A ticket to the competition?

Clal signed the girls' agreement to acquire Max

Clal Holdings has signed a memorandum of understanding with the Warburg Pincus investment fund: it will acquire the Max Group for NIS 2.47 billion.

The credit group will move to the full holding of Clal Holdings, alongside Clal Insurance Company.

Despite the understandings, the deal still requires a final signature as well as approval from regulators

Walla!

Of money

11/04/2022

Monday, 11 April 2022, 08:32 Updated: 08:48

Share on Facebook

Share on WhatsApp

Share on Twitter

Share on Email

Share on general

Comments

Comments

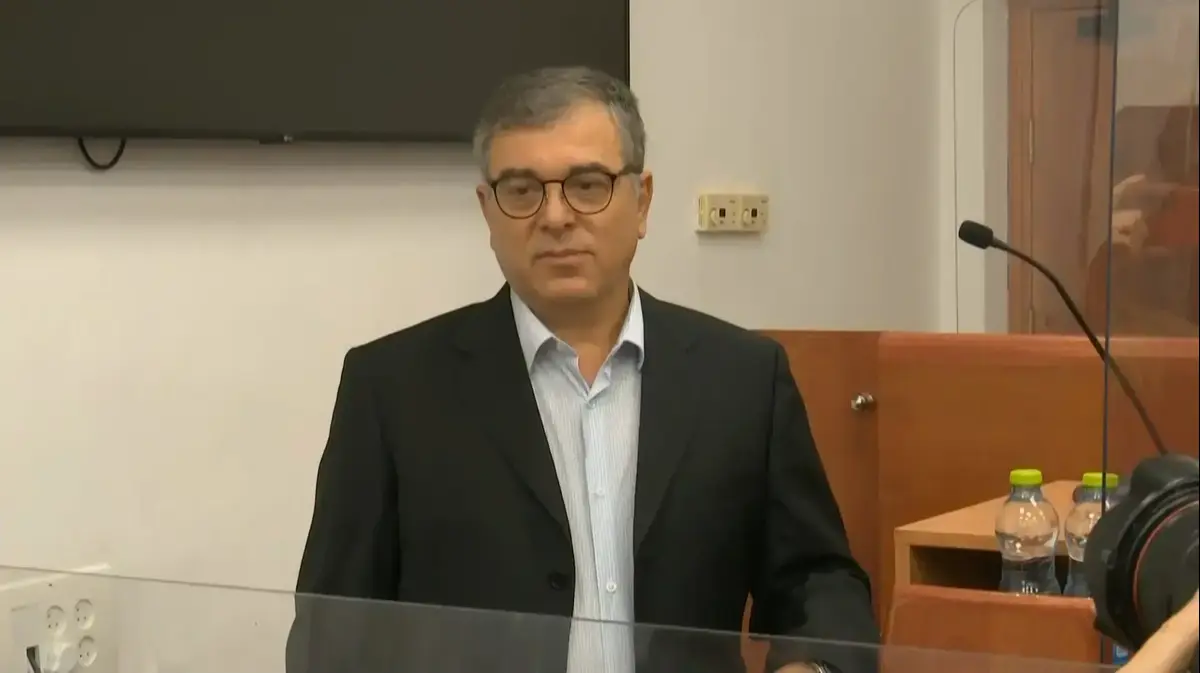

The CEO of the Clal Insurance and Finance Group, Yoram Naveh

, announced today the intention of Clal Holdings to acquire full ownership in the Max Group, from the American investment fund Warburg Pincus and its partners

. .

According to the agreement, the Max Group will be sold to Clal Holdings for an operating value of approximately NIS 2.47 billion.

Despite the understandings, there is no certainty in the completion of the transaction, and it is subject to the signing of a binding agreement and the receipt of the required regulatory approvals.

Upon completion of the transaction, Max will form an arm of Clal Holdings in favor of promoting competition in the field of credit, for small and medium-sized businesses and in the field of consumer credit.

More on Walla!

The challenges, the difficulties and the immense satisfaction: the women behind Binyamina Winery

In collaboration with Binyamina Winery

Yoram Naveh, CEO of Clal Insurance and Finance Group (Photo: Sivan Farage)

"Motivating competition in the field of non-bank credit"

Yoram Naveh, CEO of the Clal Insurance and Finance

Group: "The Clal Group today signed a memorandum of understanding, which is part of a strategic move aimed at expanding the group's operations, beyond the subsidiary's concentrated insurance and finance operations, after examining several alternatives and choosing to move forward with the Max Group. A quality company managed with great professionalism, which in recent years has built a diverse and growing financial platform.

Today, we join other moves that have already been made among the institutional bodies, which are becoming a significant factor in driving competition in the field of non-bank credit.

Clal recently published its financial results for 2021, the best since its inception, and I am glad that close to the publication of the results, and after the successful capital raising we made earlier this year, we present today our intention to strengthen the holding company with a new and complementary arm. The group's next. "

Haim Samet, chairman of Clal Holdings and Clal Insurance

: "The understanding document relating to the acquisition of Max is in line with the company's ambition to create a new and valuable profit center in the holding company, along with the extensive activity in the insurance fields. The company's interest over time. "

Haim Samet, Chairman of Clal Holdings and Clal Insurance (Photo: Ami Erlich)

Yaron Bloch, Max's chairman and senior consultant to Warburg Pincus in Israel

: "In light of the company's strong performance, various inquiries have been received in recent months from institutional and private entities interested in acquiring control of the company.

We chose to focus on negotiations at the current time with the Clal Group due to the seriousness of its intentions, as reflected in the contacts between the parties and due to strategic business suitability for the Max Group.

I believe Max's connection to the Clal Group will promote competition With its advanced capabilities and close relationship with customers, private and business, Max is an excellent platform for promoting competition in the financial system in the Israeli market.

I am happy to sign the Memorandum of Understanding, and hope to complete the negotiations in favor of signing a binding agreement. The approvals required for the completion of the transaction in the coming months. "

Yaron Bloch, Max Chairman and Senior Advisor to Warburg Pincus in Israel (Photo: Hadar Dolan)

The parties to the Memorandum of Understanding

Clal Insurance Business Holdings Group

: Shares of Clal Insurance Business Holdings are held by the public, without a controlling shareholder, and are traded on the Tel Aviv Stock Exchange.

The group's market share in terms of gross earned premiums stands at about 15% of the insurance market, and the volume of assets managed by it stands at about NIS 286 billion (as of the end of December 2022).

Clal Insurance Company Ltd. is ranked (ilAA + stable forecast) by S&P Maalot, and rated Aa1.il (stable horizon) by Midroog. The group owns insurance agencies, pension funds, provident funds, study funds

Max Credit Group

:

The Group consists of Max, a payments and financial services company that issues and clears credit cards, consumer non-bank credit to the general public and small and medium-sized businesses, and Hyp, which deals with advanced payment solutions for businesses.

Today, Max is the leading company in providing non-bank credit among credit card companies, with a portfolio of more than NIS 7 billion and is the fastest growing non-bank credit card turnover.

Of money

Insurance

Tags

Clal Insurance

max

credit

Insurance