Despite the disruption created by the consequences of the war in Ukraine, the return of inflation, rising energy and raw material prices, tensions within the global supply chain and shortages of workforce, Thales held up more than well in the first half of 2022.

The high-tech and defense group posted record performances.

Carried by strong demand in defence, space and identity-security as well as cyber, the group recorded a 45% increase in its order intake, to 11.2 billion euros.

A record level!

“

All our indicators are green

,” comments Pascal Bouchiat, CFO of Thales.

"

This is also the case for our turnover which increased by 7.7%, to 8.3 billion, our operating margin (Ebit) which increased by 23% and our generation of cash flow which was doubled, to 820 million

,” he continues.

And consolidated net income (group share) increased by 31% to 566 million.

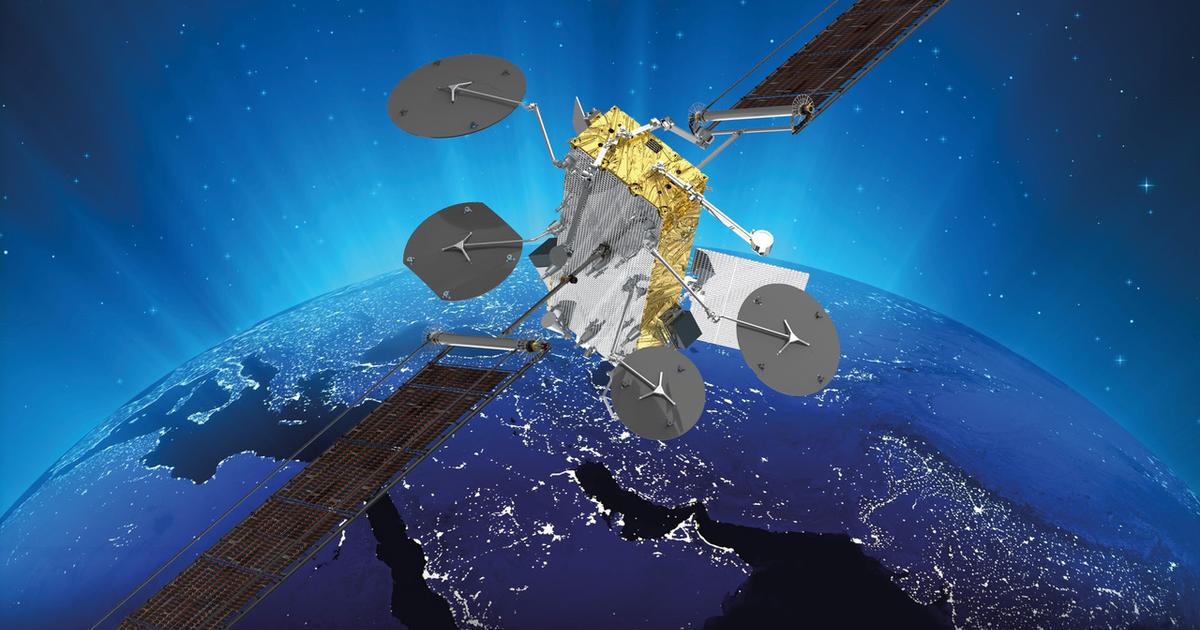

Rafale combat aircraft and Space Inspire satellites

These excellent results “

reflect the strong commercial momentum in all our markets, including military, space, identity and digital security.

Even the civil aeronautics activity is improving but it is still affected by demand, still depressed, on the market for long-haul aircraft

”, develops the financial director.

The half-year which has just ended was notably marked by a record number of orders for Rafale combat aircraft (86), in which Thales provides 22% of the value, in the form of electronic systems and equipment.

But also by the signing of orders for the construction, by Thales Alenia Space, a joint subsidiary of Thales and the Italian Leonardo, of 4 new generation digital and reprogrammable satellites, Space Inspire.

Certainly, the decline of the euro, which recently reached parity with the dollar, gave a boost, bringing a gain of 2.3% on turnover and margin.

But excluding the currency effect, the results continue to show strong growth.

“

This illustrates the group's resilience in a turbulent environment as well as the strength of its economic model with a well-distributed activity between civil and defense, an international presence in many countries as well as the quality of our solutions portfolio.

We are demonstrating that Thales knows how to navigate in all weathers

”, summarizes Pascal Bouchiat.

In Russia, where the group has ceased all activity, complying with international sanctions, the loss of turnover (1% of the consolidated total) is largely offset by the dynamism of the group's other activities.

Unchanged position on Atos

An observation in the form of regret, however.

“

We could have made even more progress with more engineers and less tension on the supply of electronic components,

” confides the financial director.

Like many companies, Thales finds it difficult to find the profiles it needs, despite still high unemployment in France.

In this context, “

we remain extremely attractive.

According to this criterion, Thales has moved up to second place, behind Airbus but ahead of Google, according to the latest Universum survey of young engineers

,” notes Pascal Bouchiat.

As proof, Thales, which plans to recruit 11,000 people worldwide, including 4,000 in France, is ahead of its 2022 plan with 5,700 new recruits halfway through the year.

The half-year was also marked by four acquisitions, including two in cybersecurity, a strategic area where the group is seeking to strengthen itself.

Hence again speculation about his interest in all or part of the struggling Atos group, an actor deemed critical by the government.

“

Our position on Atos has not changed.

We are potentially interested in any activity available in cyber but always in a friendly approach

”, insists the financial director.

In the end, despite the expected continuation of disruptions (inflation, price increases, etc.), Thales is confident in its ability to cope.

He even revised his business outlook upwards.

It now expects a book-to-bill ratio of orders to sales "

significantly greater than 1

", an organic increase (excluding currency and scope effects) of 3.5 to 5.5% from its turnover (16.1 billion in 2021).

On the other hand, its margin objective is unchanged.

It should improve to reach between 10.8 and 11.1%, against 9.8% of turnover last year.