The US authorities have launched a crusade to defend the soundness of their financial system after the fall of Silicon Valley Bank and Signature Bank in the last two weeks.

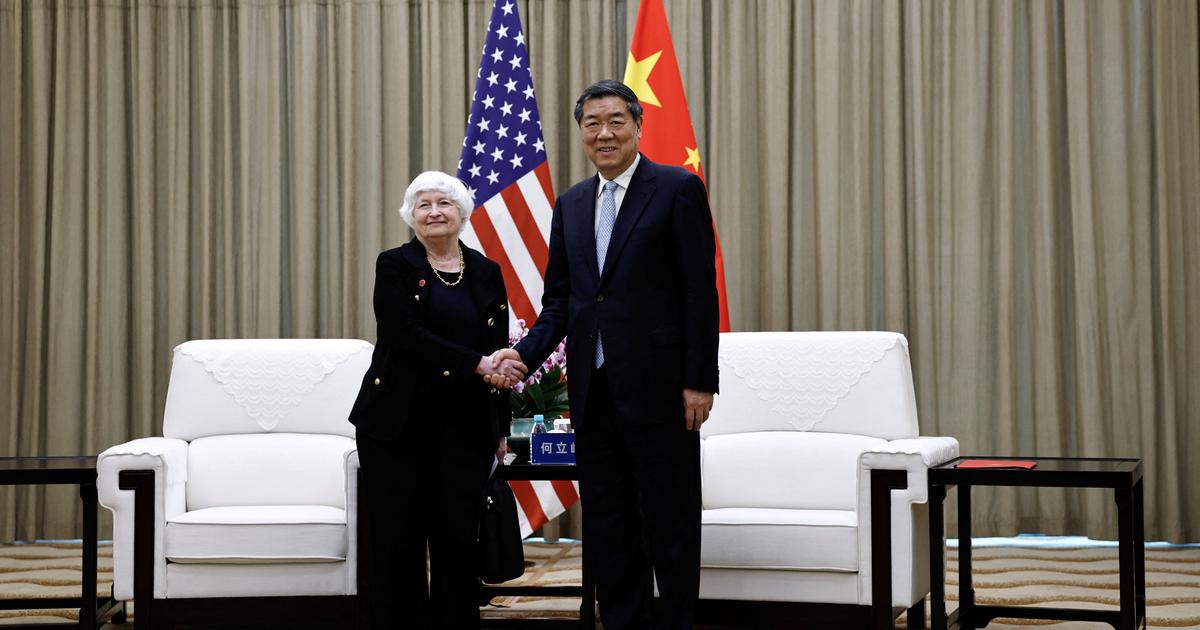

The Secretary of the Treasury, Janet Yellen, assured this Tuesday in a brief conference that "the situation is stabilizing" and that the banks are healthy.

Over time, however, she has shown her willingness to give more support to banks that need it.

Yellen has indicated that "it could be justified" to take additional rescue measures if new bankruptcies in smaller entities pose a risk to financial stability.

The treasury secretary has said that the situation is very different from 2008, but that the federal government is prepared to act forcefully.

“Let me be clear: recent government actions have demonstrated our strong commitment to take the necessary steps to ensure that depositors' savings and the banking system remain safe,” he declared.

In an intervention before the Association of American Bankers, Yellen has referred to the federal guarantee to all deposits of Silicon Valley Bank and Signature Bank, above the 250,000 dollars per client that the regulation contemplated, and has also spoken of the liquidity window that the Federal Reserve has put in place.

“Similar measures could be warranted if smaller banks suffer massive deposit withdrawals with risk of contagion,” she said.

In the questions that followed her speech, Yellen also pointed out that "it is time to assess whether some regulation and supervision adjustments are necessary" after the fall of the aforementioned entities.

He has referred to the investigation in this regard that the Federal Reserve has opened to clarify it.

The Department of Justice and the Securities and Exchange Commission (SEC) have launched investigations into the collapse of Silicon Valley Bank, and US President Joe Biden has called on Congress to tighten rules on regional banks. and impose tougher penalties on executives of failed banks.

Santa Clara, California-based Silicon Valley Bank collapsed on March 10 after depositors rushed to withdraw money amid anxiety over the bank's financial health.

It was the second largest bank failure in US history.

Regulators met the following weekend and announced that New York-based Signature Bank had also failed.

Last week a third bank, San Francisco-based First Republic Bank, was bolstered with $30 billion in funds raised by 11 of the largest US banks in an attempt to stave off their failure.

JP Morgan, which led this injection of deposits, is analyzing new measures to strengthen the bank, which this Thursday is recovering some ground on the Stock Market.

Appearing before the Senate Finance Committee last week, Yellen assured anxious depositors and investors that the US banking system “remains strong” and that Americans “can be confident” in the safety of their deposits.

This week she will appear twice more before groups of congressmen, in the Senate and in the House of Representatives.

[Breaking news.

There will be expansion soon]

Follow all the information on

Economy

and

Business

on

and

, or in our

weekly newsletter

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/NTCYHTFDBQVZDQERLHS7UMISQQ.jpg)