BBVA and Banco Sabadell plan to carry out a workforce adjustment that will affect some 6,000 jobs if the merger finally goes ahead.

As everything indicates, these departures, which will never be recovered, will be carried out mainly by early retirement, according to sources familiar with the process and unions.

Although, as in all these merger processes, exits will also be made for incentivized withdrawals.

The objective is a cost saving of around 800 million euros in two years.

To carry out their plans, both BBVA and Banco Sabadell have thousands of employees over 55 years of age.

Specifically, 6,500 workers, of which about 3,100 correspond to BBVA, while in Sabadell there are just over 2,300 employees, according to union data.

More information

The BBVA and Sabadell merger will cost 6,000 jobs and the closure of some 1,250 offices

BBVA doesn't have to spend all the US money on mergers

New turn of the screw from banking to commissions to its clients

The entity chaired by Josep Oliu had already opened an adjustment process that affected 1,800 employees, and it was going to be carried out mostly due to early retirement, but the entity paralyzed this process on Tuesday after announcing the negotiations it was holding the day before with BBVA for its merger.

The age that had been set to qualify for the early retirement plan was from 56 years.

In the case of the bank chaired by Carlos Torres, in the last processes of leaving employees due to adjustments, the ages have varied from a minimum of 53 years to 55 years.

In the first case, the exits occurred after the purchase of Unnim from the FROB, while in the second case the minimum age of 55 was set for the ERE, which was carried out after the acquisition in 2014 also from the FROB of Catalunya Banc.

Negotiations with the unions to address this adjustment will begin, however, once the merger is approved by the different shareholders' meetings, which will not occur until the first quarter of 2021.

One point that is resolved is the headquarters of the new bank.

It will be Bilbao, where BBVA's headquarters are currently located, sources familiar with the operation point out.

The new entity that will be created after this merger will have a market share of 24.4%, according to Analistas Financieros Internacionales (Afi).

It is thus placed in second place, behind the entity resulting from the merger of CaixaBank and Bankia, with a 27.7% share.

These entities, together with Santander Spain, will control a 70.6% share, with an increase of 20 percentage points as there are only three banks.

The five largest entities after the three announced mergers would accumulate 80.9% of the volume of banking business in Spain.

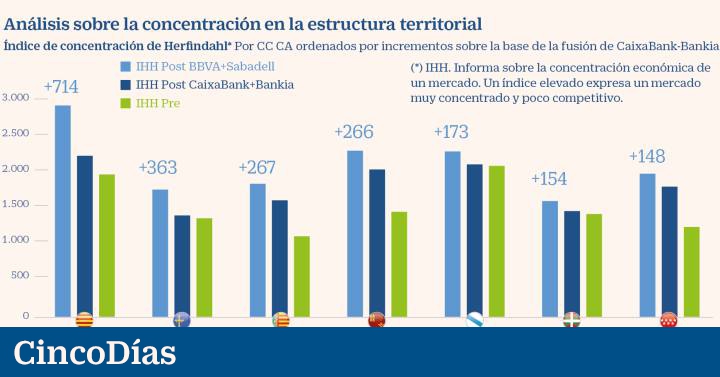

Although the concentration at the national level is "high", Afi points out that in the different submarkets (autonomous, provincial, or municipal) the concentration is much lower, thanks to the significant presence of entities with territorial specialization, especially in the territories of less population density, while in those with higher density it is the new players (neobanks, fintech and non-bank competitors) who exert a very important competitive pressure.

After the two mentioned integrations, the top 5 of Spanish entities with the highest volume of business would be completed by the one resulting from the merger Unicaja-Liberbank, with a 5.2% share, and Bankinter, with a 5.2% share.