Banque de France Governor François Villeroy de Galhau said on Friday it was "

reasonable

" for the European Central Bank to put an end to negative rates "

by the end of this year

", as the institution prepares to continue. the normalization of its policy.

“

Barring unforeseen shocks, I think it would be reasonable to have entered positive territory by the end of this year.

“, affirmed the leader Friday during a speech in Paris, in reference to the interest rate imposed on banks which entrust part of their liquidities to the ECB instead of distributing them in loans.

Traditionally in positive territory, this cash placed in reserves is currently at a negative rate, at -0.5%.

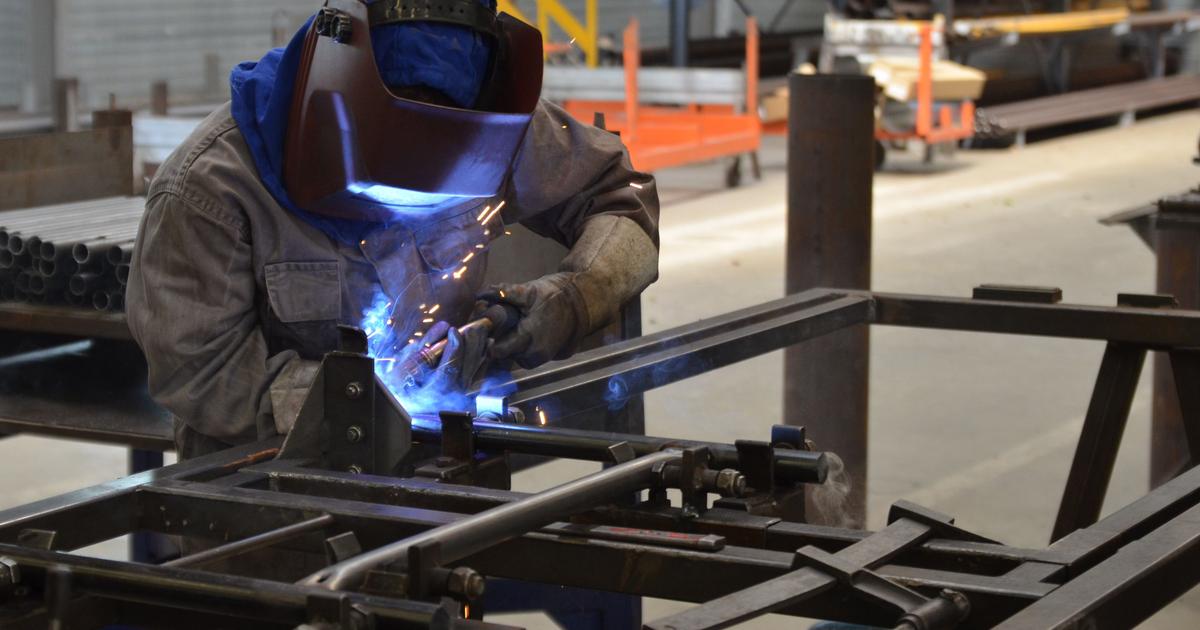

The objective of the interest rate below 0% has been to encourage banks to lend to households and businesses: at negative rates they are forced to pay the ECB to store these funds, where they are normally remunerated by the European institution.

Read alsoWill the increase in interest rates cost the State 22 billion euros?

Interest rate hikes are part of the arsenal of measures that the ECB is preparing to adopt in order to gradually put an end to its very accommodative monetary policy.

This normalization will be achieved by stopping its asset buyback policy, probably as early as July, its president Christine Lagarde recently said, then by gradually raising rates.

The monetary normalization aims in particular to try to stem the inflation which is hitting the euro zone and which, in April, stood at a record level of 7.5% over one year.

“

This trip is a fully justified normalization of policy, but not a tightening so far

,” François Villeroy de Galhau said on Friday, however, adding that “

inflation is not only higher, it is wider

,” affecting the entire economy.

Read alsoThe ECB prepares the ground for a rate hike

The speed of monetary normalization does not make all members of the ECB agree.

Some, like the member of the executive board Fabio Panetta, believe that a tightening risks weighing down the already weakened economic activity, while others call for the implementation of normalization without delay, like Isabel Schnabel , also a member of the executive board, who considers it possible to raise rates in July.

In the United States, the American Central Bank is engaged in a much more marked tightening, in particular having announced on Wednesday an increase in its key rates by half a point, now in a range between 0.75% and 1%.