Who will insure my house?

90% chance of an earthquake in the next few years

A new model for assessing the risk of damages as a result of an earthquake should prevent sleep from the eyes of every citizen in Israel: not only is the chance of an earthquake of 6 or higher on the Richter scale, in the next 15 years, standing at about 90%, it turns out that the existing insurances will have difficulty covering the damage.

what is the solution

Greenberg roasts

31/07/2022

Sunday, July 31, 2022, 08:13 Updated: 08:36

Share on Facebook

Share on WhatsApp

Share on Twitter

Share by email

Share in general

Comments

Comments

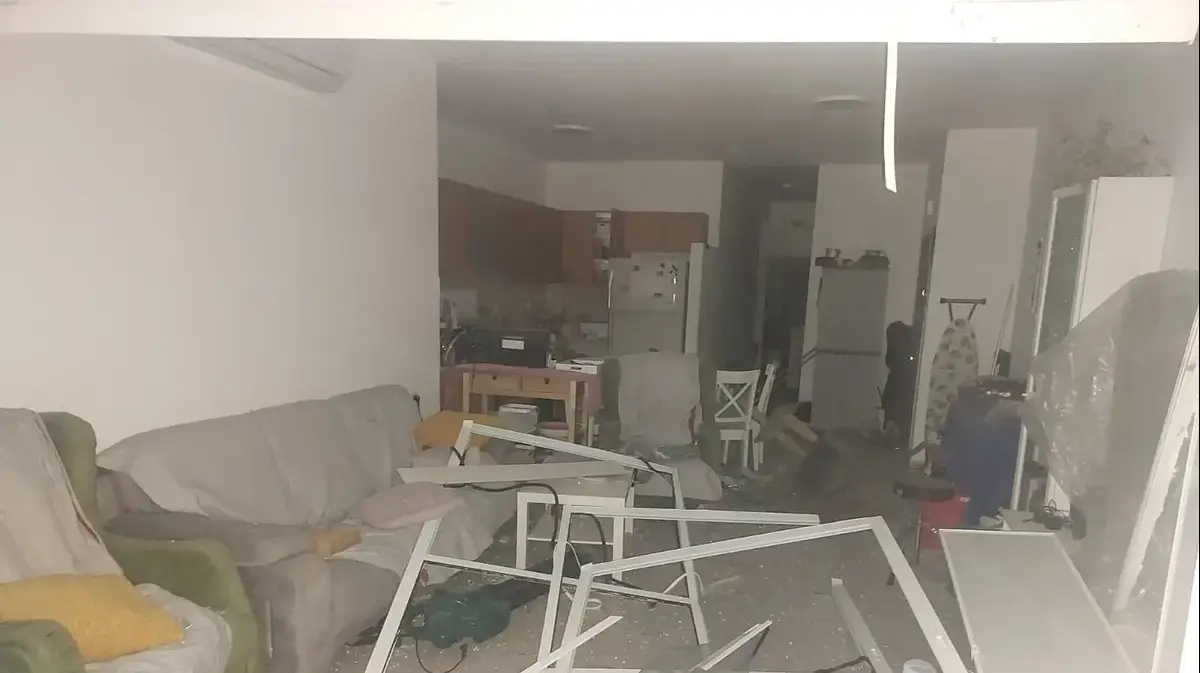

Even if the price per person is minimal, the insurance coverage does not allow those whose apartment is unfit to live in to purchase a new apartment (Photo: ShutterStock)

Live in an old house?

It may be that the insurance companies will not want to insure it - and it may be that they are right: a new technological development allows the calculation of the risk of earthquake and tsunami damage to buildings and infrastructure in Israel and predicts that the damage to buildings and infrastructure in Israel will amount to approximately NIS 650 billion.

The potential damage to private buildings is estimated at NIS 250-300 billion and is based on the expected damage estimates for each of the million private homes mapped in Israel, according to their level of risk in a strong earthquake.

This is a technology developed by the Choco insurance company and based on Google Earth, through which the insurance company created a location-based model, which enables the rating of the level of risk for buildings in Israel as a result of earthquakes, tsunamis and floods.

The model considers the various risk factors, including the distance of the buildings from the Syrian-African fault line, the sea or rivers, the year they were built, the type of buildings, the type of land they are built on, and more.

The model will incorporate knowledge and information accumulated among researchers from the Geological Institute and the Hebrew University accumulated from observations and scientific monitoring conducted over the past 100 years, and predicts a 90% probability of an earthquake with a magnitude of 6 or higher on the Richter scale during the next 15 years.

On video: Flooding in Nahariya - Hagaton overflowed (Photo: Ze'ev Kreithamer and Nahariya Municipality)

Nahal Hagaton in Nahariya and the insurance dilemma

We will recall that last March,

Dr. Moshe Barkat, the head of the Capital Market and Insurance

Authority, announced that the authority is examining the possibility of applying compulsory insurance for an earthquake, similar to the compulsory insurance for cars, following the frequency of earthquakes that began to be felt in Tiberias and Safed. Compulsory insurance of this type is found in Turkey, which also suffers is earthquake damage.

The Interministerial Steering Committee for Earthquake Preparedness, established in 1999, the body that centralizes the information and treatment recommendations on the subject, estimates that approximately 28,000 buildings will suffer severe damage, and the experts estimate that approximately 290,000 additional buildings are expected to suffer defined damage About light to medium.

The rate of building insureds in Israel is about 65%-70% according to the Capital Market Authority data, but it is possible that the new technological model will make the insurance companies unprofitable due to the risk of insuring certain buildings. For example, buildings near the Hagaton stream It is currently not possible to get insurance coverage in the winter months starting in November.

In the State Comptroller's report for 2021 on flood protection, for example, the comptroller noted that even the local drainage authorities find it difficult to insure themselves due to the large number of claims filed for flood damage, and that as of 2021, three of the drainage authorities in Israel are not insured at all.

good to know (in advance)

The people who managed to get rid of chronic pain reveal the solution

Served on behalf of B Cure Laser

Liav Gefen, founder and CEO of Shoko Digital Insurance. Developed a model for predicting earthquake damage (Photo: Dean Aharoni Rowland)

Liav Gefen, founder and CEO of Shoko Digital Insurance

, who developed the model: "The model placed the buildings in Israel on a risk map where the black and red areas have the highest risk of injury and damage.

In these areas there will be old buildings for which it will be difficult to impossible to obtain insurance coverage, and in our estimation we will begin to see a decreasing trend in the insurance portfolios of the reinsurers in Israel in this area.

Because according to the estimates of insurance underwriters in London, for example, an earthquake component in black-red areas should be 6-7 times more expensive than the current situation today, which is a uniform rate, and in green areas it should remain the same or decrease a little.

This is despite the fact that the distance between Tel Aviv and Beit Shean is not really that great, and an earthquake with a magnitude of 6 or higher on the Richter scale in Beit Shean is expected to affect Tel Aviv as well.

And this is the earthquake that the model predicts and for which the damage assessment was estimated.

We are approaching the 100th anniversary of the great earthquake that happened in Israel (1927) and the question is not if there will be an earthquake, but only when.

When we open the model we have developed to the general public, anyone will be able to log in and enter their address in order to receive a weighted score for the level of risk of the building in which they live.

The areas

of Beit Shean, Safed, Afula, Gev Ha'er, Samaria, and the Dead Sea up to Eilat are high risk areas

, where buildings built after 2014 will receive a better score, also in this area.

From the

Afula area, the Karmiel Corridor, to the opening of the Haifa Bay (Shaver Yagur area) is considered an area with a risk of a moderate earthquake, and the coastal areas are expected to feel a less strong noise than the other areas mentioned, but with

higher risks of tsunami and land subsidence."

On video: Haiti announced 3 days of mourning following the earthquake (Photo: Reuters)

before it's too late

Gefen adds: "Even in the hope that the earthquake passed without a large number of casualties, one must understand the implications of the purchase. Most apartment owners are not covered to the level of purchasing a new apartment if, God forbid, their apartment is destroyed and is in a condition that does not allow living in it.

Let's take for example the mortgage insurance, which most apartment buyers In Israel they already did years ago. But apartment prices have risen since then, while the mortgage insurance they took pertains to the price of the apartment when they purchased it. Thus, a gap of hundreds or even millions of shekels can arise between what the insurance will cover, assuming they have the financial reserves to cover it, and what is actually required.

In addition, one must take into account the percentage of self-participation in earthquake insurance, which is 10% of the insurance amount made, and other things that affect the amount that will ultimately be received by the owners of the buildings, assuming that the insurance companies have sufficient financial reserves."

The problem of insurance coverage and the need to ensure financial reserves in case of a strong earthquake has been raised over the years by various experts and government officials.

One of the proposals related to the issue is the establishment of a dedicated national fund for earthquake damage that will collect funds from the citizens through the property tax account.

This model has several problems, among them the distinction between the property owner and the property tax payer, who may be a tenant.

Whether the solution will be formed into a national fund or whether as a civil obligation to purchase an insurance policy for every building - the heads of the state have the responsibility of implementing some kind of solution, before it is too late.

Of money

Insurance

Tags

Earthquake

Insurance