Enlarge image

Exchange office in Istanbul: one low chased the next

Photo:

Emrah Gurel / dpa

The Turkish lira was at an all-time low on Monday, but its value has now skyrocketed: the value of the currency rose by 25 percent against the US dollar.

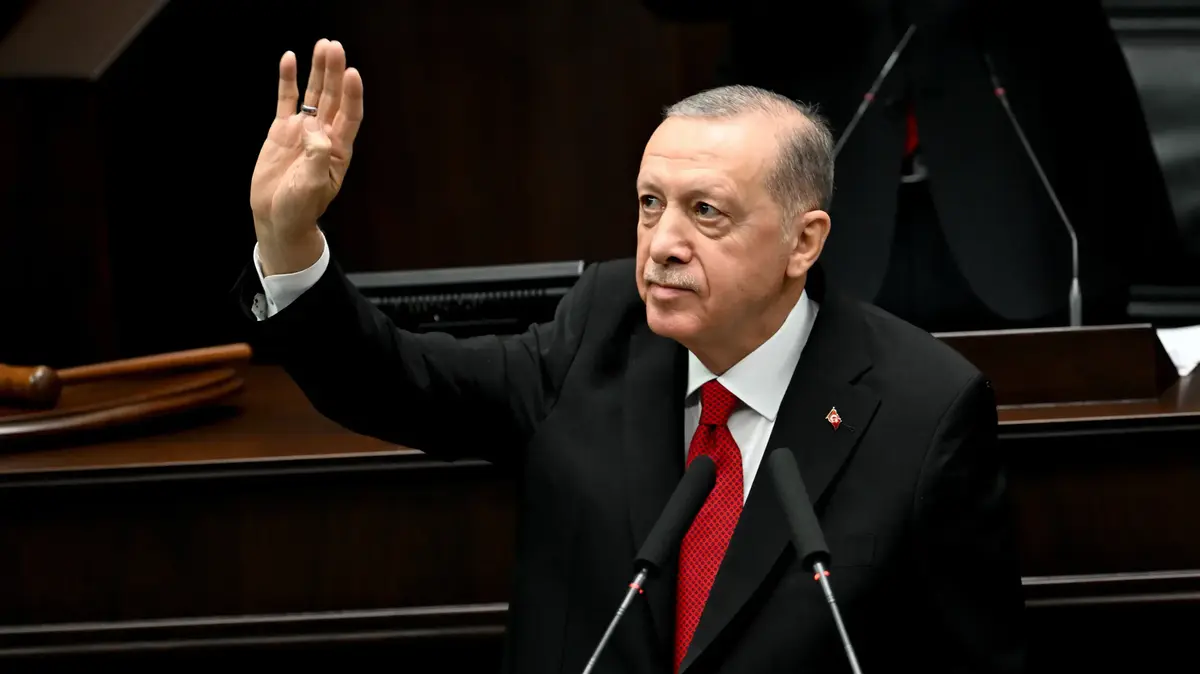

It was triggered by announcements by President Recep Tayyip Erdoğan that he would take measures against the decline in value.

more on the subject

Lira crash: How Erdoğan gambled away the strength of the Turkish economyBy Benjamin Bidder

After a cabinet meeting, Erdoğan said that future deposits should be protected against losses from exchange rate fluctuations.

Should the losses turn out to be greater than the interest promised by banks on the respective deposits, the losses should be compensated.

"From now on, none of our citizens will have to exchange their deposits from lira into foreign currencies because they fear that exchange rate fluctuations could destroy profits from interest payments," said the Turkish President.

No turning away from the free market economy

In addition, he announced further steps.

Among other things, the government also wants to help companies hedge against the risks of high exchange rates.

Turkey has neither the intention nor the need to "take the slightest step" away from the free market economy and the current foreign exchange regime, said Erdoğan.

In the hours before its announcement, there was considerable turbulence on the Turkish financial markets for the second trading day in a row.

For the first time, a dollar was worth more than 18 lira, and a euro was worth more than 20 lira.

The Turkish stock exchange had recently suffered severely from the lira depreciation.

The national currency had lost more than half of its value in the current year up to Erdoğan's package of measures.

In the vicious circle of inflation

The main problem of the lira is the rapid loss of credibility of the Turkish central bank.

The central bank has been on a strict rate cut since late summer despite high inflation of a good 21 percent.

However, the price losses of the lira only fuel inflation - a vicious circle.

President Erdoğan is constantly putting pressure on the central bank to further cut interest rates.

Again and again he fired central bank members who opposed his course.

Erdoğan takes the view, contrary to common economic theory, that high interest rates promote inflation.

At the beginning of December he announced: "Interest is an evil that makes the rich richer and the poor poorer."

jlk / dpa