It could be said that the life of Rolando González Bunster is like a movie.

His childhood was surrounded by mysteries and fears if one remembers that his father, the lawyer and industrialist Luis González Torrado,

accompanied Perón since 1946 without having charges in his government

.

And he followed him in two exiles when he was overthrown by the Liberator.

One, in Venezuela in 1956 and then in the Dominican Republic, where this businessman finally settled with his family.

At that time, González Bunster was 10 years old and like many Dominicans in the days of the dictator Trujillo, he ended up studying at Georgetown University in the United States

.

His bank partner was Bill Clinton.

González Bunster is today the director of the Clinton Foundation.

Solar panels in the Dominican Republic

In the North country he had many jobs but his adventures at Paramount marked him on fire.

He was dedicated to

collecting funds for films like Love Story, The Godfather, by Coppola or Rosemarie's Baby, by Polansky.

And upon his return to the Dominican Republic, he knew how to build from nothing what is now an empire in the

electricity business on an island that thrives on tourism, fishing, sugar cane, cigars, and rum.

Along that long road, he had decisive support, such as that of the CEO of Seaboard Corporation, Harry Bresky, who provided him with capital.

Seaboard

owns the Tabacal mill in Argentina.

Thus, his Interenergy holding is

valued at US$1.5 billion, has operating profits of US$200 million,

and is 80% owned by the González Bunster family and 20% by the Brookshields fund of Canada.

It has 700 employees and

has US$1 billion to invest in renewable energy

.

They are partners of the American AES in multiple projects.

Former US President Bill Clinton and his wife, Hillary Rodham Clinton.

Legend has it that González Bunster started in the electricity business at the request of President Balaguer in 1987, when he faced the lack of a reliable electricity supply.

Days after that conversation, on a train, while traveling in the US to Greenwich, Connecticut, “a man sat in front of me who opened a map of the Dominican Republic.

He was the CEO of the Wärtsilä Diesel teams.

Thirteen months later we signed the first private contract for the sale of energy to the Dominican Government”.

The teams are still Wärtsilä.

Outside the Dominican Republic,

it developed the largest wind project in the region in Panama.

He named it Laudato Si in honor of the Pope.

In Chile he acquired a wind farm and a solar park.

The heart of the holding is Cepm, the company that

changed the hotel industry in the Dominican Republic by providing them with energy.

Now they are on their way to generate 100% from solar, biomass and wind.

It also accounts for gas businesses.

It has the signature Activa to offer internet.

And in a country that receives tourism with a demand for environmental care, it launched clean energy in a very comprehensive way, from generation to changes

to electric vehicles.

In this way, its subsidiary Evergo was born to charge electric vehicles that are growing

exponentially in the Dominican Republic.

In what looks like a smart pump, charging can be completed in 30 minutes.

That network has just landed in Mexico.

And they are setting up charging stations,

service stations for electric charging.

As for electrical distribution, it is offered to 55,000 hotel rooms with very few interruptions in a country accustomed to frequent and prolonged power outages.

And it developed the prepaid energy model through an app: it is used by 70% of users for rates that imply 10% of the average salary.

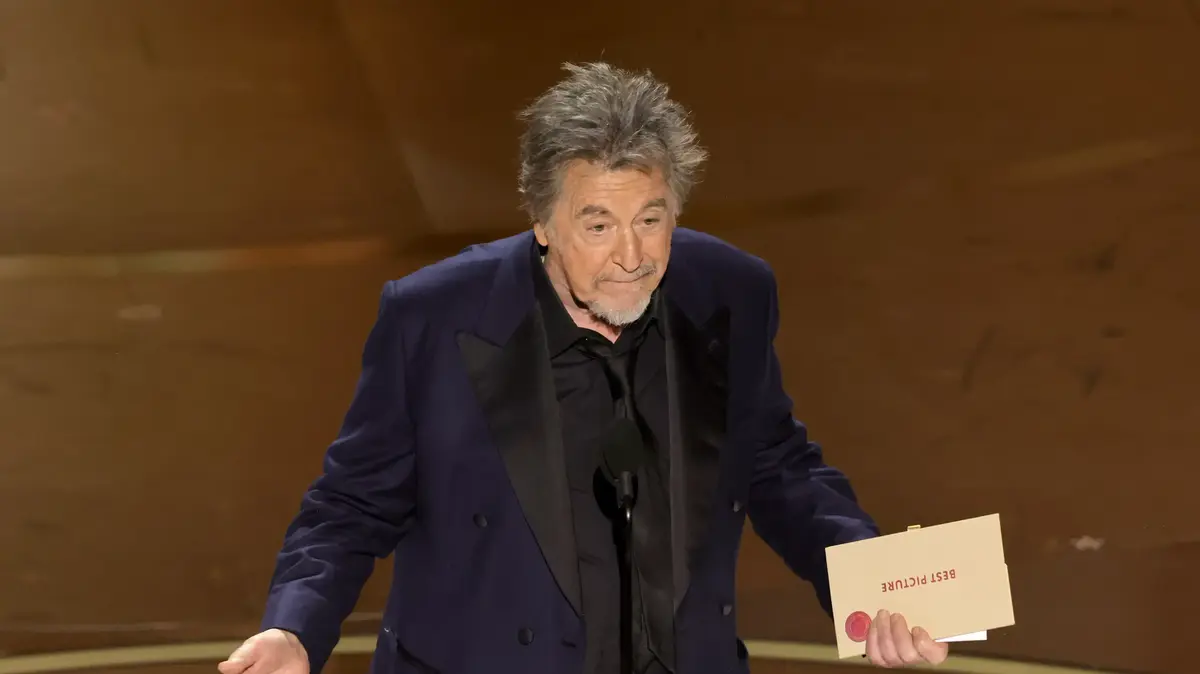

Michael Bloomberg

When he is in the Dominican Republic, González Bunster lives in the exclusive Casa de Campo on the paradisiacal beaches of the Caribbean and has Bloomberg as a neighbor,

in addition to receiving the Clinton couple often.

On Sundays he dedicates it to his two favorite hobbies, golf and doing crossword puzzles for the New York Times.

But he continues to supervise his businesses, which are expanding throughout Central America, Chile, Uruguay and Paraguay.

He is one of those who work without having a desk.

According to Forbes magazine, he has one of the largest fortunes in the Caribbean with

US$670 million.

And they call him Don Rolando after the inhabitants of Saona, in the south of the country, who went to receive him after he installed two solar energy parks and brought light to that island, the same one that Columbus touched in 1492 when he arrived in America and that did not I knew electricity.

General view of one of the entrances to the Casa de Campo complex in the coastal town of La Romana (Dominican Republic).

Casa de Campo is a luxurious urbanization on the shores of the Caribbean.

González Bunster says that he analyzed Edenor before it passed into the hands of Manzano y Vila.

"Are you interested in buying Edesur?" he was asked.

-I am an economist, I can look at numbers but I don't know how to read an Argentine balance sheet.

It is impossible.

I also don't have a strategic partner, my investors won't let me go to Argentina.

Getting funds for Panama, for example, was easy for us.

It has the dollar as its currency.

In Argentina, stocks are the default.

I would buy Edesur if it can be projected into the future, but what is the point if they freeze you if they give you the dollar in official pesos and it is not known if the money can be withdrawn.

The most serious problem is how the shareholder is recognized in an investment of these characteristics.

The business cannot be faced when there is no remuneration for the investment.

-With a war in Ukraine that does not end, what do you expect in the energy business?

-The world is very convulsed, the pandemic generated a disruption in the supply chain, made freight more expensive, there is a shortage of gas.

The US, which supplied the gas in Central America, sends it to Europe, which is governed by the Dutch price and achieves incredible margins.

That is why I am interested in the possibility of importing liquefied gas from Argentina.

-As I would do it?

-Argentina has the second largest oil and gas resource in the world, and is building the gas pipeline.

If I could, I would order a tanker to be built to convert the gas that comes from Vaca Muerta to liquefied natural gas, that is feasible.

It is an investment of US$ 600 million and it would be necessary to invest in a deposit in the port.

Of course, YPF would have to deliver the gas to me.

The President of the Dominican Republic was with Minister Massa for this issue.

And Massa invited him to make the investment.

-Where is your energy company going?

-We started as a generator, then a distributor, then we expanded our distribution area, but the electricity business does not end with what we already have.

We are going to 100% clean energy, which also means the transformation of mobility, of cars, motorcycles, transportation.

And we do it with a focus on the environment.

It is also business because the profit margin is increased when diesel or diesel is abandoned and is fed with energy from the sun or the wind.