Financial News

Written by: Wan Ran Huang Jie

2020-07-28 11:58

Last update date: 2020-07-28 11:58Gold continues its upward trend! Entering July, the price of gold continued to climb, gold futures hit US$2,000 for the first time, and then turned around and fell back to the latest US$1,967.5, up 0.6%; spot gold latest reported US$1,902.02, up 0.8%.

The latest silver futures reported at 22.85 US dollars, down 0.6%; the latest spot silver reported at 22.77 US dollars, up 0.8%.

According to Chow Tai Fook's website, the bank's 999.9 ornament gold quoted at 21,200 Hong Kong dollars every two today, breaking the 20,000 mark! The selling price of the same industry Luk Fook was also quoted at HK$21,180.

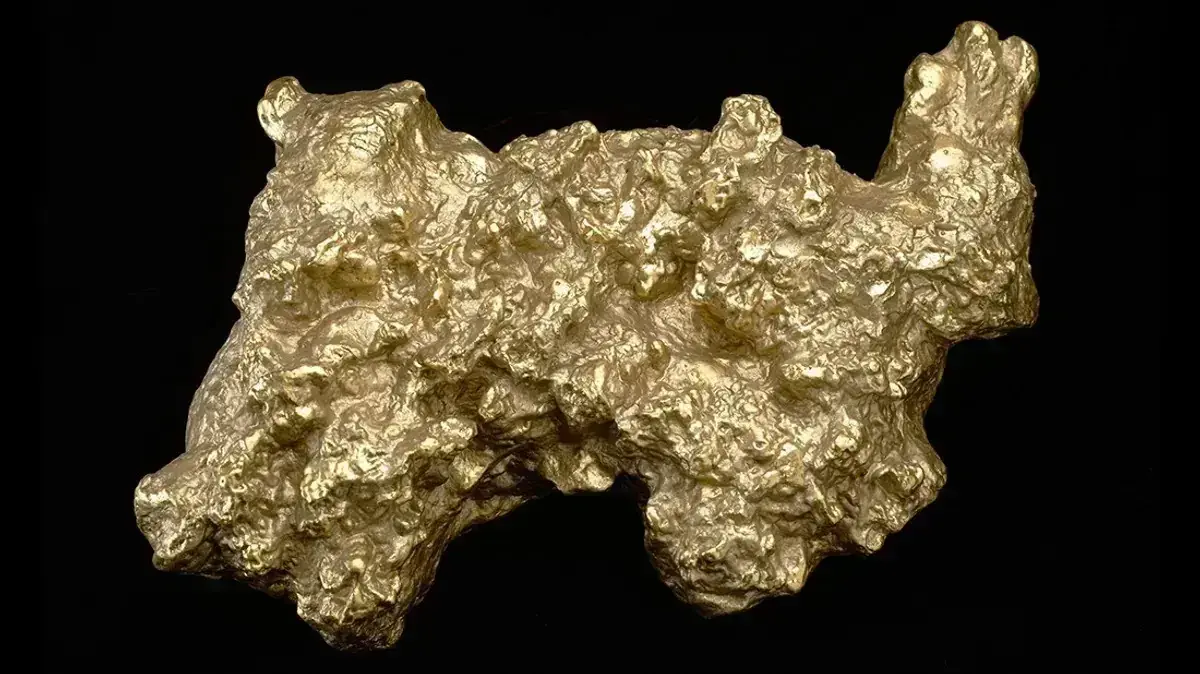

The global monetary easing policy has caused funds to push up international gold prices. (Visual China)

According to Wind statistics, since the beginning of the year, London gold has risen by 25%, and New York gold has risen by about 25%.

China's Sina.com reported that the world's largest gold ETF: SPDR Gold Trust's holdings increased by 5.84 tons from the previous day, an increase of 0.48%, and the current holdings are 1,234.65 tons.

As the price of gold soars to record highs, traders are giving up their bearish bets on gold. According to IHS Markit Ltd. According to the data, the short position of the US$75 billion SPDR gold ETF accounted for the percentage of the issued share close to the lowest level since July 2009. At the same time, the ETF's call option volume hit a record second-high level last week.

The new crown pneumonia epidemic and the sharp drop in real interest rates caused by central bank stimulus measures have caused funds to flood the gold market. According to analysts at Sundial Capital Research Inc, the rising kinetic energy of gold prices and the plunge in the US dollar have caused the bullish position of betting on gold to rise dramatically.

World Gold Council: Gold prices rose 16.8% in the first half of the year, three factors drive the inflow of safe-haven funds

Gold, silver and Chuangxin Gaode silver said that legal tender will become a ``momentary cloud''

Analysts with skyrocketing silver prices: the outlook is as optimistic as gold

Golden Week Tai Fook