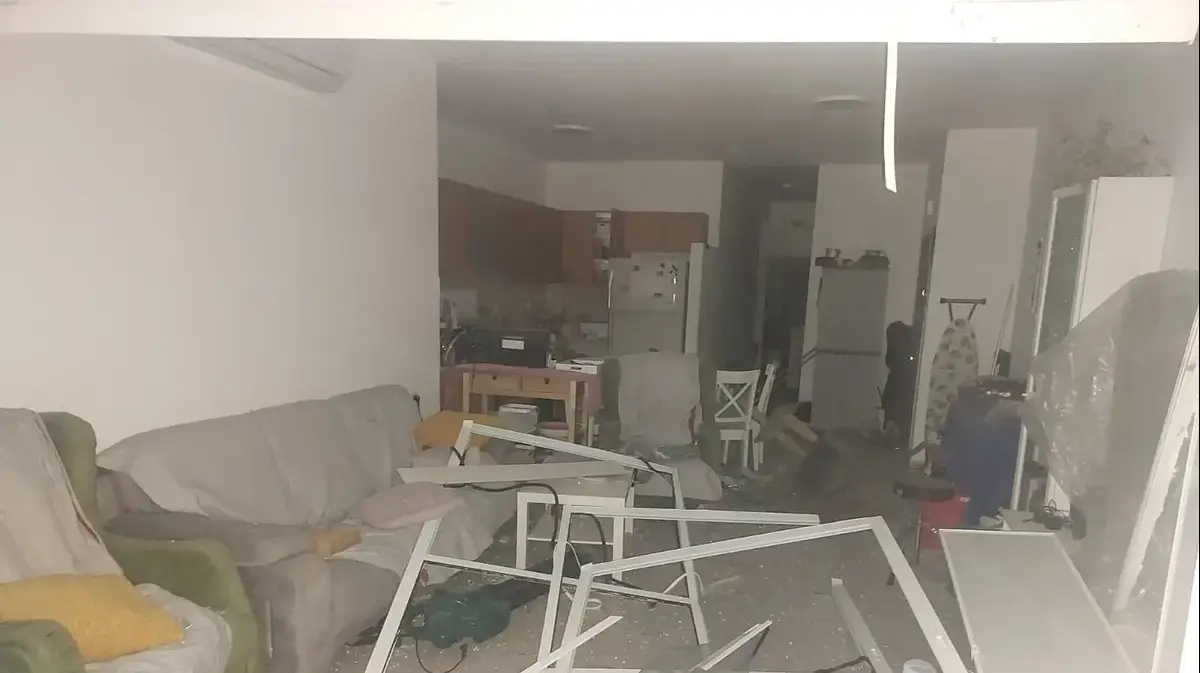

Floods and floods following Hurricane Ian (Anadolu Agency)

In January, the "Inside Climate News" website published an analysis of United States government data from which it emerged that insurance payments to farmers across the country increased by more than 400% when it comes to damages related to drought and by 300% in losses from rains and floods between 1995-2020.

Farmers received compensation worth $143 billion in total, with 75% of the amount related to drought and rain that destroyed crops or prevented planting for the next season.

The increasing frequency and intensity of extreme weather events - from fires in the United States to record-breaking heat waves in Europe, to floods in East Asia and droughts in Africa - are turning the spotlight on insurance companies and the losses they suffer due to climate change.

A federal regulator in the United States even said that the potential damage from climate change could be as severe as the consequences of the mortgage crisis that led to the financial crisis in 2008.

According to a study by Munic Re, the world's largest reinsurance company, natural disasters caused significantly higher losses in 2021 compared to the two previous years.

Storms, floods, fires and earthquakes destroyed $280 billion worth of property - of this figure, only $120 billion in losses were insured.

This gap, or the uninsured part, was 57%.

"This year is also not an easy year. Only in the first half of 2022, losses of approximately 68 billion dollars were recorded worldwide due to natural disasters and extreme weather," says

Dekla Wagner, insurtech expert, head of innovation at the international reinsurance giant Munic Re in Israel

, to "Walla!".

And as losses mount, insurers are being forced to rethink the effects of climate change on their underwriting, pricing and investment choices, as well as the bottom line.

A key factor in changing thinking in the field is information - more information and more effective information will help companies predict and assess costs, as well as the risks.

Wagner emphasizes that the historical information is indeed extremely important, but the changing reality due to the climate crisis also indicates the future - "therefore the insurance market has undergone a transformation in recent years: from an approach of risk transfer to an approach of risk mitigation, and damage prevention and preparation . The best tool we have today is technology," she adds.

Technology has several roles in the climate world, Wagner explains.

While insurance companies are considered the greatest experts in risk measurement, the new reality also requires them to reevaluate the entire value chain of insurance, a new understanding of the damages and the impact of natural disasters and climate change that create them - and most importantly how to prepare and deal with them.

Despite the new risks, insurance companies still need to develop new products, as well as respond to populations that need innovative solutions in the field of insurance but now have a specific response.

In recent years, technological means have been developed that help farmers better predict storms, droughts and other climatic phenomena (Photo: ShutterStock)

Another function of technology is to strengthen the client's resilience, that is, how the insurance company helps prepare the insured for the next event, how it ensures that the services it offers provide resilience for the client as well as for itself, and how it can help the insured reduce damages so that there is more room for new services.

The technology that helps insurance companies today is technology that deals with information, stores it, optimizes it, analyzes it.

"This is about the use of certain databases, real-time information, intelligence tools that store information from sensors and aggregate the information. Artificial intelligence obviously plays a central role in this transformation. The information can help in understanding events, their effects, where the more dangerous areas are, as well as quantifying the the risks and to understand them and in managing claims to minimize the damages," says Dekla.

Myonic Re has its own technologies and databases in the field of climate, Wagner says, because the company has been dealing with climate and risk management for decades, but in general insurance companies collaborate with start-ups to use the technologies they have developed.

For example, an Israeli company that specializes in radar photography in order to track crops.

The technology she developed helps farmers make various assessments from the photographs, without sending a person to the field itself, for example, to prepare for a certain storm or decrease in rainfall and so on.

An insurance company can cooperate with a start-up of this type to help its insured minimize damages in advance, reduce the risk of determining which coverage is appropriate.

The cooperation with start-ups adds costs to the insurance companies because they have to pay for their services.

The question arises whether these additional costs will not ultimately be passed on to the customer.

Wagner is quick to reassure: "Our expectation is that the technology will introduce efficiency, save expenses and in the long run will have a positive effect on costs as well. The burden of proof is indeed on the technology companies, but we have learned from other sectors that this is happening."

More in Walla!

Writing a resume in the third age: this is how you will find a job after retirement age

In collaboration with the lottery

Flood in Nahal Revivim, winter 2020. A company in the UK offers parametric insurance that is connected to sensors that measure floods (photo: official website, Ornit Ginat community coordinator in the KKL-JV forests)

One insurance tool that expresses the innovation of the climate insurance world is parametric insurance.

According to Wagner, the idea is simple: parametric insurance covers the probability of a pre-defined event - and is paid according to a pre-defined cost.

In this way, the familiar process of formulating a claim, filing a claim, proving the claim, quantifying the damage and so on - is actually redundant.

"This is a tool that helps insurance companies simplify insurance," explains Wagner.

"For example, if the technology indicates five consecutive days of wind at a certain speed - the farmer receives a predetermined payment. If the forecast does not materialize, there is no need to prove damage.

"Technology helps to maintain this insurance through a smart contract, written and based on blockchain, and all possibilities and probabilities can be defined in advance. A completely automatic and fast process that reduces costs. For example, a company in the United Kingdom offers parametric insurance that is connected to sensors that measure floods. In the world of parametric insurance, it is more common And it is mainly common in the field of agricultural insurance. But the tool is also suitable for other types of insurance and other insureds, because it is the technological innovation that makes it possible to put parametric insurance into practice."

Another technological tool that insurance companies use in the climate field is simulations.

How the effects of the climate affect the portfolio of policyholders, similar to investment portfolios in the world of finance.

According to Wagner, "using this tool, it is possible to analyze a combination of climate data and macroeconomic data in order to predict pricing changes in the portfolio, or for example to make decisions regarding investments. At the end of the day, insurance companies, like investment management companies, also want to minimize damages because in line Bottom line, this translates into economic value," Wagner notes.

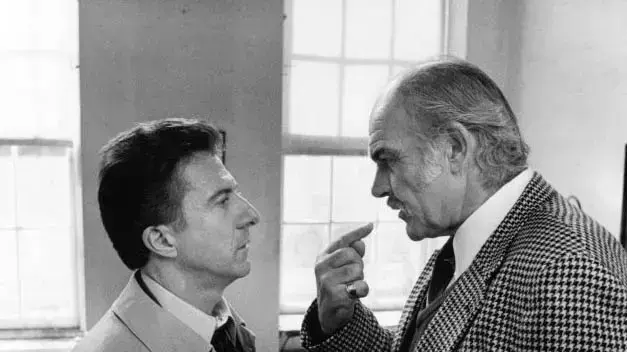

Dekla Wagner, insurtech expert, head of innovation at the international reinsurance giant Myonic Re in Israel (photo: Public Relations)

Of money

Insurance

Tags

natural disaster

technology

storm