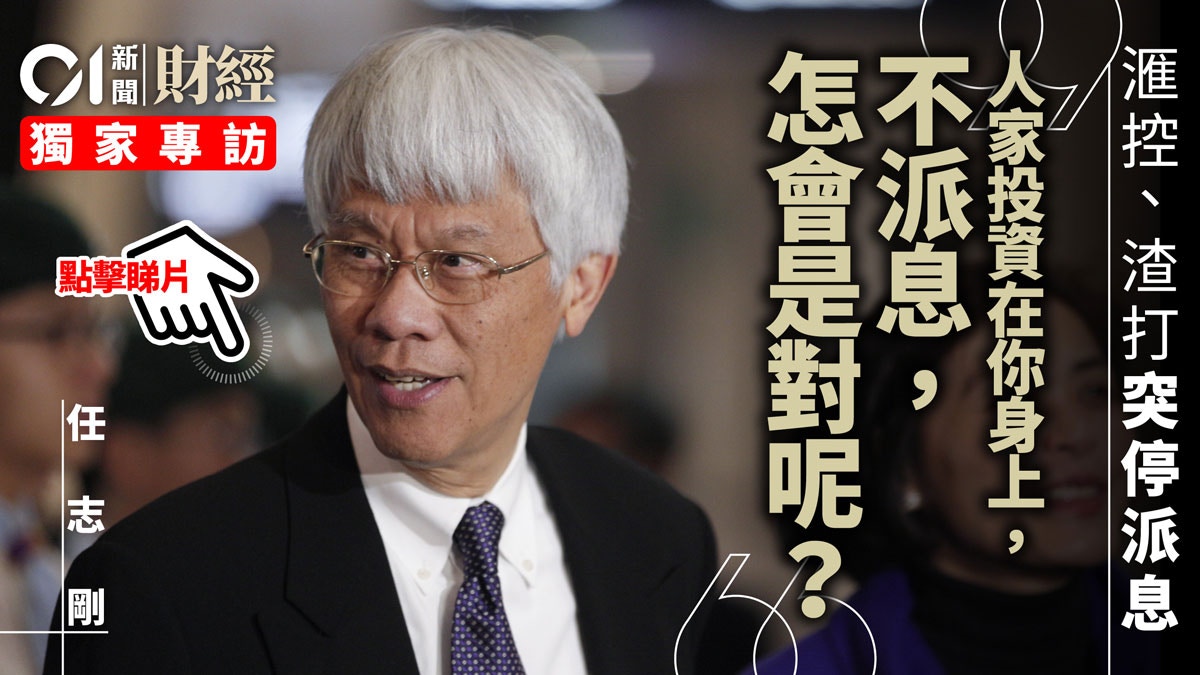

The event aroused heated discussion in the market. Ren Zhigang, the former president of the HKMA, held the Wealth Fund (2800), which is considered to be an indirect shareholder of HSBC. Qianren, do n’t you pay dividends, will you? ”He accepted an exclusive interview with“ Hong Kong 01 ”, explaining why he gave shareholders some rewards“ for granted ”, but did not specify that since the bank registered overseas, its Hong Kong subsidiary" "Bring up" the parent company, the headquarters should be moved back to Hong Kong.

Ren Zhigang said that the special method of instructing banks to refrain from paying dividends is to "show the sun." (Profile picture)

"I personally prefer to respect business decisions. You run a company or a bank. You want to do something. You do it according to the situation. If you want to pay dividends, Mi Pai, because you have to measure your own prospects. Bury your strength, and then do it first. The shareholders have a lot of returns. Of course, people invest in you. You do n’t pay money, you do n’t pay dividends. Do you know? "

There are many ways to stop bank dividends

At the beginning of his accent, Ren Zhigang stated that he was no longer the person in charge of the supervisory authority and only viewed the "lost interest" issue in his personal capacity. He confessed to the British regulator's sudden suspension of bank dividends to deal with the economic crisis, a special practice "headshot." "I'm going to the Yingfu Fund. There is HSBC in the fund. I am indirectly a shareholder. You suddenly don't pay dividends. Then HSBC's stock price fell a lot. I have opinions as an investor, but I don't speak narrowly. Investment perspective. "

Ren explained that during extraordinary times, extraordinary measures can be understood, "that is, in the old days, when we received the bank, we would not lose the shareholders." However, if regulators want banks to support the economy and increase credit in an economically difficult environment, there are actually many ways, including regulating capital adequacy, liquidity, and leverage. "As you know in Hong Kong, the counter-cyclical capital buffer (CCyB), Yu Weiwen's reduction, this is so! I don't give you a high capital adequacy ratio, that is, you (the bank) can do More credit! "

Ren Zhigang, who has been involved in Hong Kong ’s monetary and financial affairs for a long time since the early 1980s, again pointed out that the Monetary Authority had earlier reduced the discounted window interest rate to facilitate the banking system to obtain liquid cash. As for the adjustment of leverage, the Federal Reserve demonstrated last Wednesday (1st) that it would relax the supplementary leverage requirements of large banks and encourage banks to continue to borrow. "That is to say, usually I do n’t think your leverage is too high because the leverage is too high. There may be a problem, and the family's economy is not good, I will increase your leverage. "

Ren Zhigang believes that Yu Weiwen, the current helmsman of the HKMA, has recently reduced the countercyclical capital buffer as a suitable measure to encourage banks to make more credit. (Photo by Liang Pengwei)

Subsidiary "raise" parent company headquarters should be moved to Hong Kong

With so many policy tools, but using the bank ’s special method of not paying dividends, Ren Zhigang asked: "I am good as an investor and an analyst, so I will show my head," if "traditional means are not enough, and the economy ﹚ Well, there are big problems? If so, where are the sources of these problems? What is the problem with the United Kingdom? Is the British economy really bad? If so, how should Hong Kong respond? ”

Ren Zhigang did not provide a predetermined answer to the above question at one breath, but questioned the relationship between the parent company and the subsidiary of the "two" banks by not naming them. "For example, the British economy is really poor, and traditional means are not enough. To use such special means, I have to ask one more question, will the two parent companies make unreasonable reasons to their subsidiaries What is the requirement? If so, what should the two subsidiaries in Hong Kong do, or what should the Hong Kong Monetary Authority do? Can they borrow the British approach, that is, Hong Kong subsidiaries do not pay dividends to their parent companies, Of course, to protect the interests of Hong Kong, can it be different? "

The regulator used unconventional measures, and Ren Zhigang asked back, is the local economy really so bad? (Reuters)

Ren Zhigang continued that a parent company and a subsidiary are located in two places, but the subsidiary is the parent company's flagship for profit. Will there be conflicts of interest in supervision? At the same time, since the subsidiary company "brings up" the parent company, should its headquarters move back to Hong Kong? "I think it should be moved. The first channel is to take care of the interests of shareholders. Zhongyou, many investors look at it. Banks pay dividends so they can buy first, or buy derivatives. You suddenly It ’s so bad (without dividends), is it so miserable? So I do n’t need to use this method if it's not necessary, and I use this method. Is there a reason behind it? ”

Ren Zhigang Monetary Control Bureau Standard Chartered

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/MZAOVOYMVFG7HL4MJNE6R4WAIY)