The UBS Global Real Estate Bubble Index: The Tel Aviv Housing Market is Overrated.

Between Tel Aviv and Dubai

Photography:

UBS

Produced by the Department of Special Supplements

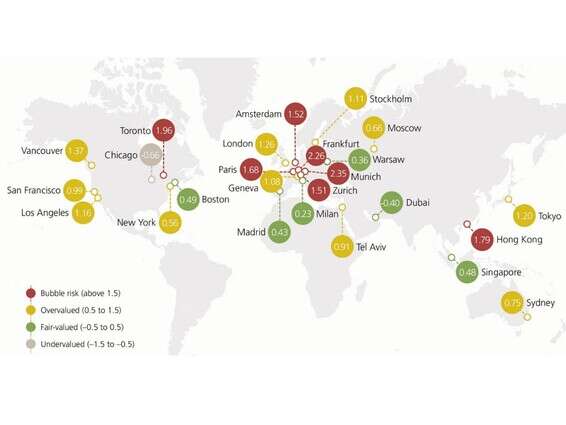

The UBS Bank's Global Real Estate Bubble Index for 2020 states: The housing market in Tel Aviv is out of balance and underestimated, but not yet at risk of a real estate bubble.

An analysis of residential real estate prices in 25 major cities around the world shows that Munich and Frankfurt in Germany are at the highest risk.

The UBS Index is an annual study produced by the Chief Investment Officer of UBS Global Wealth Management.

The index signals a risk of a bubble forming or a significant overestimation of the housing markets in half of the cities surveyed.

The highest risks to the bubble are in Europe, but the housing market in Tel Aviv is also in the overestimation zone.

Despite the expected weakness in the short term, housing prices are expected to rise in the medium term.

However, the epidemic increases long-term uncertainty.

Over the past 30 years, Tel Aviv has experienced the highest price increase among the cities participating in the study.

Today housing prices are rising again, due to the financing conditions and the housing supply expensive reality.

The government reduced the purchase tax on second homes, thus encouraging investment in the housing market.

Caroline Kunhart, director of Central and Eastern Europe, Greece and Israel at UBS, commented on the Tel Aviv data: "Despite the short-term uncertainty, favorable financing conditions and limited housing supply are expected to maintain the rise in housing prices. It is also a sign of Tel Aviv's economic growth. "

Hot market

The euro area stands out as the area where the housing markets are the hottest.

Munich and Frankfurt at the top of the table, Paris and Amsterdam are close behind, and are also marching in the risk zone for bubble formation.

Similarly, Zurich, Toronto and Hong Kong show an imbalance.

Unlike last year, the housing market in Vancouver is now within the spectrum's overestimation range, alongside London, San Francisco, Los Angeles and to a lesser extent New York as well.

Estimating housing prices in Boston, Singapore and Dubai remained fair.

The same is true of Warsaw, which was included in this study for the first time.

Chicago still suffers from an underestimation, and lies alone at this end of the scale.

Map of real estate bubbles in the various cities // Photo: UBS

Price increases (after adjusting for inflation) have accelerated on average in the last four quarters.

In many of the most prominent cities in Europe, prices have soared by more than 5%, with Munich, Frankfurt and Warsaw leading the way.

Rising prices in cities in Asia and the Americas, with the exception of Sydney, remained in the low-to-medium single-digit range.

Madrid, San Francisco, Dubai and Hong Kong are the only ones where prices have fallen.

This is the lowest number of cities that have shown a drop in prices since 2006.

Demonstration of resilience

Despite the corona, housing markets demonstrated resilience in the first half of 2020. The study presents three main reasons for this.

First, housing prices are a retrospective economic indicator, reflecting economic decline only after a certain delay.

Second, most potential home buyers did not suffer a direct impact on their income in the first half of 2020. The credit options offered to companies and short-term employment plans alleviated the damage of the crisis.

Third, governments have demonstrated support for homeowners in many cities during periods of closure.

Housing subsidies have increased, taxes have been lowered, foreclosure lawsuits have been suspended.

According to Dark Mark, chief investment officer at UBS Global Wealth Management: "At the moment it is not known to what extent the rise in unemployment and the bleak outlook for household income will affect housing prices, but it is clear that the current acceleration will not be sustainable in the short term. "In a drop in most cities, which indicates a possible correction phase after the subsidies evaporate and the pressure on revenues increases."

The high market estimates and the uncertain expectations in the short term put the long-term urban housing route under focus.

On the one hand, the main drivers of the rise in urban housing prices are still valid - employment opportunities, quality services, low financing costs and limited supply growth.

On the other hand, the epidemic seems to have accelerated the change in the direction of population movement from the cities towards the wider metropolitan areas around them.

Claudio Safotelli, director of real estate at UBS's chief investment officer, explained: "The rise of the home office calls into question the need to live close to city centers.

The pressure on household incomes is causing many to move to cheaper suburban areas.

Beyond that, cities that are already trapped in debt and economically weak will have to respond to the crisis by raising taxes and cutting public spending, two measures that do not bode well for property prices.

"All of these factors together raise the likelihood of uncertain effects on urban housing in the longer term."

Matthias Holzie, lead author of the study and head of real estate investment in Switzerland, added: “Cities that are currently at risk of a bubble seem to be coping with the corona crisis relatively well.

The local economies of Munich, Toronto and Hong Kong are likely to recover quickly.

But even in the absence of a broad correction of the market, the potential for additional capital gains seems narrow.

The chances for buy-to-let investments are low given the property-to-rent ratio, which is at an all-time high.

In such an environment, the sale of assets justifies discretion, as it is likely that investors will find assets with more successful risk-return characteristics. "

What's going on in the world?

The index ratings of all cities in the euro area have increased in the last four quarters, and the valuations there are the highest in the world.

The imbalance increases even more in light of the low financing costs, which are not adjusted to the strength of local economies.

Particularly notable are prices in Frankfurt and Munich, which have more than doubled in the last decade.

On the other hand, London stands with the second price increase in its weakness among all the cities in the study.

The city remains a territory that enjoys overestimation, but political uncertainty and a tough taxation and supervision environment are putting pressure on housing prices.

Foreign buyers seeking to take advantage of the weak currency are expected to support the medium-term price level.

Zurich has recorded the highest rate of price increase in Switzerland in the last decade.

The housing market is characterized by a relatively rapid expansion of supply, with the vast majority of buildings being leased.

Housing near the city center is enjoying an increase in demand.

Willingness to pay reflects the expectation that prices will continue to rise.

In light of these developments, the city is now joining the ranks of cities at risk for the bubble.

The Geneva housing market is recovering from the losses it suffered between 2013 and 2016.

Low mortgage rates make home ownership attractive, given the inflated rents.

Index ratings in U.S. East Coast cities have been relatively stable over the past five years. In contrast, West Coast markets have developed less consistently. In Los Angeles, index ratings have continued to rise, while in San Francisco valuations have fallen due to falling housing prices.

The decline in mortgage rates to low levels supports U.S. housing prices. Price changes in the cities surveyed are in line with the national average. The increase in demand in city centers has slowed, in light of suburban mobility due to cost issues and corona effects. , Business and Regulation, is accelerating this trend.

The real estate market in Dubai has reached a new low. Since the last peak in 2014, prices have fallen by more than 35%, and the valuation rating is close to low price levels. Positive effects of high population growth and more favorable mortgage regulation are offset by continued high supply growth And low fuel prices.

Housing prices in Hong Kong and Singapore were relatively stable in the first half of the year.

While apartment prices in Hong Kong are more than 50% higher than prices 10 years ago, prices in Singapore have remained unchanged.

The uncertainty makes it difficult for market prospects in these two cities, but it is likely that demand in the medium term will remain high, given their important status in the region.

The housing market in Tokyo is extremely dynamic, thanks to the high population growth and attractive financing conditions.

In Sydney the easing of loan terms and the cut in interest rates by the Bank of Australia have led to a modest, and probably transient, recovery.

Produced by the Department of Special Supplements

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/RCG5X3THKFDNBE5JDXQVKMDMQQ.jpg)