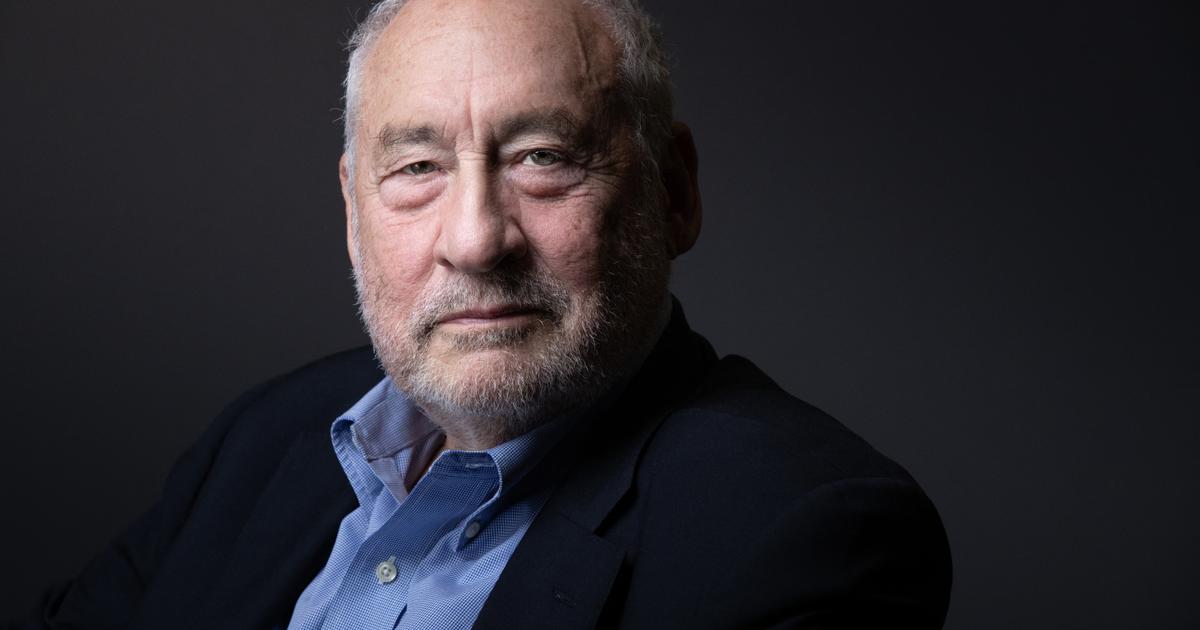

A few days after the bankruptcy of the Silicon Valley Bank, which shook banks and world markets, the Nobel Prize in economics Joseph Stiglitz does not exclude, in an interview with AFP, other failures to come.

An exit that takes on even more meaning in the face of the difficulties encountered on Wednesday by Credit Suisse, the second Swiss banking establishment.

"

Banks are healthier than in the past, especially in 2008. There has been progress, but not as much as necessary

," asserts the economist.

"

There are always rumors about this or that bank being vulnerable, but unless you know their balance sheet, their exposures and (their results) in the stress tests, it's difficult to verify them," he said

. -he adds.

Focusing mainly on the bankruptcy of SVB, Joseph Stiglitz believes that new technologies are poorly taken into account by the banking system and favor 'bank runs', these famous bank panic movements which can push customers - households and businesses alike - to withdraw their money.

Which is what precipitated the fall of Silicon Valley Bank.

“

We thought until now that bank accounts were difficult to move.

But when everyone manages their bank account online, it's much easier to withdraw all their money and put it elsewhere

,” he says.

And to add: “

the stability of the financial system must be rethought, taking into account new technologies

”.

LIVE - Credit Suisse: Bruno Le Maire will have contact with his Swiss counterpart "in the next few hours"

"

A trauma that will have longer-term effects

"

The measures of the American authorities and the assurances of the European governments on the solidity of the banking system following the bankruptcy of the Silicon Valley Bank (SVB) were able to stabilize the markets a little on Tuesday.

But “

fears about the solidity of the sector

” persist and “

the shadow of the collapse of the SVB still hovers

”, underlines Susannah Streeter, analyst at Hargreaves Lansdown.

Proof of this is this Wednesday, the statements of the largest shareholder of Credit Suisse, the Saudi National Bank, have put the Swiss establishment in great difficulty.

Perceived as the weak link in the banking sector in Switzerland, Credit Suisse saw its share price drop by up to 30% to hit a new all-time low at 1.55 Swiss francs despite attempts by its chairman, Axel Lehmann, to reassure .

During a conference, the latter assured that the bank does not need government assistance.

This is "not

a subject

", he said, stressing that the bank relies on "

solid financial ratios

", without however managing to reassure the markets.

However, the concern goes beyond the borders of the Alpine country.

French Prime Minister Elisabeth Borne has asked the Swiss authorities to solve the problems of Credit Suisse.

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/WWFMH3RJQFHGDLP4L4JLWOGC6Y.jpg)