consumption

National Infrastructure: Meet the major players in the field in Israel

The establishment of infrastructure takes years, and accordingly, the investment in the four public infrastructure companies in Israel is also one that yields a long-term return.

Therefore, investors may want to be patient: not every loss in a large auction necessarily means a loss of income.

Roast Greenberg

03/05/2022

Tuesday, 03 May 2022, 12:31 Updated: Wednesday, 04 May 2022, 18:01

Share on Facebook

Share on WhatsApp

Share on Twitter

Share on Email

Share on general

Comments

Comments

Building on the foundations: Israel's population is expected to grow by about 30% by 2025 and the four Israeli infrastructure giants, who take care not to miss any tenders, are expected to grow with it.

But these companies are not satisfied with the options in the field of infrastructure, and have begun to flow into other areas of growth - including even nursing homes.

The corona pushed them even further, after the government decided that this period was suitable for a more massive investment in infrastructure, and accelerated the activity of companies traded on the Tel Aviv Stock Exchange, with a total value of about NIS 40 billion.

But the backlash behind investors' trust lies precisely in the lack of competition from the other players in the Israeli economy, who are unable to take on mega-projects.

The shares of the Big Four have risen by an average of 143% since the closure of the first corona in Israel until the beginning of the week, of which about 32% has increased since the beginning of 2021. This is compared to 72.2% and 90.71%. , And 34.54% along with 34.51%, an increase in the indices since the beginning of 2021.

The Ashtrom Group

, which is traded on the Israeli stock exchange at a value of NIS 9.5 billion, leads the increase experienced by the four stocks with about 302% since the low reached in March 2020 and 58.8% since the beginning. The year 2021 until the beginning of the week (see table).

Shikun

VeBinui, on the other hand, closes the table from the bottom with the smallest increase since the beginning of 2021 of the four - 6.14%, but the second highest since the Corona low - 125.23%.

More on Walla!

You have chosen: The winners of the Product of the Year Award Israel 2022

In collaboration with Product of the Year Israel

Shares of the largest infrastructure companies in Israel (Photo: Walla !, no)

Land for big players only

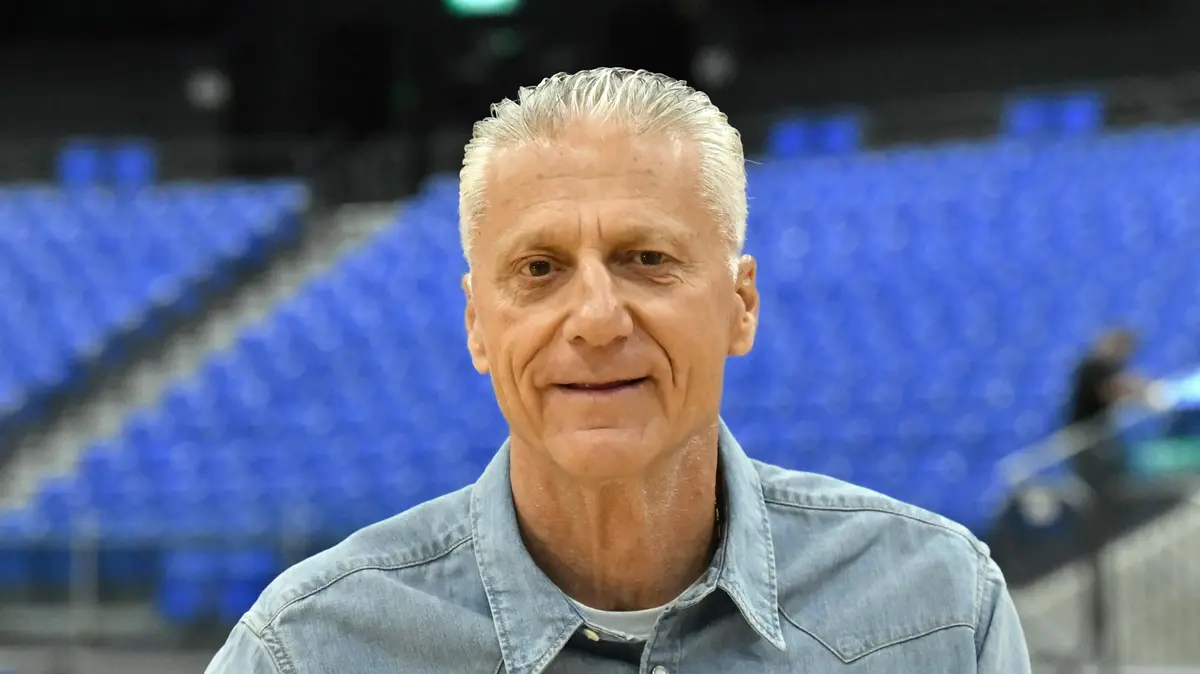

Itzik Raz, an analyst at Migdal Capital Markets

, the investment house of the Migdal Insurance Company, explains: This is worthwhile for the government, as investing in infrastructure at the right pace and focus leads to an increase in economic productivity.

In this aspect, all companies operating in this field benefit, but the truth is that only the four largest companies Energy and more, while the smaller others, work for them primarily as subcontractors in these projects.

Even projects that were supposed to be a barrier to knowledge, such as the light rail project, are not a barrier for companies, which approach these tenders with a professional knowledge partner from abroad, whether it is an Italian, Spanish or Chinese company. As for investors' trust, this is another matter.

If you look at Shikun VeBinui, you should remember that Shikun VeBinui tried to spin-off (a process in which a division or business unit becomes an independent entity and the parent company's shareholders receive a dividend in the form of shares in the new company). Investors

had

an expectation of a flood of value following the spin-off, with an initial value of about NIS 5 billion that was put into operation, dropped to about NIS 3.5 billion in a very short time, and about NIS 2.75 billion, which has not yet been flooded.

Shikun also tried to acquire 50% of Egged's shares without success, and the company experienced difficulties in its operations in Texas USA. Along with these, the completion of the Ashalim project in 2020 led to the revenue share not reaching 2021

. In the tenders of the Ministry of Defense for the construction of the Intelligence Campus and the Information Technology Campus, in the amount of NIS 3-4 billion for each project, and that it has a large accumulation to continue in the amount of billions of shekels. "

Itzik Raz, Analyst of "Capital Markets Tower" (Photo: None)

The position of investors

Raz adds: "One must understand the view of investors, who do not win such large tenders and others have negative effects on the level of expectation from the companies, which are not necessarily reflected in the companies' business results

.

If Shikun VeBinui wins, then the effect on it will be positive both on the side of the activity and in its perception, but if it does not win, the perception is as if it has lost income.

But in practice, she did not lose them, as they had never been with her, and the company would simply proceed to subsequent auctions.

Ashtrom, on the other hand, has not had a significant win in the last year or two, but they made an interesting takeover bid for the Ashtrom Properties subsidiary, which investors really liked.

The group also has a respectable backlog of around NIS 7 billion, and stable activity in real estate, through the Ashdar company.

Data from the Israel Government's Infrastructure Website for Growth show that as of 2022, there are initiation and construction projects with a construction cost of about NIS 56 billion, along with about NIS 5 billion construction projects for education infrastructure, and this trend is expected to continue over the next decade.

"The approval of the state budget supports this trend," Raz details, "and today the government ministries are preparing to publish the winners of the various tenders, with the expectation of many more tenders.

The significant companies that will compete in these tenders are already known. These, and what steps will be required on the part of the companies, which sometimes slide into areas that on the face of it seem to belong to them.

For example, Electra acquired Egged Transportation, among other things, as part of its competition in the highway tenders.

And perhaps the most unexpected example - the Shafir Engineering Group has acquired the "120" nursing home chain from the Phoenix Insurance Company, and expects to triple the number of housing units in the sheltered housing chain in the coming years.

In general, the field of infrastructure has a place in Israeli economic activity, since it is based on a need for years to come, and in my view the sector is worthwhile as part of the investment portfolio in the local stock exchange. "

Of money

consumption

Financial consumerism

Tags

Infrastructure

Stock Exchange

tender

Housing and Construction

Ashtrom

Electra

Shafir Engineering