Credit card as a means of saving?

Turns out there is such a thing

Credit card company Max has launched the savings services that will be offered to the company's credit card holders.

The program was developed together with the consulting company led by Prof. Dan Arieli and will allow its members to save on a variety of routes.

Walla!

Of money

19/06/2022

Sunday, 19 June 2022, 13:38 Updated: 13:55

Share on Facebook

Share on WhatsApp

Share on Twitter

Share on Email

Share on general

Comments

Comments

Max today launches the "Save in" Max services that allow Max credit card holders not only to spend money using the card as everyone is used to, but also to save money, by transferring to savings made directly from the credit card and digitally.

Thus, Max customers will for the first time be able to manage the expenses and savings in one place and will be able to view the details of the expenses along with the details of the savings and returns on the money accumulated.

In recent months, as part of the preparations for the launch of the new product, Max Pilot has been held with the participation of over a thousand customers.

Among the pilot findings, it was found that the most common goal for saving is a vacation, followed by a wedding, studies, apartment, vehicles and unplanned events.

In addition, there are those who have defined the purpose of saving for the benefit of buying tefillin, a surrogacy procedure, a gift to the spouse and even helping others.

Most savers opted for a monthly standing order on the card, and the average savings amount was about 600 NIS.

Another interesting finding is that the rate of savings opened among customers from the ultra-Orthodox and Arab societies was higher than their share of the population.

About 52% of the savers are men and the age ranges in which the most savings were opened are 30-40, followed by 40-50.

More on Walla!

"He who works hard succeeds": the book that teaches how to write a book

To the full article

"Money aside" savings route (Photo: PR)

With the initial identification of the public's need to save, which even intensified during the Corona period, Max decided to conduct a broad preliminary examination of the savings issue that included economic-behavioral research work and extensive public opinion polls

led by the "Sustainable" consulting firm led by Prof. Dan Arieli

.

As part of the joint work, the motivations and barriers of Israelis were studied in everything related to saving and financial planning, and various concepts of tools were examined that will help those who want to save, all with the aim of changing savings and investment habits.

The main research question was "How can Israelis be helped to" reverse "their credit card - and use it to save money for various future purposes?"

The study found that more than half of Israelis were interested in improving their ability to save, mainly in case of an emergency and also for the benefit of housing and real estate.

40% of those surveyed said that it is difficult to save and about 30% would like the help of financial entities to promote savings efforts.

It is also found in the sample that about 70% have money available for savings, with the majority of the amounts ranging from 1,000 to 50,000 NIS per year.

It also emerged that about 40% of Israelis currently save by leaving money in the current account (checking account at the bank), without defining a specific goal

. Various savings (for example: buying a car or saving for an event) and up to the preferred saving technique (standing order for saving a fixed amount each month, and depositing a fixed percentage of the salary were the most effective).

Significant potential has also been identified for the use of shared savings with relatives (especially spouses and parents - for example around goals related to children and the apartment), and the importance of milestones embedded in the interface and ongoing feedback for savers' perseverance.

The research findings have been incorporated into product planning and design, and will be integrated extensively in subsequent versions, along with additional ways to increase savings.

"Money Plus" savings route (Photo: PR)

How do you start saving?

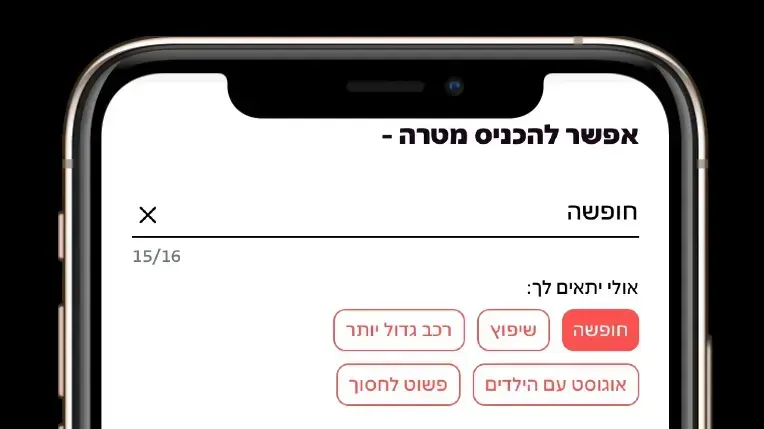

The savings are already available in the personal area of the site and in the Max app (sometimes a version update is required), customers can set the deposit amount and mode of deposit, one-time or monthly, and then be asked to choose one of the two offered programs, "money aside" or "money plus"

: On the side "

-

• Flexible deposits starting from 50 NIS per deposit, in one-time or monthly deposits.

• The track does not carry a return and there is no management fee or commission.

• Exit option at any time - the money is available for transfer to the bank account within 3 days - at no cost.

"Money Plus"

-

• Monthly deposits starting at NIS 200 per month and one-time deposits starting at NIS 2,500, for a savings policy from Direct Insurance.

• Yield-bearing track, depending on the mix of investment tracks chosen by the client (choice between 4 investment tracks).

• Exit option at any time - the money is available and will be transferred to the bank account within 7 days - at no cost.

"We are the first credit card company in Israel to launch a track that encourages savings alongside expenses" (Photo: Hadar Dolan)

"An experience that will encourage the public to save"

Ron Painero, CEO of Max:

Max

continues to create value for the public and offers a variety of financial solutions on top of the means of payment.

We are the first credit card company in Israel to launch a route that encourages savings alongside card expenses.

This is great news for the Israeli public who are looking for simple ways to put money aside for everyday needs.

We have designed for the customer an easy and simple digital user experience that will encourage the public to save as part of the ongoing expense management.

The message of our campaign is - "Save as if there is tomorrow" from the perception that we all have goals and objectives that we would like to achieve, from a trip to a family event, even saving small amounts each month.

"Just log in to our app, set a goal, choose a savings route and how much you want to save and see the savings deposits as part of all the expenses on the credit card."

Of money

Our money

Tags

max

credit cards

Savings