The Federal Reserve is ready to slow the pace of interest rate rises in its fight against inflation.

Its president, Jerome Powell, said this Wednesday at a conference in Washington that moderation "could come as soon as the December meeting."

After four consecutive increases of 0.75 points in interest rates, those words imply that the next increase will be 0.50 percentage points.

Wall Street has reacted with strong increases.

“My colleagues at the FOMC [the committee that sets monetary policy] and I are firmly committed to restoring price stability.

After our November meeting, we noted that we expected continued rate hikes to be appropriate to achieve tight enough policy to bring inflation down to 2%,” he said at the end of his speech.

And he added: “The full effects of a rapid tightening have so far not yet been felt, so it makes sense to moderate the pace of our rate hikes as we approach the level of tightening that will be enough to bring inflation down. .

The time to moderate the pace of rate hikes could come as soon as the December meeting.”

According to Powell, the timing of that easing is far less significant than the question of how much more the Fed will have to raise rates to control inflation and how long it will take to keep policy tight.

“Re-establishing price stability is likely to require keeping monetary policy tight for some time.

History advises against premature loosening of monetary policy.

And I end by saying that we will stay the course until the job is done”, he concluded.

The next meeting of the Federal Reserve is on December 13 and 14, just after knowing the inflation data for November.

Powell has celebrated that inflation has given a breather in October, but has stressed that the data of one month is not enough to start claiming victory.

On November 2, the central bank's monetary policy committee approved an increase in the price of money of 0.75 percentage points, to the range of 3.75%-4%, the highest rates since the first half of January 2008.

In the press conference after that meeting, Powell already opened the door for the increase in December to be of a smaller amount and most analysts already considered a rise of 0.50 points as more likely.

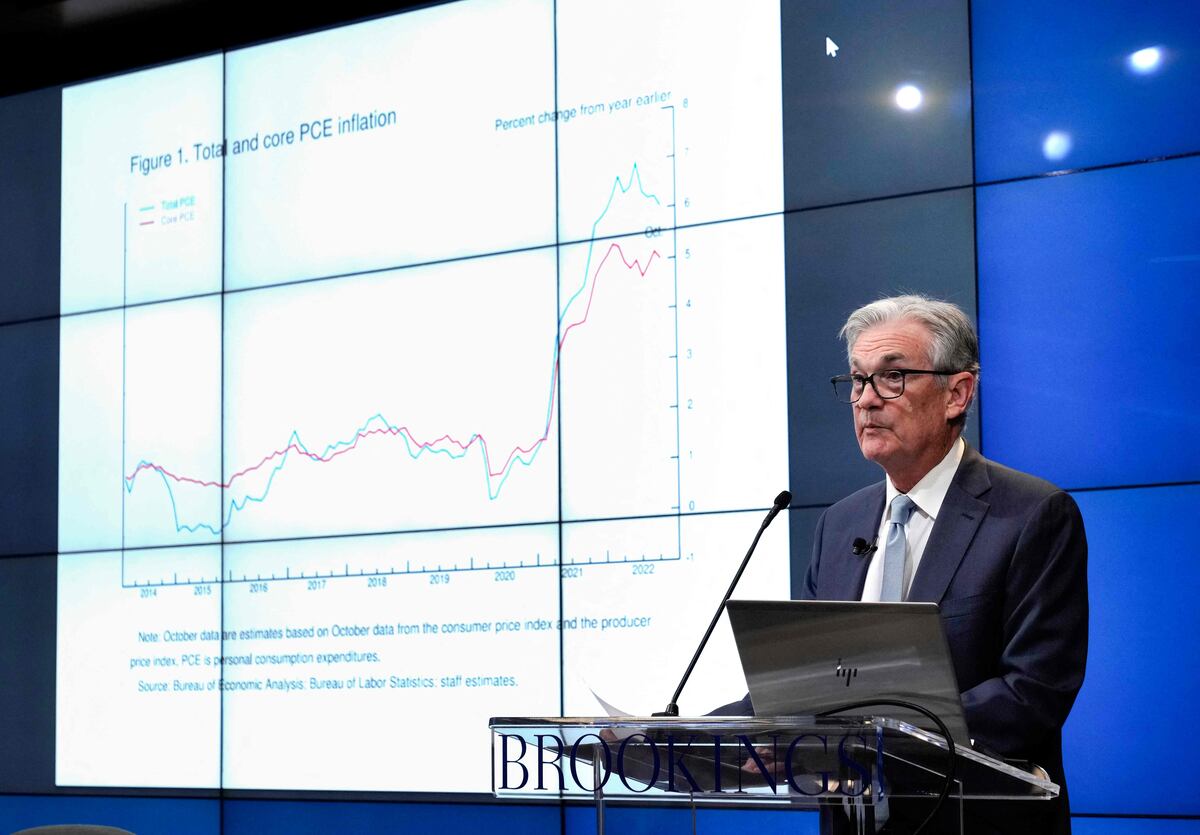

Powell has delivered his speech at the Brookings Institution in Washington.

Before pronouncing the most awaited words of his, he has reviewed inflation trends, emphasizing core inflation, which excludes energy and food prices.

He has insisted that price rises are still too steep and that there are still more jobs available than unemployed in the labor market and nominal wages are rising above the rate that would be consistent with 2% inflation.

And even so, they are losing purchasing power, as it happens to himself, as he has recognized.

The Federal Reserve has launched the most aggressive rate hikes since the 1980s in response to inflation that is also the highest in four decades.

Rates have gone from near zero to the current range of 3.75-4% year to date and will likely end 2022 at 4.25-4.5%.

At the December meeting, the Federal Reserve will update its forecasts on the evolution of the economy, inflation, unemployment and interest rates, but Powell has already anticipated that rates will probably rise more than expected in September, when the ceiling was near those levels.

[Breaking news.

There will be update soon]

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/O3URHWIQOUAJHPGYUFW2ZWAF2I.jpg)