Enlarge image

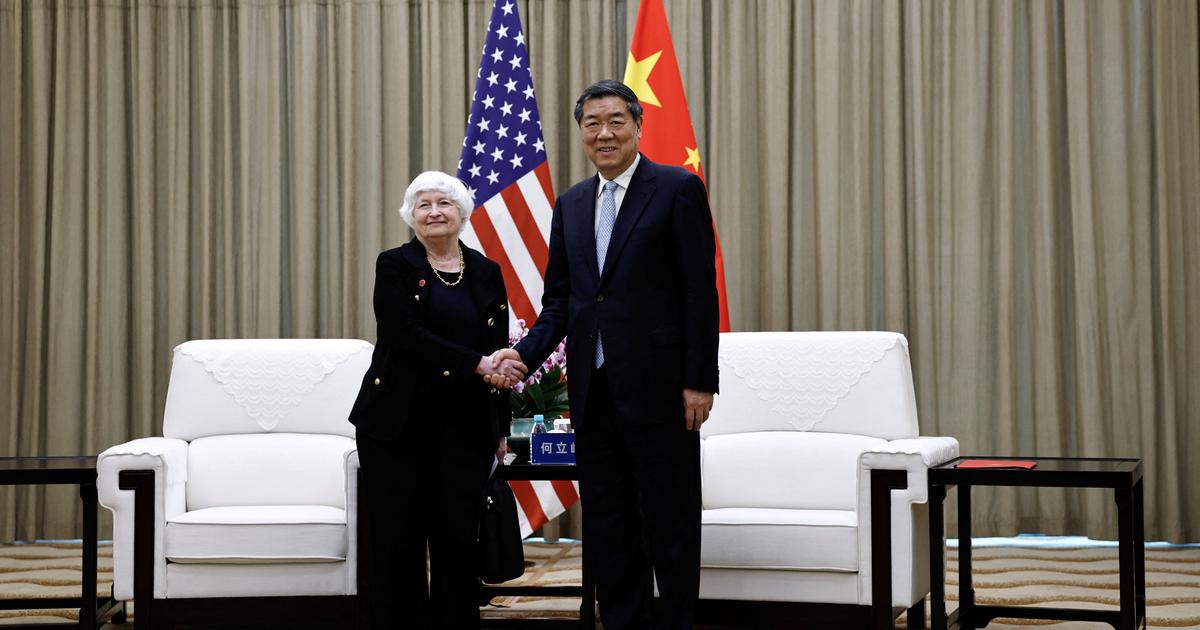

Janet Yellen: Normal interest rates would be "not a bad thing"

Photo: WPA Pool / Getty Images

Consumer prices are already rising sharply, while interest rates remain at lows.

Many have now got used to the logic that follows that debts can be financially worthwhile and savers are coldly expropriated.

But will this monetary policy turn around at some point?

In the opinion of the US Treasury Secretary Janet Yellen, somewhat higher key interest rates would in any case be advantageous for the USA.

The billion dollar spending program of US President Joe Biden would be good for the US, even if it would contribute to higher inflation and higher interest rates, Yellen told the Bloomberg agency.

"We have been fighting against inflation, which is too low, and interest rates, which are currently too low, for a decade," said Yellen, who was at the helm of the US Federal Reserve until 2018.

If interest rates returned to normal it would be "not a bad thing".

Will the aid packages increase inflation?

However, the current head of the Fed, Jerome Powell, recently announced that he did not want to raise interest rates in favor of the economy for the time being.

In this way, loans are to remain cheap for companies and the economy is to be supported; most recently, zero interest rates until 2023 were discussed within the Fed.

It can therefore still be doubted that there will actually be a turnaround in interest rates.

Biden, in turn, wants to help the US economy with a trillion infrastructure program out of the corona crisis.

The main aim is to create jobs for workers and the middle class.

According to some experts, these aid packages could actually fuel inflation in the US even further.

However, Yellen denied these fears in the Bloomberg interview.

The packages would run to about $ 400 billion a year in spending, which is not enough to cause inflation to rise.

The current price increases are driven by temporary, pandemic-related anomalies, such as bottlenecks in the supply chain.

Consumer prices in the USA had recently risen more sharply than they had been since 2008.

Compared to the same month last year, the cost of living rose by 4.2 percent in April, and the US government plans to announce the rate for May at the end of this week.

apr / Reuters