Of money

news

"The greatest Ponzi scam ever in Israel"

Hundreds of investors have submitted a request to the court to dissolve Michael Ben-Ari's company and even claim that there is a fear that he has fled Israel.

"Some of the victims who lost their money are widows, orphans, divorced women, heirs who lost their parents' inheritance and retirees."

Tags

fraud

David Rosenthal

Monday, 10 May 2021, 12:50 Updated: 12:53

Share on Facebook

Share on WhatsApp

Share on general

Share on general

Share on Twitter

Share on Email

0 comments

315 victims of businessman Michael (Mike) Ben Ari filed a motion in the Tel Aviv District Court this morning (Sunday) to dissolve the EGFE Israel company he owns, claiming that it is "one of the biggest and most serious ponzi bites in Israel, if not the largest of them." NIS 300-600 million and it is reminiscent of the deeds of the international crook Bernard Madoff, who also claim that Ben-Ari sent them an e-mail last Thursday, according to which he fled Israel and threatened not to return money to anyone who dared to sue him.

More on Walla!

NEWS

Everything is tastier with beer butter: potatoes and mushrooms of a goat furrow

To the full article

Do we also have our own Madoff?

(Photo: Reuters)

Through attorneys Eitan Erez and Mor Ben-Shoshan of Eitan S. Erez & Co., the victims claim that Ben-Ari, through his company, took out money from hundreds of investors, who were allegedly destined to trade in various investment channels, but in practice he refrained from investing the money and paid them the astronomical interest he promised from the fund. For older investors. According to them, the scam was discovered in early April following his arrest by the Securities Authority.

Attorneys describe how at least 400 victims lost their money, some widows, orphans, divorced women, heirs who lost their parents' inheritance, the disabled, the visually impaired and young and old couples And retirees. "Most of the victims lacked knowledge and understanding of investments. Mike Ben-Ari managed to mislead these victims with the help of his charisma and through false and seductive representations he presented to them," claim attorneys Erez and Ben-Shoshan.

The request shows that the volume of spending from the victims intensified significantly in the first quarter of 2021, when Ben-Ari already knew for sure that he and the company were about to collapse and that he was under investigation by the Securities Authority.

Despite this, he continued to collect millions of shekels from the victims and even repaid a check of one of the investors in the amount of $ 200,000 just one day before his arrest, last month.

(Ben Ari was released under house arrest with a bank guarantee of NIS 2 million).

A business that has been running for 15 years, more than 3 times the life span of an average Ponzi scam.

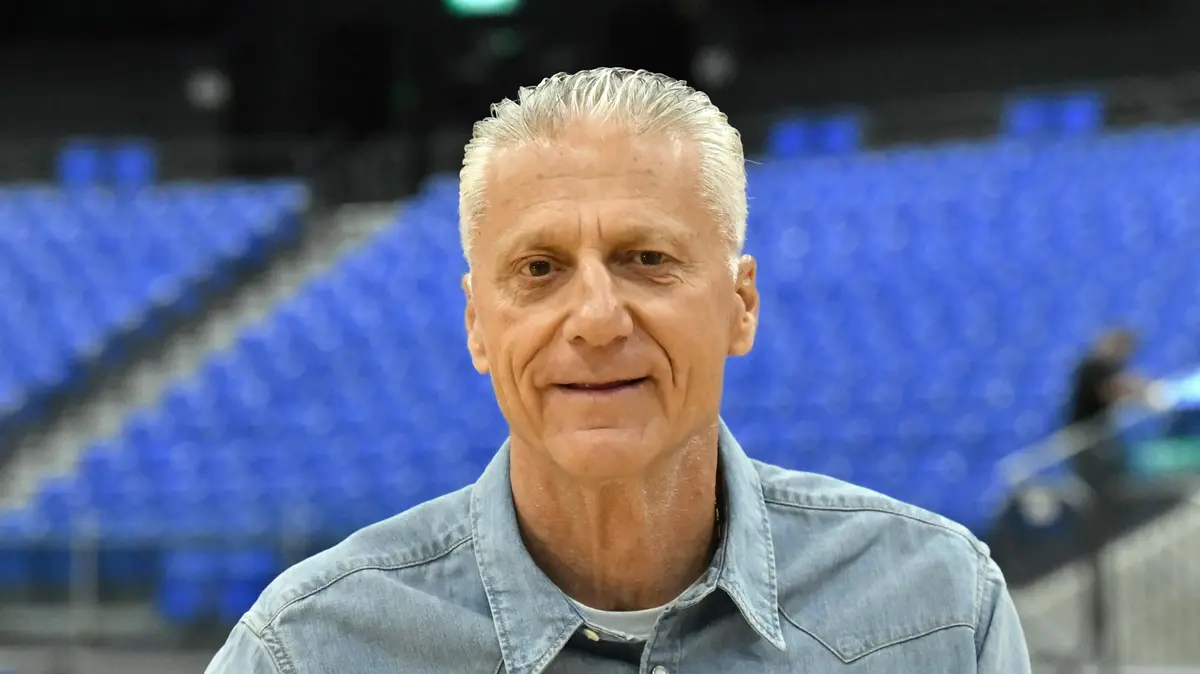

Adv. Eitan Erez (Photo: Yachz)

The request shows that EGFE, which is controlled by Ben Ari and his brother, was presented to the victims as an international company, which offers solid and safe financial services and investments, with positive returns to more than 800 customers from Israel and around the world. In the marketing videos presented to them, Ben-Ari stated that the company manages $ 60 million for a thousand customers. Ben-Ari introduced himself as someone who immigrated from the United States about 30 years ago, worked at Bank Leumi as an investment advisor and 20 years ago decided to start an independent business. The

victims claim that Ben-Ari also used other factors to carry out his stings, as of the date of application. At the end of their involvement in the case, for example, Michal Mansano, an employee of the company who was presented to the victims as the firm's director and with extensive experience in customer relationship management and business development; Tali Bar-Gil, who served as the investor relations manager; Ben Ari for many years; And other assistants.

Attorneys Erez and Ben-Shoshan claim in the petition that Ben-Ari has remarkably managed to run his Ponzi business for more than 15 years "although history usually shows that the lifespan of a Ponzi plan is 2-5 years until it explodes."

Luxurious parties and launches for investors

The application states that the Ponzi scheme focused mainly on investments in municipal bonds issued in the US, by different countries or by cities. According to them, Ben-Ari created a cover story according to which his investments succeed in generating high profits because their money is invested in all kinds of American funds such as Blue Fund. River, which reportedly operates out of Colorado, USA. In retrospect, it became clear that this fund had severed ties with Ben-Ari as early as the early 2000s, and Ben-Ari even admitted that he had lied about his ties with this foundation. "Unfortunately, the applicants came to know that the same investment channels do not exist and were only intended to serve as a cover for Ben-Ari's Ponzi scheme," the petition states, "

In order to increase the victims' trust in him, Ben-Ari introduced himself to investors as a person. Living in great wealth and successful in business, including residences in North Tel Aviv, lavish parties and launches, grandiose events with famous artists, to which investors and their friends were invited.

It was further alleged that Ben-Ari used to confuse his clients by massively using high English words that were not at all understood by most investors (such as arbitrage, hedge, short, etc.) and name dropping when they sometimes received receipts from a company listed on St. Island. Keats are back in the Caribbean. It was further alleged that they were promised holdings in the Buxite mine in the Montenegrin state of Montenegro.

To the astonishment of the applicants, the petition states that since Ben Ari's arrest last month, it has become clear to them that he misled investors in order to steal their money and that over the past day their anxiety has increased after sending an email to some of them stating that he left Israel and will not return until the PA Securities will not accept its terms.

It was further alleged that Ben-Ari admitted in the same email that he lied to investors about the same fund called "Blue River" and even threatened to report to the income tax on the so-called "unreported" funds that were invested in him.

It was also stated that he would return money only to those who would not sue him and would make sure that those who sued him would not receive anything (which in itself constitutes a criminal creditor preference, according to an attorney).

Along with the liquidation request, a request for temporary liquidation was submitted to the company. Tel Aviv District Court.

Share on Facebook

Share on WhatsApp

Share on general

Share on general

Share on Twitter

Share on Email

0 comments