What will happen when we retire?

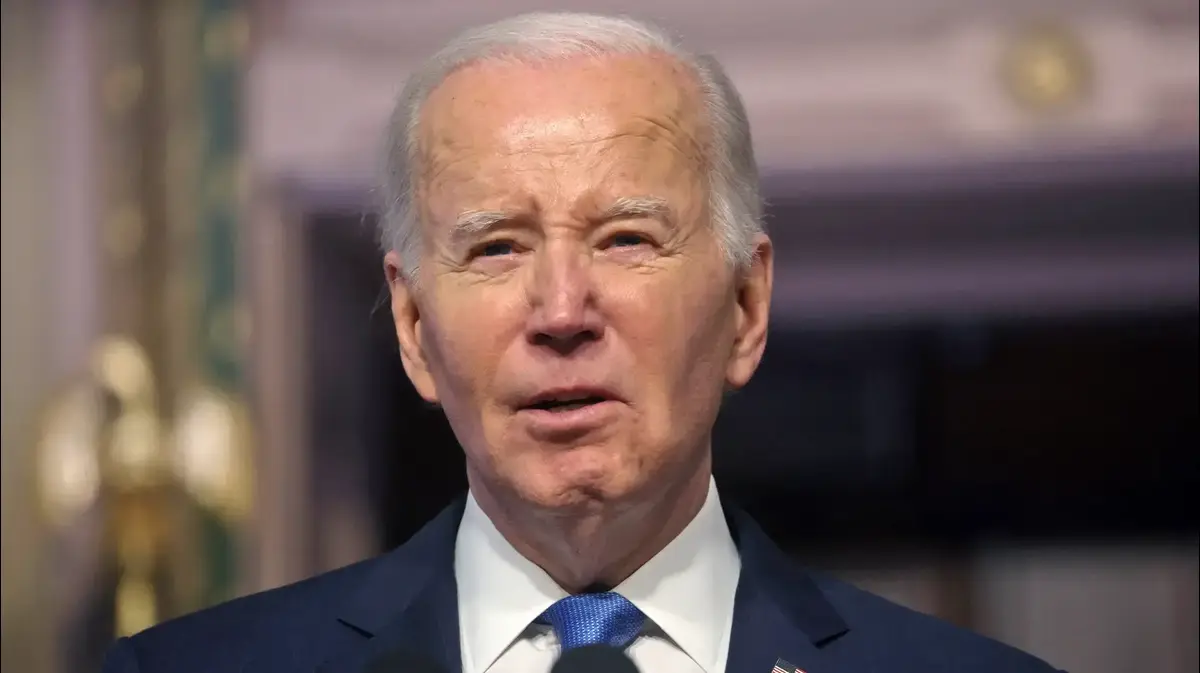

The frightening centralization may harm savers (Photo: ShutterStock)

The research department at the Bank of Israel found a high degree of concentration among the financial entities that manage our pensions, they are the same entities responsible for paying us a pension upon reaching retirement age, or to our loved ones in the event of death.

The management usually includes long-term investment avenues as well as training funds.

Our capital managers are called in the professional parlance, the institutional bodies.

These managers are under the supervision of the Insurance and Savings Capital Market Authority, affiliated to the Ministry of Finance.

The tremendous increase in the number of employees in recent years, the tremendous growth of the economy, the continued increase in real wages in recent years, the low unemployment rate and an increase in the number of businesses (all this after in 2008 there was an expansion order for mandatory pensions and also after last year, Minister Avigdor Libermon had the wisdom to stop as of October last year the issuance of bonds "8 are new for the pension market") resulted in a huge accumulation of capital managed by those institutions.

Already in July of last year, the institutions managed NIS 2.2 trillion for the public, which was 132% of GDP.

The frightening concentration may harm savers just as concentration in other industries harms the ability to compete and improve the situation of the consumer, in our case harming the saver on a bad day.

Most of our pension money is not invested in the local high-tech industry, but in Nasdaq (Photo: ShutterStock)

Who does the law protect?

The Bank of Israel found that half of the huge amount is managed by four institutional entities and 90% of the huge amount is managed by only 11 institutional entities.

Those of you who have your money managed should have remained calm if there was a real dispersion in the managed portfolios, along with taking informed risks for the biting management fees that the institutions bite from our hard-earned savings.

Please note, the Bank of Israel found a lot of similarity in the asset portfolios, that is, entities copy one of the portfolio composition names.

Not only that, the central bank fears that in the case of a one-off shock and the similarity in the investment portfolios, such an event may spread and become a systemic event for all economies, all financial, in other words harm you.

The legislator, through the statutory authority in the capital market, allows institutions to charge high management fees relative to the risk they take in managing the portfolios.

That is, copy from another institution and send to the file you manage.

Pay attention to the madness, in a comprehensive pension fund, the institutions are allowed to charge up to 6% of the monthly deposit amount, that is, for a deposit of NIS 1,000, a credit of only NIS 940 is recorded in your pension portfolio, and you are also allowed to charge up to 0.5% of the amount you have accumulated over the years: you have accumulated a million NIS for your pension ?

The managing fund may collect up to NIS 5,000 per year.

In a general pension fund, it is allowed to collect up to 4% of the monthly deposit and another 1.05% annual management fee from the accumulated amount.

In executive insurance and provident funds, you can collect up to 4% of the deposits and another 1.05% of the accumulation.

In practice, there is slight competition between the institutions for the management of long-term savings portfolios, mainly the pension channel.

The institutions entice (mainly) unionized workers in large companies to move to them and offer them lower monthly deposit fees and lower management fees than the allowed ceiling.

The idea is to receive large portfolios and manage them for years, the money flows into the institutional coffers, sometimes without effort to try to make changes in the portfolio in order to achieve a higher return for the management fees that are charged.

Those who do not understand and know the details of the deposit and management fees, or who work in small factories or tiny workplaces, usually pay more.

More in Walla!

A short visit to the pool changed my life - and you can too

Served on behalf of TI SWIM

Hi-tech workers in Israel (illustration).

They benefited from the boom in the industry, but why shouldn't local pension funds benefit from the development achieved with the help of their tax money as well? (Photo: ShutterStock)

after the herd

Pay attention to what the Bank of Israel says about the behavior of the institutions.

It is true that there is a minority of potential assets for investment, "but, apparently, also herd behavior in the investments of the institutional bodies".

In other words, the research department of the Bank of Israel accuses the portfolio managers who manage NIS 2,200,000 billion for you of tending to the behavior of a herd.

The Securities Authority says in a report it published in 2020, that there is high concentration in the pension industry and moderate concentration in the provident fund industry. According to the Authority, this has consequences for the various options available to savers. This affects the fluctuations and liquidity of the institutional bodies, and the pricing and issuances.

In the face of these claims, the Capital Market Authority, which is responsible for overseeing the industry, claimed last year that there was no evidence of the effect of centralization - and in practice the long-term savings system in Israel is cheap and reliable compared internationally.

The Bank of Israel rejects - in a report it published just recently on financial stability - the claims that the Capital Market Authority is complacent, and explains that joint ownership of competing entities and multiple meetings in the markets between the competitors may lead to a cartel-like equilibrium, which leads to a higher level of concentration than is actually measured in the field

. The long-term saving, says the central bank, administrative bodies are related to each other through joint holding of tradable financial assets, such as bonds or issued shares.

Which negatively affects the level of competition for innovation, the corporate governance, the wages of the workers in the arena and the price of the products.

True, there are not many investment options in Israel for tradable companies that would allow competition between the institutional bodies.

That's why some of them take part of their investments abroad in order to diversify. There, the degree of similarity in the asset portfolio of the institutions is much lower than in Israel, so the central bank found. Investments abroad are more complicated, also because of the low recognition and ability to analyze the assets abroad compared to Israeli assets , which are close to the institutional investors in terms of familiarity that goes beyond the financial statements.

The fluctuations in the foreign exchange rates of the shekel against the dollar and other currencies also oblige the institutions to protect the investment in huge sums, which leads to changes in the exchange rate at a relatively sharp rate, according to what is happening - mainly in the American Nasdaq index.

When the Nasdaq goes up, they switch to investing abroad and hedge the investment by selling a future currency, usually dollars, for a shekel - which causes the shekel to appreciate, and vice versa.

Demonstration of high-tech workers in Tel Aviv.

The threats to take money out of Israel do not really sleep for savers in the pension funds (Photo: Yanon Shalom Yatach)

What's wrong with high tech?

If there is room for diversity, naturally there was room to invest in the Israeli high-tech industry that has been so successful in the last two decades.

So why do institutional investors prefer to invest in traditional financial assets or stock exchanges abroad and not in Israeli high-tech?

The main reason is that the chance of profit in one or another company can be enormous or a colossal loss. There is really no possibility of investing in a basket of high-tech companies that open and close frequently, soaring in stock prices theirs or crash. Why take the long-term investor's risk in roller coaster assets? Here, too, there is no desire for any institutional entity to enter into an adventure, if it can invest in relatively solid assets and live off the management fees. That is why most of Israel's high-tech profits go to foreigners, capital funds risk, or multinational companies seeking to benefit from the benefits of Israeli technology.

This is at a time when the locals, or should we say the "natives", cannot enjoy the fruits of the high-tech industry, an industry that the Israeli government encouraged at the taxpayer's expense through the allocation of sources, territories, tailor-made laws and tax breaks... More from the high-tech industry are those with high salaries in the industry, those who got to perform the famous exits.

"Your people" do not and cannot enjoy the fruits of the high technology industry that is very close to their home, in the neighborhood, in the nearby industrial area, or in the neighboring city, especially in the center of the country.

We were asked, what is the practical meaning for savers among households of the threats of some of the heads of Israeli high-tech companies to withdraw part of their deposits from the Israeli banking system abroad, or even spending the money in practice? There is no effect on household savings, they are not invested in high-tech at all or enjoy its fruits.

If there is a large outflow of capital, the value of the shekel will decrease slightly, which may lead to an increase in the inflation rate on the one hand, a bad thing for "your people", but on the other hand, also to an increase in the level of competition of Israeli firms and more jobs in the factories and traditional businesses in Israel.

In the local factories and businesses, few of which are exposed abroad, mainly the low-wage earners, from the lower deciles, who apparently did not participate in the demonstrations in Jerusalem on Monday this week or in the demonstrations across the country for the past few weeks, work and earn.

The sad story of the teachers in the UK, they lost about 20% of their savings.

Could this also happen in Israel? (Photo: ShutterStock)

Risk of contagion

Let's return to the alarming report of the Bank of Israel, which is concerned about the speed of contagion of activity between financial entities as a result of exposure to a shock. The fear is that because of the similarity between the investments, during a shock, the crisis will increase in the form of simultaneous realizations of the same assets, such as bonds or stocks , which everyone (almost) owns.

The similarity between investment portfolios may become a systemic risk: in clearer language: a risk to the entire financial market and the entire economy, which may harm all financial entities.

At the beginning of the shock, the main damage will be through the erosion of financial assets and then through the erosion of real assets.

Then the road to crisis is short.

Banks are careful not to use this word, warns the Bank of Israel report, in order not to push down private consumption and the level of investments in the economy.

What will happen in the event of a crisis?

Then they will ask for help from the state - whether fiscal or monetary, as a last resort, at the expense of all of us.

The Bank of Israel rightly cites as an example, not necessarily the shocks of 2008 in the USA at the time of the collapse of the investment bank Lehman Brothers, but what happened in Great Britain only in September of last year, when pessimism regarding the fiscal policy of the British government caused a decrease in the value of government bonds, which A bond used as collateral in hedging transactions in which, please note, the pension funds are also involved.

This is where the crisis unfolded: liquidity difficulties forced the funds to sell bonds in huge amounts, which further led to the deterioration of bond prices... Only the intervention of the central bank, as the ultimate emergency lender, stopped a crisis that could have dragged Britain into a massive economic crisis.

We will add that the pension of teaching staff and others in the higher education system in Great Britain lost 20 billion pounds out of the 92.2 billion pounds that were accumulated in it before the crisis, a loss that will not be possible to restore.

The pensions of lecturers, professors and administrative employees fell without a hitch, years of pension savings went down the drain.

Let's return to Israel, at the beginning of the spread of the corona virus in Israel, the institutional bodies were forced to increase dollar collateral against exposure to futures contracts in foreign exchange. They did this through the massive sale of government bonds, which are usually very liquid, but not liquid enough in times of crisis.

Only the just, smart and immediate intervention of the Bank of Israel, which purchased the bonds that were thrown onto the market, saved the situation. But who would bet that the government will always come to the rescue to prevent the spread of pension burning?

From all of the above it is somewhat difficult to draw a conclusion that will prevent crises.

After all, economic crises and business cycles will come, and there will always be a need for an immediate solution by the government and the central bank.

This is what several governments and many central banks did in the case of a powerful contagion like in 2008.

The basis is a strong banking and financial system that will be shocked, but will also be able to withstand strong shocks.

The Bank of Israel strengthened the banking system since 2008 through the requirement to increase the system's equity.

If in the end it is the state that provides an umbrella in the form of help in an emergency, as was the case with the stock market crisis in October 1983, or in 2008, or with the outbreak of the corona virus, we need to think about the wages in the financial system, among the institutional bodies and in the banking industry.

The formula is very good for those involved in the financial system in Israel and in the world.

In Britain, it turned out that the fat cats who manage the pension system of the academic institutions, five of them, earned about 1 million pounds a year and one of them even 2.5 million pounds a year.

They celebrated until the crisis that crushed the pensions of the partners in the funds they managed.

That's how it is, dear readers, when there are profits in good times, the high salary goes to those who do the financial work and enriches the members of the closed club, but when a crisis breaks out, the whole nation, you and I, pay the price through the mechanisms of the broad government.

Does that sound fair to you?

Of money

Tags

pension

Bank of Israel

institutional