“When I started giving more than two and a half months of salary in taxes, I thought it was too much.

When I got to almost four months, I couldn't take it anymore.

It is to escape this tax overdose that Sandrine, 37 years old and executive in a bank, decided to go on the offensive four years ago.

"I said to myself:

Stop, let's

stop

".

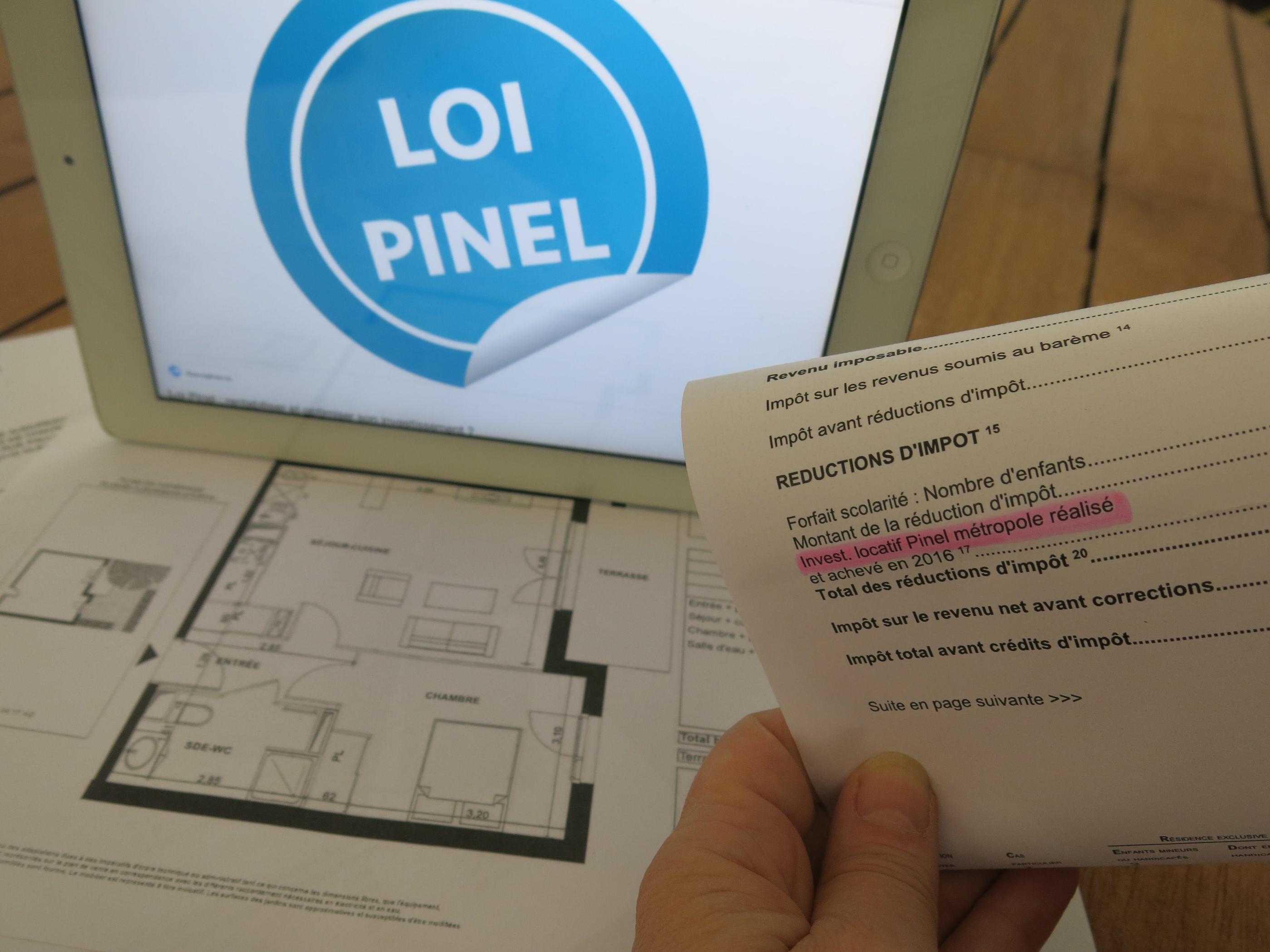

Already the owner of her main residence and of another old property bought on credit and rented out - but whose property income came to increase her taxation - this Val-de-Marne resident turned to the Pinel device to reduce the tax bill, while continuing to build up assets.

The mechanism makes it possible to reduce taxes by 12% of the price of the six-year course, 18% over nine years or 21% over twelve years, by investing in areas defined by the State where rental demand exceeds supply. .

And by renting out the accommodation while respecting rent ceilings and resource ceilings for tenants.

Two apartment purchases

With her first Pinel apartment bought for 272,000 euros in Bordeaux (Gironde), Sandrine saw her taxation drop from 12,000 to 6,000 euros.

And last year, she bought another property, still under the same tax exemption system.

“In Rouen (Seine-Maritime) this time, on the advice of my wealth management advisor,” she explains.

I wouldn't necessarily have thought of investing in it.

"

Read alsoReal estate: the top 10 French cities where Parisian tenants prefer to invest

"It is the 11th largest urban area in France with 176,000 jobs, rental demand is blatant there," explains Nicolas Adam, from the Quintésens group, which supported it on the project.

Her annual income tax bill should fall to 2,000 euros and even less since in July 2020, Sandrine became a mother.

“I should not be far from 0 euros in taxes, she calculates.

I am not unhappy, even if behind that, there is debt.

"

"I prefer to put this money on four walls than to give it to the State"

This is the secret of such a tour de force to achieve such an important tax exemption.

His monthly loan payments represent 100% of his salary.

But it also receives the rents for its two Pinel apartments and the old rental apartment.

"I think Pinel is

The

investment to reduce taxation by establishing a heritage adds Sandrine.

I would rather put these 12,000 euros on four walls than give them to the State.

"

Provident, she also sees her investments as a second source of income when the credits are over, why not take a step back professionally, an essential complement to her retirement or a way to protect her children by leaving them a heritage.

"The resale of the property is not the only option at the end of the tax exemption period," says Nicolas Adam. With 30,000 students and flows passing through the city, which hosts the country's fifth port, there is the option of continuing rental operations under the non-professional furnished rental system and generating rents net of tax. "