Enlarge image

A man with goods in Istanbul's Eminönü district: the country suffers from high raw material prices

Photo:

Emrah Gurel / dpa / AP

In the New Year, there will also be drastic increases in energy prices - but inflation in Turkey has already gotten increasingly out of control in the weeks before that.

This is shown by the figures for December, which are now available.

In that month, the inflation rate jumped over the mark of 30 percent and reached 36.08 percent year-on-year, the highest level in around two decades, according to the Turkish statistical office in Ankara.

Observers were surprised by the strength of the price increase, they had expected about 27 percent.

The rate has more than doubled since the summer.

The increase in the cost of living has recently been driven by higher food prices.

From November to December alone, the rate of price increase was 13.6 percent.

High unemployment

In December, producer prices even rose by 79.89 percent year-on-year and thus also rose much faster than expected.

The prices that producers charge for their goods will likely, with some delay, at least partially affect consumer prices.

The rapid decline in the rate of the Turkish lira, which goes hand in hand with inflation, makes it more expensive to import goods into the country.

In addition, there are comparatively high raw material prices on the world market.

This is one of the reasons why the country is in a difficult economic situation, which is reflected, among other things, in high unemployment.

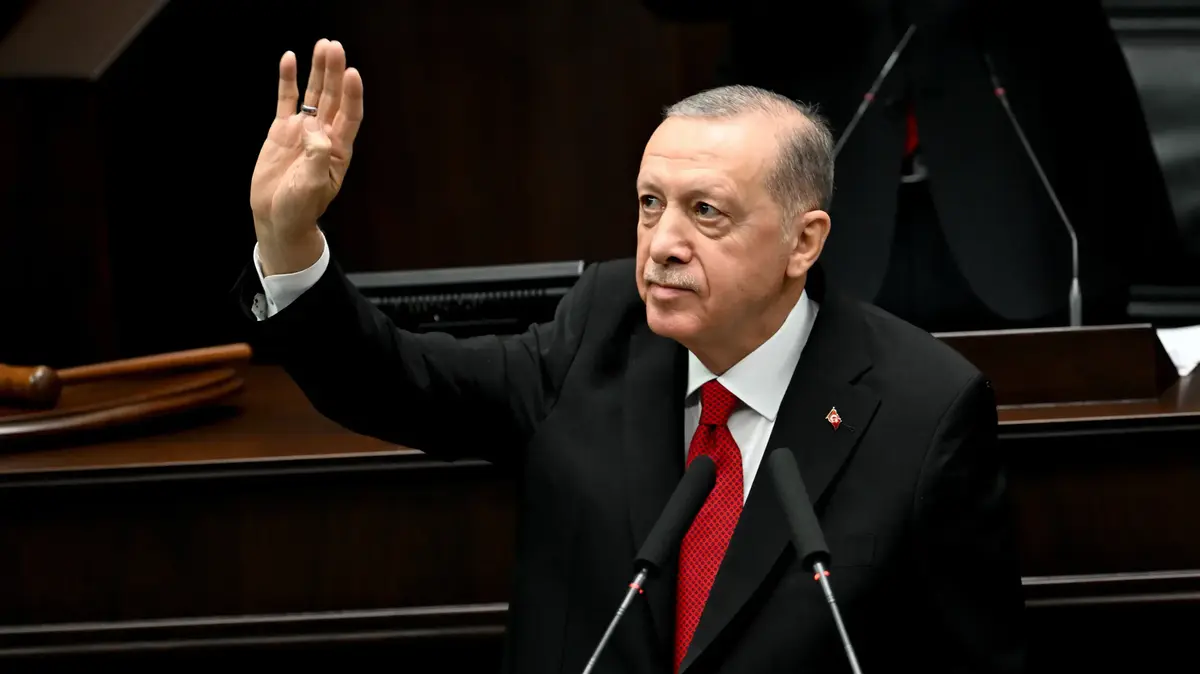

The situation has been worsened for months by the Turkish central bank, which, under pressure from Turkish President Recep Tayyip Erdoğan, has recently continued to lower the key interest rate despite high inflation.

He wants to boost loans and investments through low interest rates, and presidential elections are due again in 2023.

Central bankers are actually bracing themselves against galloping inflation with higher key interest rates.

Because without interest, investments in Turkish assets will now become even less attractive for investors, the currency will become even weaker - and will further fuel inflation, as imported goods become more expensive.

The Turkish lira came under pressure on the foreign exchange market on Monday.

Compared to the US dollar and the euro, the exchange rate fell by more than two percent in the morning.

apr / dpa-AFX / AFP