When the three founders of Nvidia founded the company in 1993, they did not know what to name it and began to call it NV, initials of next version, or next version. Therefore, when looking for the final name, they looked for words that began with the letters nv. Finally, from the Latin invidia (envy) they suppressed the first letter. The company is now the envy of the tech sector. It is one of the winners of the fever for artificial intelligence. It has skyrocketed on the stock market and knocks on the door of the trillion dollar club.

At the same time, it has boosted the prices of other firms in the sector. On Friday, the star was Marvell Technology, another Silicon Valley semiconductor maker, which soared 32.4% after announcing that it expects to double its revenue next year from artificial intelligence. The company is already worth more than $56 billion. Qualcomm (+000.6%), Micron Technology (+1.6%), Intel (+2.5%), AMD (+8.5%) are among those that have been infected by the euphoria, which has also crossed the Pacific and boosted South Korean and Taiwanese firms such as SK Hynix (+5.5%), Mediatek (+5.3%) and TMSC (+1.4%).

Nvidia presented on Wednesday good results for the first quarter, but above all, some surprising forecasts for the second. "In the more than 15 years we've been doing this work, we've never seen guidance like the one Nvidia just presented with a second quarter outlook that's clearly cosmological and shattered expectations," Bernstein analysts wrote in a report to clients.

Basically, the company said it expected revenue of about $11 billion (about 000.10 billion euros) in the second quarter when what the market expected was less than $300.7 billion. Artificial intelligence is the reason sales are skyrocketing. Amazon Web Services, Google Cloud, Microsoft Azure and Oracle are among the firms vying to lead the new technology, but all of them turn to Nvidia for their data centers and processors.

The data center business grew 14 percent to $4.280 billion in sales, driven precisely by demand for its powerful processors from cloud service providers as well as large consumer Internet companies that use Nvidia's chips to train and deploy generative AI applications such as OpenAI's ChatGPT.

FILE PHOTO: The logo of NVIDIA as seen at its corporate headquarters in Santa Clara, California, in May of 2022. Courtesy NVIDIA/Handout via REUTERS THIS IMAGE HAS BEEN SUPPLIED BY A THIRD PARTY. MANDATORY CREDIT/File PhotoNVIDIA (via REUTERS)

After publishing those forecasts, Nvidia's stock soared around 25% on Thursday and approached that trillion-dollar bar. It is already the fifth most valuable private company in the world, only behind Apple, Microsoft, Alphabet and Amazon, four other large technology companies, although much better known to the general public. The increase in value in one day was 183.800 billion dollars, the third largest in the history of the Exchange, only behind Amazon's 191.300 billion on February 4, 2022 and the 190.900 billion that Apple revalued on November 10, 2022.

The high-powered processors designed and manufactured by Nvidia have been added to different booming businesses. In its 30-year history, Nvidia has pioneered the graphics processing of computers and video game consoles. To have increasingly better images, it has been exponentially increasing the power of its processors, with capabilities for robotics, cloud computing, aerospace, weapons manufacturing, the metaverse, cryptocurrencies, autonomous driving, image recognition and, of course, artificial intelligence.

The latter is perhaps the one that benefits him the most. "I wouldn't dare say he's won the race, but right now he's winning it," Zeno Mercer, principal analyst at ROBO Global, said in an opinion picked up by Bloomberg.

Some analysts fear a bubble like the one that hit tech stocks in 2000 could occur. The question is whether strong growth in demand for microrockers is an extraordinary and exceptional phenomenon or something sustainable. Depending on the scenario, the valuations would be one or the other.

Huang, billionaire

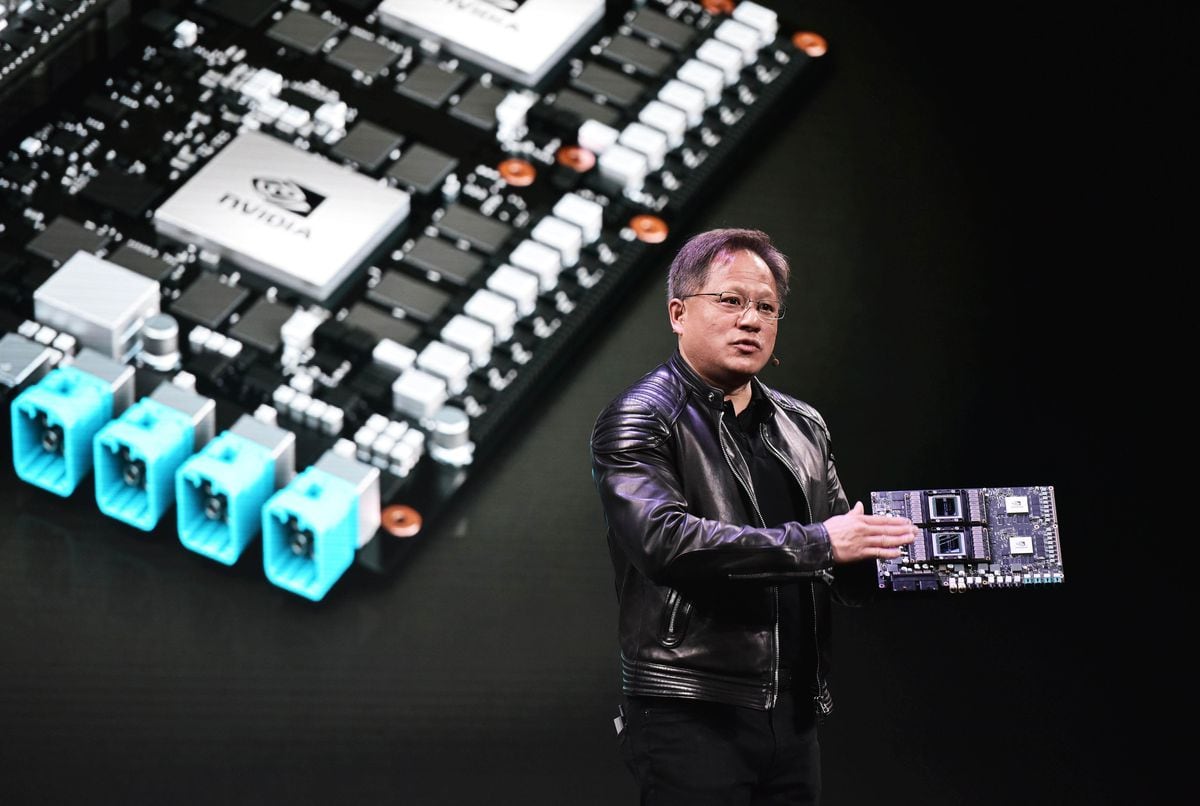

"The computer industry is going through two simultaneous transitions: accelerated computing and generative AI," Jensen Huang, Nvidia's founder and CEO, told analysts Wednesday. "We are receiving incredible orders to retrofit data centers around the world," he added. A trillion dollars of installed global data center infrastructure will shift from general-purpose to accelerated computing, as enterprises rush to apply generative AI tools like ChatGPT across different products, services, and business processes. "The budget of a data center will shift very strongly towards accelerated computing," he added.

Jensen Huang, 60, born in Taiwan and educated as a child in the United States, is a graduate of Oregon State University and Stanford University. He founded the company with Chris Malachowsky and Curtis Priem, with a vision to bring 3D graphics to the gaming and multimedia markets. He has run it ever since and has become the head of a large company with the longest history in all of Silicon Valley. In 1999, Nvidia invented the GPU, the graphics processing unit, which laid the foundation for a profound change in the industry.

With the revaluation of Nvidia on the stock market, Huang's fortune has skyrocketed. According to the latest annual remuneration report, he owns about 87 million shares of the company (3.5% of the capital), valued at about 34,000 million dollars. He is one of the 40 richest men in the world. His compensation package in shares, and that of the rest of the company's employees, is also going to skyrocket. According to its latest quarterly report, the company has incentive plans for 40 million shares, valued at current prices at more than $15 billion.

Follow all the information of Economy and Business on Facebook and Twitter, or in our weekly newsletter

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/DIAGMBIFCBFTJADD5SB7GXXY2A.jpg)