Today, December 22, the day of the Christmas Lottery, Abengoa is playing it.

The extraordinary general meeting, called to endorse a new board of directors and the future of the group, is presented as the last attempt so that the Andalusian firm does not disappear after more than five years adrift, several changes of presidents and several other plans of salvation.

Abengoa went from an exemplary signature that appeared in Barack Obama's speeches as a technological model in the fight against climate change and from touching the sky (as when its subsidiary Atlantica Yield went public on the Nasdaq in 2013) to collapsing almost overnight in the morning.

It did not measure growth well and went into a spin.

Meanwhile there was a cash drain, loss of contracts, exodus of executives, reduction of staff (it has gone from 26,000 to 14,000 jobs, 2,700 in Spain) and delays in payroll.

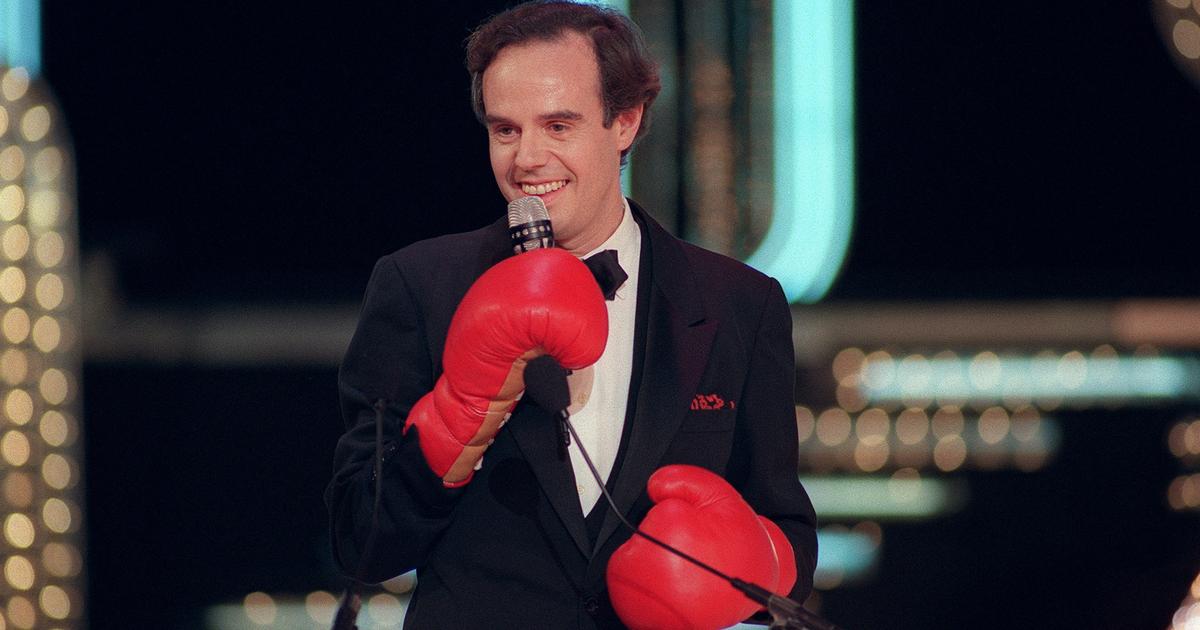

It was the megalomaniac dream of Felipe Benjumea, a man who within the group was considered a god and who seemed convinced that his mission was to change the world's energy model.

For better and for worse, he was responsible for both its brilliance and its downfall in the 24 years that it presided over the group.

He designed an ambitious strategy;

He embarked on an endless adventure of building power plants, desalination plants, and infrastructure that took him to nearly 80 countries;

he set up an enviable solar temple in Sanlúcar la Mayor (Seville) and installed a state-of-the-art headquarters in the Palmas Altas neighborhood.

But the empire of the sun fell apart.

The group had grown too much and too fast without Benjumea wanting to see it, despite the fact that some independent members of the council who ended up leaving (José Terceiro, Carlos Sebastián, Daniel Villalba ...) warned him of excessive leverage.

This circumstance and the regulatory changes of the PP Government undermined the strength of the group.

Abengoa's Stations of the Cross began when, in November 2014, the stock fell by 75% in two days.

As a result, it proposed a debt restructuring, reduced its stake in the flagship subsidiary (Abengoa Yield) and carried out important divestments (it had already divested Telvent and Befesa).

Subsequently, it decided on a recapitalization plan, which however failed to get the rating agencies to improve the rating.

In the summer of 2015 the situation worsened with new write-offs on the stock market until in September the bank said enough.

He took action on the matter and tried to get Gestamp to enter through a capital increase in which the Riberas family group would have taken 25%.

The attempt failed by not accepting the injection of liquidity.

A final blow to force the resignation of Benjumea, who was replaced by José Domínguez Abascal, a man from the house whom Benjumea would later take revenge by demanding his departure, making use of the fact that he had political rights of more than 50%.

Antonio Fornielles, who had been his auditor at KPMG and who would be replaced by Gonzalo Urquijo, took the reins.

Meanwhile, the company rushed to the pre-bankruptcy that presented with a financial debt of 8,904 million euros and a total liability of about 25,000.

The meeting that is held today is presented with differences between the management and the minority meeting in Abengoashares, which in the previous meeting on November 17 threw the Chairman, Gonzalo Urquijo, and the remaining six members, from the board of Abengoa SA castled in the Abenewco1 subsidiary.

They also prevented the appointment of a new council chaired by Marcos de Quinto and proposed a trio to form another reduced council, which must be voted on today.

The minority parties announced the challenge and presented their parallel triumvirate.

Last week, the two parties reached an agreement with the mediation of Banco Santander.

The pact, which supposed that the three directors proposed by the minority would be supported and then one of them resigned and another representative of the management entered and accepted the bailout conditions, divided the minority, which with a narrow difference (55% by 45%). %) finally rejected the pact forcing the resignation of De Quinto.

The minority elected Clemente Fernández, former president of Amper, as a new candidate.

It is expected that this relationship of forces will be reproduced in the meeting, so that the minority, who have already sent their voting delegations, will come out with flying colors.

Once that step is taken, Fernández is expected to join the board of the parent in place of one of those elected.

Later, he will be able to assume the presidency of Abenewco1 after holding meetings in the subsidiaries.

If it is fulfilled, the Cantabrian executive would be in charge of leading the third restructuring.

His objective is, after examining the company, to renegotiate the bailout signed on August 6 and even to ask for help from the SEPI restructuring fund.

Urquijo agreed to finance 230 million with ICO endorsement;

lines of guarantees of 300 million with support from Cesce;

removes 50% of the debt with financial creditors and a solution for the debt with suppliers, who are offered 5% of cash flows and funds for selling assets.

In addition, the parent company would cease to be the head and would only have 2.7% of Abenewco1, for which it is required that 96% of the 153 million it owes be converted into participating loans.

Something that had strong opposition from the minority.

The contract includes, as a suspensive condition, that the Junta de Andalucía contribute 20 of the 250 million planned.

However, the Board ensures that it never made a commitment and that it is not in a position to do so, which has caused the end of the term to be reached without the signed agreement.

The result of today's meeting will determine that the 20 million will be put by Santander, according to group sources.

The group faced a restructuring in 2017 in which a debt reduction and recapitalization was carried out for 7,000 million.

Later, in 2019, in a second reconversion, another 3,000 million were capitalized.

In total, a reduction of 95%.

A fiefdom of the Seville bourgeoisie

Several families of the Sevillian industrial bourgeoisie join together under the name Abengoa, the firm that they founded in January 1941 under the auspices of the incipient Franco regime to manufacture single-phase five-amp meters in the Heliópolis neighborhood of the Andalusian capital.

It received that name from the acronym of the surnames Abaurre, Benjumea, Gallego and Ortueta.

They were joined, by marriage or other circumstances, the Solís and the Aya, and all were represented on the board of directors until the crisis erupted in 2015. Always under the command of some Benjumea, first the patriarch Javier Benjumea Puigcerver and then his son Felipe Benjumea Llorente, one of the only two males of a brood of 13 siblings, as holders of the largest shareholding package.

For years, a large part of the wealth of these families was nourished by the dividends of the company.

Today they are blurred and divided and those who remain loyal to the capital of the company do so through the company Inversión Colectiva, which controls less than 2.5% and has a large part of the shares pledged by Santander.

Benjumea, who like the rest of the families did not accept the intervention of the creditor banks, would later claim 1,005 million from Santander and HSBC, entities that he blamed for the fall of the Sevillian multinational after his dismissal.

He also had to sit on the bench, along with the CEO, Manuel Sánchez Ortega, for the compensation of 11.4 and 4.4 million euros they received when the pre-contest was already underway accused of unfair administration and face penalties of between three and five years in jail.