Growth that will remain "very solid".

The fifth wave of Covid-19 and the Omicron variant could cause French growth to gasp next year, but the French economy should have erased the scars of the pandemic by 2024 and regained its pre-crisis cruising speed , according to the Banque de France.

A slightly lower growth forecast

The institution unveiled on Sunday its macroeconomic projections for 2024, in which it lowers very slightly (by 0.1 point) its growth forecast for 2022, now anticipating an increase in gross domestic product (GDP) of 3.6%, after 6.7% in 2021.

A more cautious figure than the 4% still advanced by the government, but far from the thunderclap addressed in Germany by the Bundesbank which lowered by one point to 4.2% its growth forecast for the German economy.

"We expect a slight slowdown in early 2022 linked to the new Covid wave, but then growth will resume," said to Les Echos the governor of the central bank, François Villeroy de Galhau.

And what will not have been won next year will be caught up the following year, anticipates the French central bank, since it raised by 0.3 point, to 2.2%, its growth forecast for 2023.

With a GDP growth forecast of 1.4% in 2024, "we are gradually joining the growth trend that was that of before the crisis", which had not been the case after the financial crisis of 2008, underlined Olivier Garnier, the director general of the institution, during a press conference.

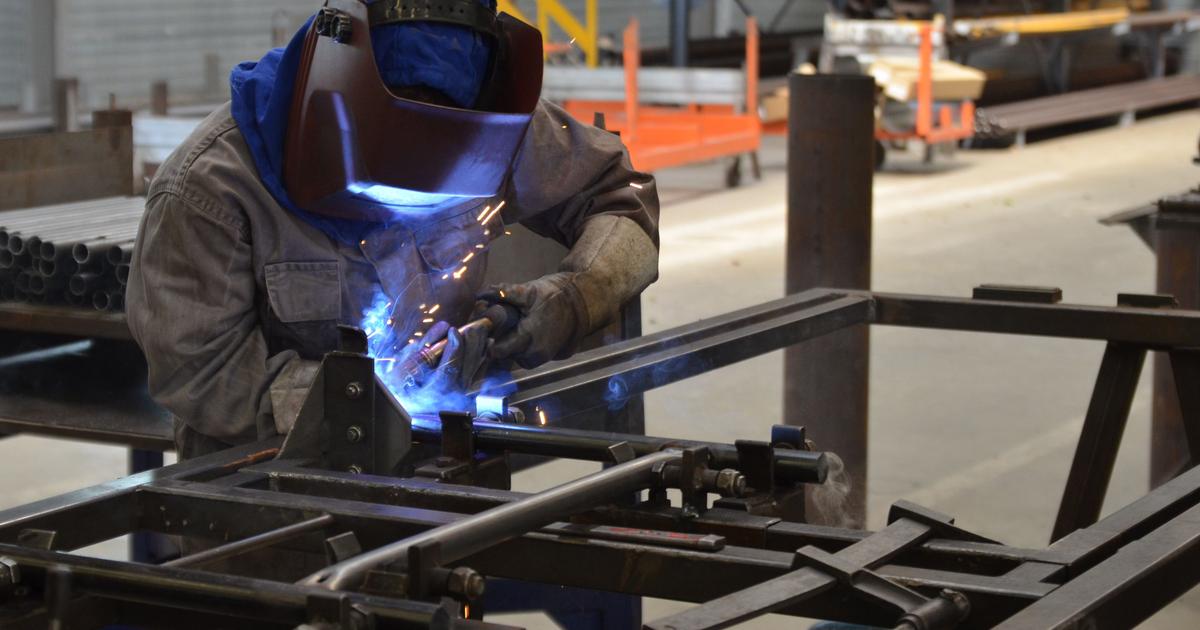

This means that "the crisis has left no scar in terms of the level of production and potential production", thanks in particular to the recovery plan and the France 2030 investment plan, as well as to "the dynamism of the labor market. ".

A still high public deficit

But that would be insufficient to initiate the country's deleveraging, warns Olivier Garnier: in 2024, the public deficit would still remain close to 3.5% of GDP and the debt stable around 115% of GDP, despite the end of spending related to the epidemic.

To have more growth in the long term, it is necessary to increase "the labor supply" and "the skills available to companies" which "will have to make a better place for seniors", according to François Villeroy de Galhau, who also calls for “Go further on learning”.

In the meantime, the return to the pre-crisis growth path will be driven by “more sustained” consumption, with households starting to draw on the savings surplus of 170 billion euros accumulated during the crisis, according to the Bank. of France, which estimates that they should have spent a fifth of it by 2024. Companies should also maintain a high level of investment thanks to margins preserved during the pandemic.

Conversely, the contribution of foreign trade, still lagging behind in certain sectors, "will not recover in 2022".

An expected drop in unemployment

Growth would also translate into an increase in employment, with an unemployment rate around 7.9% in 2022, as well as an increase in purchasing power, supported by wage increases.

Read also Unemployment insurance: what changes for the unemployed on December 1

However, the Banque de France underlines the uncertainty linked to the evolution of the health situation.

It also presents an alternative scenario, in the event of the imposition of additional restrictions in the first half of 2022, which would lead to weaker growth next year in France (around + 2.2%), but which would catch up in 2023. (+ 3.5%).

Supply and recruitment difficulties could also tarnish the trajectory if they last longer than anticipated.

A decline in inflation in 2024?

As for inflation, the surge of which in recent months has become the “first concern” of the Minister of the Economy Bruno Le Maire, and against which the government has stepped up actions aimed at households, in particular modest ones (additional energy check , inflation compensation, gas price freeze, etc.), the Banque de France sees two successive phases.

After a peak at 3.5% at the end of 2021 of the harmonized rate of inflation (used to allow European comparisons, and more integrating energy prices than the index published by INSEE in France), inflation should remain at a level above 2% for a large part of 2022, before a decline around 1.5% in 2024, a level higher than that before the crisis and rather identical to that observed before the financial crisis of 2008.