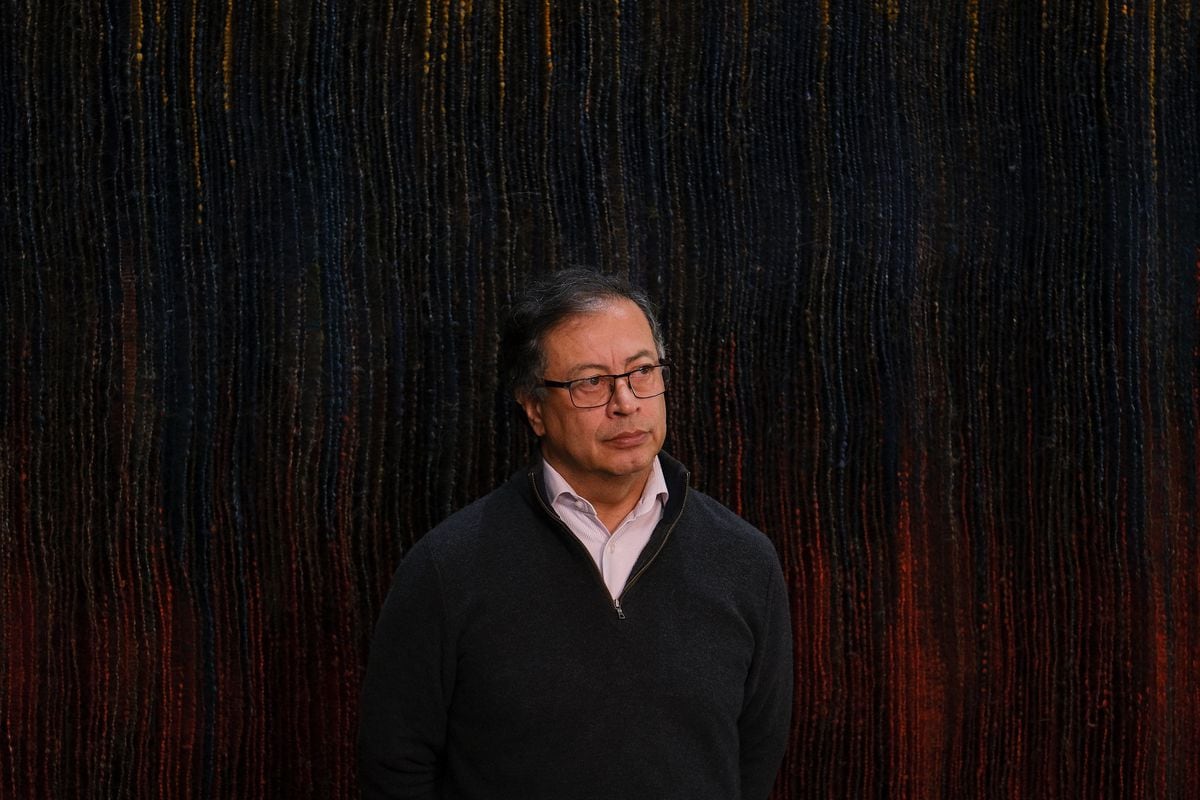

Photograph of October 26, 2018 of the new Colombian Finance Minister, José Manuel Restrepo, during an interview in Bogotá.Mauricio Dueñas Castañeda / EFE

Someone had to do it and José Manuel Restrepo (Bogotá, 1970) accepted.

When Colombia's finance minister and some vice ministers resigned from their posts on May 3, President Iván Duque's Cabinet stumbled.

An immediate replacement was needed, someone prepared in matters of public finances, but above all, willing to take the reins of the office where the tax reform was born, which triggered the violent protests that continue today in the streets of Colombia.

MORE INFORMATION

Iván Duque loses his chancellor amid a wave of external criticism against Colombia

What is happening in Colombia?

The keys to a conflict that spreads across the country

Academic with a doctorate from the University of Bath, Restrepo clarifies: "I am not a candidate who appears overnight." He came to the cabinet as Minister of Commerce, a portfolio that he still holds pending the official appointment as Minister of Finance. Duque announced his appointment in a tweet shortly after the resignations and what remains is an official ceremony. Due to his years in front of the Ministry of Commerce, Restrepo claims to be the best qualified official to approach companies and find a new tax agreement in which those with more income pay more taxes.

His predecessor, Alberto Carrasquilla, had been an official in the government of former President Álvaro Uribe, a polarizing figure in the country.

Restrepo, on the other hand, is not linked to Uribism and brings to the table a clean slate in which he seeks to design his own proposal for the Government to collect more taxes without affecting the middle class.

Meanwhile, public debt is growing and it is estimated that by the end of this year it will reach 65% of gross domestic product.

In a telephone interview with EL PAÍS, the official shows confidence that the country will achieve a new reform and preserve the investment grade of sovereign debt.

Question.

As a civil servant, as a new Finance Minister and as a Colombian, how do you feel about seeing the protests?

Answer.

The Government has been a democratic government that believes and respects social protest, that sees it as a legitimate democratic right and that values a respectful protest in which the rights of others are not affected. In this sense, it is to reject the abuses of the public force, as well as blockades, acts of vandalism and acts that damage the property of others or when violence occurs on public property. Having said that, it seems to me that it is very important to recognize that this protest deserves to be heeded. How? With an attitude of dialogue, consensus building, open listening. I receive a mission, which is to identify ways to achieve sustainable social spending with sustainable financing. At this time more than ever in our country we need acts of greatness to be able to listen to the other,to listen to different actors in society, such as young people and entrepreneurs. Surely later with the unions, with the political parties and leaders, with the academy, with the territorial entities and with the representative actors of public finances to build consensus. We faced the impact of the pandemic that affected us in key indicators such as poverty, unemployment and that affected many sectors. What one also picks up there is a concern, a feeling from the youth, for example, also from other social actors, a genuine concern that deserves to be addressed. And that is why in our social spending project what we want is to serve those most vulnerable actors in society.with political parties and leaders, with academia, with territorial entities and with representative actors of public finances to build consensus. We faced the impact of the pandemic that affected us in key indicators such as poverty, unemployment and that affected many sectors. What one also picks up there is a concern, a feeling from the youth, for example, also from other social actors, a genuine concern that deserves to be addressed. And that is why in our social spending project what we want is to serve those most vulnerable actors in society.with political parties and leaders, with academia, with territorial entities and with representative actors of public finances to build consensus. We faced the impact of the pandemic that affected us in key indicators such as poverty, unemployment and that affected many sectors. What one also picks up there is a concern, a feeling from the youth, for example, also from other social actors, a genuine concern that deserves to be addressed. And that is why in our social spending project what we want is to serve those most vulnerable actors in society.We faced the impact of the pandemic that affected us in key indicators such as poverty, unemployment and that affected many sectors. What one also picks up there is a concern, a feeling from the youth, for example, also from other social actors, a genuine concern that deserves to be addressed. And that is why in our social spending project what we want is to serve those most vulnerable actors in society.We faced the impact of the pandemic that affected us in key indicators such as poverty, unemployment and that affected many sectors. What one also picks up there is a concern, a feeling from the youth, for example, also from other social actors, a genuine concern that deserves to be addressed. And that is why in our social spending project what we want is to serve those most vulnerable actors in society.

Q.

What will the new tax reform look like?

R.

I would not call it a tax reform, but a social spending project with sustainable financing that has three purposes. The first is to advance in serving the most vulnerable. Recognize that these most vulnerable actors are young people who are looking for a job for the first time, those who are looking for free access to higher education in the most vulnerable strata. And there it must be recognized that President Iván Duque has already announced that free access to higher education in all public institutions to about 700,000 young people. Today the informal ones are also vulnerable, those who face the day-to-day with resources and who need emergency income. That is why it has been thought of continuing a program such as the Solidarity Income that exists in Colombia.And the micro and small entrepreneurs that have been severely affected by the pandemic are also vulnerable. Another point of consensus is that this project cannot touch, it will not interfere and it will not affect the middle class. And there is another point of consensus is that we have to take advantage of that sense of solidarity that the business sector and the wealthiest sectors have expressed to raise their hands and say 'we want to contribute'.

Q.

What was, in your opinion, the error of the previous proposal?

R.

I do not usually act based on rear view mirrors. I see from the present to the future, and in the future what we need is not to affect the middle class. We should not touch the value added tax (VAT). We must not expand the natural persons base or the income tax. Second, we must go to what the wealthiest sectors have already expressed, business sectors that through their unions have expressed that they want to contribute and point out ways to do so through instruments such as an income tax surcharge, matters related to income tax. goods, among other issues. And third, that in any case we collect the interests and concerns of all political actors regarding social vulnerabilities. And there is coincidence in the vulnerable sectors, in the unemployed, in the young,in women who lost their jobs, in informal ones and in micro and small enterprises.

Q.

If a tax reform is not passed to collect more taxes, Colombia is at risk of losing its investment grade, which would trigger interest payments.

R.

Our response seeks to ensure that there is stability in our public finances.

And also guarantee that social stability, which is a source of growth, a source of development and, ultimately, a source of macroeconomic stability.

International actors, markets and risk analysis have to be fully aware of the impact that the pandemic has had in countries like Colombia and recognize the difference between temporary impact or permanent impact.

Q.

So you trust that Colombia will not lose its investment grade?

R.

We are making the effort to guarantee fiscal stability that sends clarity to international markets and simultaneously social stability.

We cannot be indifferent to the social contract.

The two things have to be seen in balance.

The two purposes are not alien.

And I believe that in a post-pandemic scenario, for all national and international actors, this should be clear enough.

Subscribe here

to the

EL PAÍS América

newsletter

and receive all the informative keys of the current situation in the region.

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/KIKO6HTUA5FDJCVN5PDXADVCBA.jpg)