One zero: the first digital bank launched its operations

ONE ZERO ends the running period and launches the subscription fee routes.

The CEO, Gal Bar Dea: "We were able to establish not only a complete bank with all the services and products that are available in any other bank, but also to lead to a vision of digital private banking for everyone, not just the wealthy." What are the routes and how do you join?

Walla!

Of money

08/16/2022

Tuesday, August 16, 2022, 2:23 p.m. Updated: 3:57 p.m.

Share on Facebook

Share on WhatsApp

Share on Twitter

Share by email

Share in general

Comments

Comments

ONE ZERO.

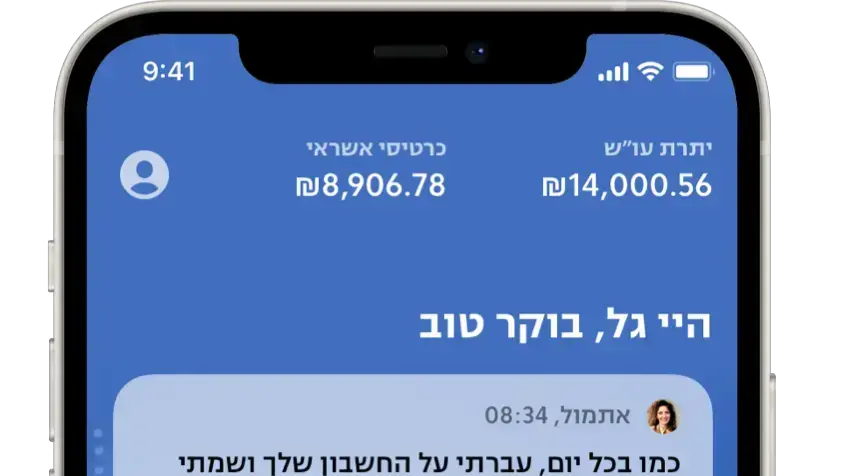

The pilot is over, they are going to compete with the old banks (Photo: ONE ZERO)

ONE ZERO has completed the run-in period and is increasing the pace of recruiting customers among the general public.

So far, more than 12,000 customers have joined the bank, with 35% of them transferring a salary or NIS 5,000 every month, who have more than NIS 200 million in checking and deposits. In recent months, the bank has been opening hundreds of accounts every day.

Communication between the digital bank and the customers.

Another area that moved from the physical space to the virtual (Photo: ONE ZERO)

Three elective tracks

The bank offers its customers a choice between three routes:

Route One

- an 'all-inclusive' subscription fee package at a cost of NIS 49 per month, which for the first time in Israel assigns a personal money manager to each customer.

Every day, smart AI-based technology scans the account and cards (including other accounts subject to 'Open Banking' approval) and updates customers on any unusual event, problem or opportunity with hundreds of recommendations and insights.

The finance managers work, analyze the insights and provide a proactive service with the aim of helping clients in managing their finances: maintaining personal and family financial health, preventing unusual events that will harm financial strength and maximizing financial potential for the benefit of financial well-being.

The subscription fee package will replace hundreds of tariff commissions (subject to a generous reasonable usage limit as detailed in the bank's tariff) and will create certainty and transparency, so that all the recommendations of the financial managers will be based solely on seeing the best interests of the customers.

In addition, Route One customers will benefit from high interest rates on deposits and soon also a continuous pension advisory service (for the first time with monthly updates) and discounted fees for trading in stocks (when the service is launched in early 2023).

Route One+

- Combines between Track One and an 'all-inclusive' trading package in Israel (first on the US stock exchanges and later on the Israeli stock exchange) without minimum commissions and buying and selling commissions (up to 15 operations per month) at a total price of NIS 119 per month.

In addition, the bank will not charge securities account management fees in the subscription fee tracks. This is the fee charged today for simply holding a portfolio of securities and for ONE ZERO package customers it will not be charged at all. This track will be launched with the launch of trading activity in securities in early 2023. Package One+ will gradually include a full financial package that will also include additional consulting packages that will be revealed gradually, similar to the 'family office' service that is currently accessible only to the wealthy.

Track Zero

- Includes a full digital bank, service of professional bankers 24/6 with no current account fees, no card fees, no anachronistic fees such as a credit allocation fee or a fee for opening a loan portfolio and payment based on a fair rate for additional services. This is the cheapest banking route in Israel, without Small letters such as "only for students", "only for salary transferors", "only for the first year", etc. The route does not include the daily financial check-up and personal financial management. This route will be launched in early 2023.

Until then, the customers who join early, will enjoy a trial period of the package at no cost. Before the end of the benefit period, customers will receive several proactive reminders and will be able to choose whether to continue enjoying the premium package or switch to the Zero route based on the traditional commission model and without the financial management service. In addition, at the beginning of 2023, customers will be able to choose an extended route, One+ based on Route One benefits and an "all-inclusive" securities trading package.

Starting today, those who wish to open an account will fill in their details on a dedicated landing page that appears on the bank's website and will then receive a link to download the application for the purpose of opening the account.

The bank will continue to add customers gradually and in a controlled manner, at a pace that will allow it to maintain a high level of service.

The process of opening the account takes place completely digitally in a few minutes, when at the end of the process the customers choose a debit card and enjoy an immediate overdraft facility. Thanks to the bank's smart underwriting technology, 75% of the bank's customers have so far received an overdraft facility that is the same or higher than what they are entitled to La in their previous bank, which allows them to move activities with ease, comfort and speed.

The bank is currently in a closed pilot for opening joint accounts and plans to launch the service during the fourth quarter of 2022. At the same time, a closed pilot for trading activity in foreign securities has recently begun, and such trading activity is expected to be launched in early 2023.

More in Walla!

"People watched someone in distress and did nothing. This disturbing side interested us"

In collaboration with the lottery

One-Zero: An example of a communication screen between the customer and the bank (Photo: ONE ZERO)

How do you open an account?

ONE ZERO launched in March last year a closed pilot for friends and family after less than 15 months from the date of receiving the temporary license from the Bank of Israel.

Last January, after receiving the permanent license from the Bank of Israel, the bank gradually began to add customers from the waiting list that numbered over 80 thousand registrants.

The customers who have joined so far have been designated Founders and transfer a monthly salary or an amount of at least NIS 5000.

These are the first customers of the bank who expressed trust in it in the first stages and experienced the birthing ropes of the run-in period, sent feedback and helped build the bank.

Customers who join the bank starting on August 16, 2022, will be associated with the bank's central premium package called One, which includes a pro-active personal money management service around the clock.

Since this is a service and an innovative pricing model that the Israeli public has not yet experienced and since the bank is in the final stages of completing the envelope of services, operations and troubleshooting, the bank will only start collecting the monthly subscription fees starting in January 2023.

Gal Bar Dea, CEO of ONE ZERO (Photo: Yanai Yehiel)

Gal Bar Dea, CEO of ONE ZERO

: "In less than 3 years since we started, we were able to establish not only a complete bank with all the services and products that are available in any other bank, but we are starting to offer for the first time in Israel and in the world a premium banking service through a personal money manager who is available 24/6 to manage all the money for our customers in one place - on the way to a vision of digital private banking for everyone, not just the wealthy.

More and more financial services will gradually join and along the way not everything will be perfect, but we are running really fast and the route is very clear.

We are here for anyone who wants to save time, hassle and headache in money management."

Of money

our money

Tags

Bank

fintech

Digital banking

banking

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/QLZQABDBZ5HQNGMWYSXWPVJXMY.JPG)

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/HWNXJOM4ENEOHCQN3NSKWWMECM.jpg)