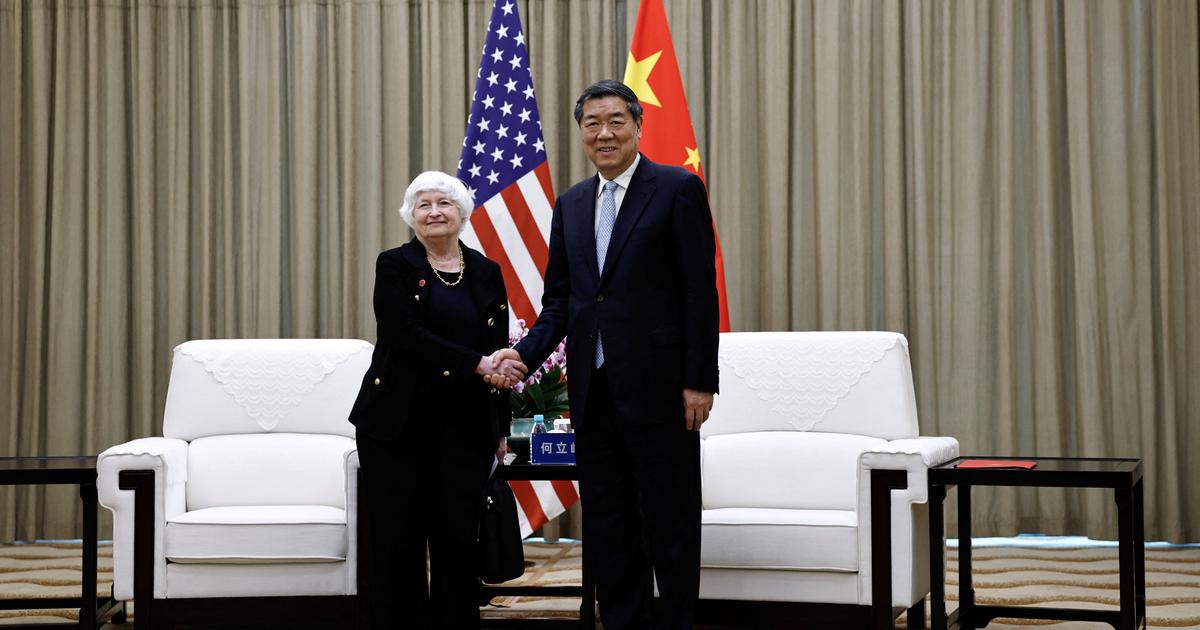

US Treasury Secretary Janet Yellen on March 10, 2023. EVELYN HOCKSTEIN (REUTERS)

The Secretary of the Treasury, Janet Yellen, has reiterated this Thursday before Congress the calls for calm on the US financial system.

Yellen appears before a Senate committee to discuss President Joe Biden's budget plan, but she now rules after the fall of Silicon Valley Bank and Signature Bank.

In her opening statement, released by the Treasury Department, Yellen states: "I can assure the members of the commission that our banking system remains strong and that Americans can trust that their deposits will be there when they need them."

It is the same message that the president, Joe Biden, already conveyed in a brief intervention last Monday.

Unlike Biden, who did not answer questions, Yellen will have to face some senators who are suspicious of public support for financial institutions and who will surely be critical of the way in which the Federal Reserve has exercised supervision of medium-sized banks, in the eye of the storm.

The appearance before the Senate Finance Committee comes amid turmoil in world markets and concerns about financial stability following the rapid failure of three regional US banks and the troubles of Credit Suisse Group, which has enlisted the help of the Swiss central bank with a liquidity facility of around 50 billion Swiss francs.

In her speech, Yellen will highlight the "forceful and decisive actions" taken by the Treasury, the Federal Reserve and the FDIC to bolster confidence in the banking system, according to the initial speech.

In her opening speech, the Treasury secretary maintains that the measures adopted by the Government demonstrate its commitment to guarantee "that depositors' savings continue to be safe" and to allow bank clients to pay their payroll and bills .

Members of Congress are likely to question whether the money earmarked to guarantee customer deposits is a bailout, how much taxpayers will have to pay for the intervention despite Biden saying it won't, and the possibility of new regulation. that affect the banking system.

Biden himself and numerous Democratic congressmen are calling for a tougher law, to reimpose midsize banks with the Dodd-Frank requirements from which they were exempted in 2018. That law, passed in 2010, was a response to the financial crisis of 2008. His relaxation had the support of one of the congressmen who gave him his name, Barney Frank, who was now a director of the intervened Signature Bank.

Massachusetts Democratic Senator Elizabeth Warren has been one of the most active: “In 2018, I sounded the alarm about what would happen if Congress rolled back critical Dodd-Frank protections: Banks would take on risk to increase their profits and they would collapse, threatening our entire economy, and that is precisely what has happened," he said Tuesday in a statement.

“President Biden has asked Congress to strengthen the rules for banks, and I am proposing legislation to do just that, repealing the core of Trump's banking law,” she added.

Senator Bernie Sanders joins that call: “Five years ago, I helped lead the effort against the bank deregulation bill that has led to the downfall of Silicon Valley Bank and Signature Bank.

Now is the time to repeal that law, take down the too-big-to-fail banks, and serve the needs of working families, not vulture capitalists.

We cannot continue to have more and more socialism for the rich and rugged individualism for everyone else,” he has said.

Yellen declared on CBS's Face the Nation

last Sunday

that a full-blown bailout with public money was not on the table.

"We're not going to do that again," he said, referring to the response to the 2008 financial crisis, which included multibillion-dollar bailouts of big US banks to stabilize the economy.

Yellen, a former Federal Reserve Chair, led the San Francisco Federal Reserve during the 2008 financial crisis.

Follow all the information on

Economy

and

Business

on

and

, or in our

weekly newsletter

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/DJ5T7BYQ3ZRXF6NV2ONTSLUMRU.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/DIAGMBIFCBFTJADD5SB7GXXY2A.jpg)