In supermarkets, labels keep getting reprinted.

Because in Turkey, prices change quickly and all the time: flour and chicken have increased by 86%, bread by 54%, sunflower oil by 76%.

In December, the increase in consumer prices reached 36.08% over one year (against 2.8% over one year in November, in France).

And the situation could actually be worse: the opposition and part of the population accuse the National Statistics Office (Tüik) of knowingly and largely underestimating the rise in prices.

This mad inflation, which the country had not known since September 2002, stems from a collapse of the currency.

Since the start of 2021, the Turkish lira has lost almost half (45%) of its value against the dollar.

So much so that millions of Turks are now struggling to find accommodation and food, even among the middle class.

On December 12, thousands of people took to the streets to protest against the decline in their purchasing power.

How did we get here ?

Several factors triggered the storm that the Turkish economy is going through. Totally dependent on the outside for gas and oil, Turkey is hit hard by the rise in the price of hydrocarbons. Since the coup attempt in 2016, the Turkish political situation has also known turbulence which frightens foreign investors. Turkey is also very dependent on it. Finally, the Turkish economy lacks the capacity to manufacture products with high added value, and is no longer as competitive as China, for example, on products with low added value. “It finds itself caught between emerging and developed countries,” summarizes economist Rémi Bourgeot.

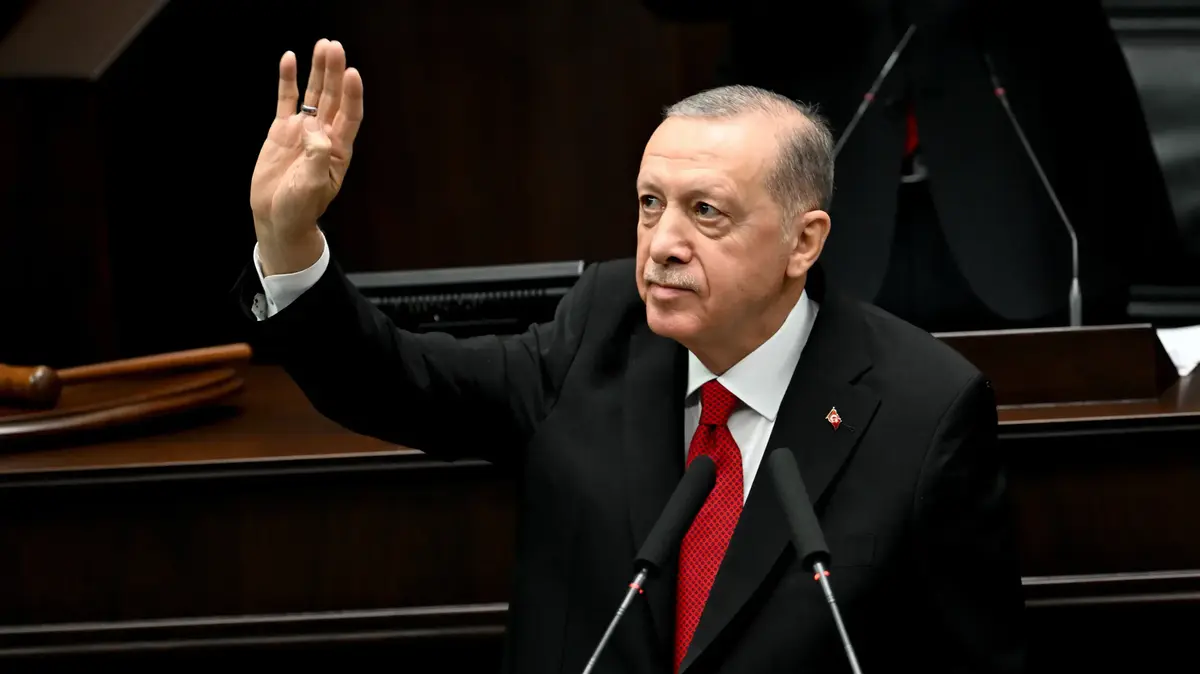

All these structural weaknesses are amplified by "the inappropriate decisions" of Turkish President Recep Tayyip Erdogan, underlines the geopolitologist Didier Billion, deputy director of the Institute of International and Strategic Relations (Iris). According to classical economic theories, high interest rates make it possible to lower prices: by reducing borrowing, the money supply in circulation decreases and slows down inflation. This is what the United States plans to do in 2022 to prevent consumer prices from skyrocketing.

Recep Tayyip Erdogan thinks the opposite. Low rates would reduce companies' financial charges, which would encourage them to lower their prices. Indeed, exports benefit from this situation. The numbers are good, but they are almost drowned out by a series of negative aspects: Inflation, seven times higher than the government's initial target, is out of control.

“In addition to his claims to improvise economist, Erdogan punctuates many of his speeches by accusations of the conspiratorial type on powers which would be angry with Turkey, he also speaks of the '

lobby of interest rates

', continues Didier Billion, author of "Turkey, an essential partner" (ed. Eyrolles).

There are also many religious references condemning usury rates, even though the Gulf countries do not spit on it.

This break with the principle of reality is very worrying.

"

What consequences?

The EU will not be affected by Turkish monetary instability. "There will be no drying up of deliveries of Turkish products, on the contrary, they will cost us less", explains Didier Billion. “No one really understands its strategy, but we can assume that Turkey could once again become the China of Europe it was 25 years ago, a country-workshop to run the industry with a strong workforce. 'work at low cost', abounds Guillaume Perrier, author of 'Dans la tête d'Erdogan' (éd. Actes Sud).

On the other hand, imports are becoming more and more problematic.

In this politically explosive context, President Erdogan raised the minimum wage on January 1 from 2,825.90 to 4,253.40 pounds (around 275 euros), an increase of 50%… largely erased by the economy.

"I fear that all wage increases have melted in two months," reacted Monday on Twitter Gizem Öztok Altinsaç, chief economist of the Turkish employers' organization Tüsiad.

"When democracy was skating, there was at least the economy, notes Guillaume Perrier, who is worried about" the very rapid impoverishment of the population ", particularly affecting young people, and" the brain drain ".

The crisis affects all sectors.

The producers of hazelnuts in the country, the world's largest exporter, also impoverished, are forced to slow down their activity.

To grow hazelnuts, you need fertilizer: it costs three times more than last year.

Read alsoNutella: should we really fear a shortage?

Books are becoming a luxury, notes Courrier International, because the publishing sector is very dependent on paper imports.

In the space of a year, "the price of paper went from 700-800 dollars (618-707 euros) to 1500 dollars (1325 euros)" per tonne, explained to AFP Haluk Hepkon, owner of the Kirmizi Kedi publishing house.

A sudden increase which is necessarily reflected in booksellers.

What solutions?

It will be necessary to resort to an acceptance of the interest rate hike.

And "restore confidence", advocates Didier Billion.

First among the Turkish middle class, one of Erdogan's electoral bases.

However, with the current crisis, "they are gradually breaking away from him, which will cause him difficulties" during the next presidential election, in 18 months.

Also restore confidence with foreign investors, elements necessary to revive the Turkish economic machine.

“But the president's liberticidal strategy is not favorable to it.

And as long as he is in power, he will pursue the same policy.

"