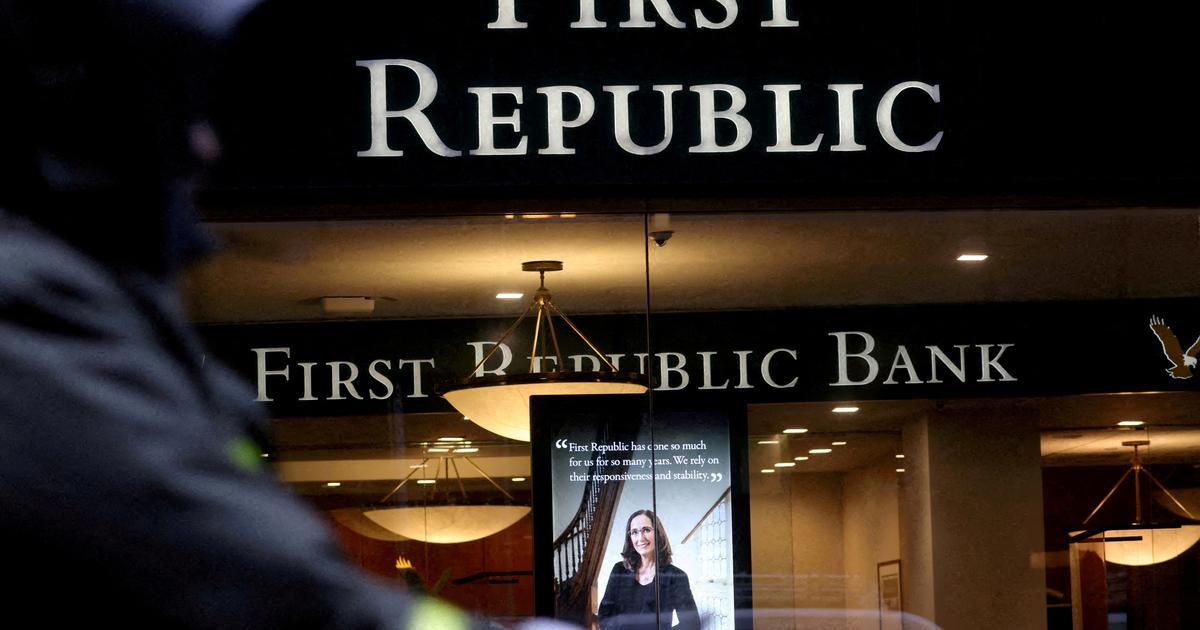

The American regional bank First Republic plunged again Friday on Wall Street after a short respite, the rumors on a strategy or a rescue plan multiplying without however materializing for the moment.

The action plunged 48% in mid-session on the New York Stock Exchange after having already lost more than 95% of its value compared to the beginning of the year.

It was down to under $4.

The fate of First Republic has been up in the air since the close failures of three similarly profiled US banks in early March.

The authorities and other financial institutions soon came to its rescue to prevent it from experiencing the same fate as Silicon Valley Bank and Signature Bank, namely bankruptcy.

But First Republic confirmed late Monday that many of its customers withdrew deposits, more than $100 billion in total in the first quarter.

It was able to count on the 30 billion contributed by the other banks but it is insufficient in the eyes of investors, who made the action plunge on Tuesday and Wednesday before giving it a break on Thursday.

Management did present Monday evening some measures to strengthen the financial health of the bank and underlined that it was studying “

strategic options

” but did not give many details.

Intervention of the authorities?

Sale of the bank as a whole or of only certain assets?

Status quo, betting on an upcoming drop in interest rates?

Rumors have since abounded on possible solutions without any official announcement.

For Alexander Yokum, of the CFRA firm, the two most likely scenarios are that the authorities take control of the establishment before reselling its assets at a reduced price or that one or more banks buy back certain assets from First Republic.

Read alsoFirst Republic Bank plunges 49% on Wall Street after a massive withdrawal of its deposits

“There is a high probability that the bank will not get out of it”

But even the latter hypothesis faces significant hurdles as a majority of First Republic's loans are fixed-rate mortgages, which have therefore lost value with the recent rise in interest rates, explains- he.

The scenario of a simple takeover by another bank is, for a similar reason, unlikely in his view: the new owner should immediately integrate into his accounts the fact that the assets of First Republic linked to fixed rates such as mortgages or treasury bills have lost value.

Eric Compton, of the firm Morningstar, estimated in a note Thursday that the bank was worth almost nothing on the stock market: "

at this stage, we estimate that there is a strong probability that the bank will not come out of it, and even if First Republic survives, we believe that the dilution of existing shareholders necessary to fix the bank's balance sheet would drive the stock to zero value

,” he wrote.

The quotation of this one was suspended several times Friday on the Nasdaq for volatility.