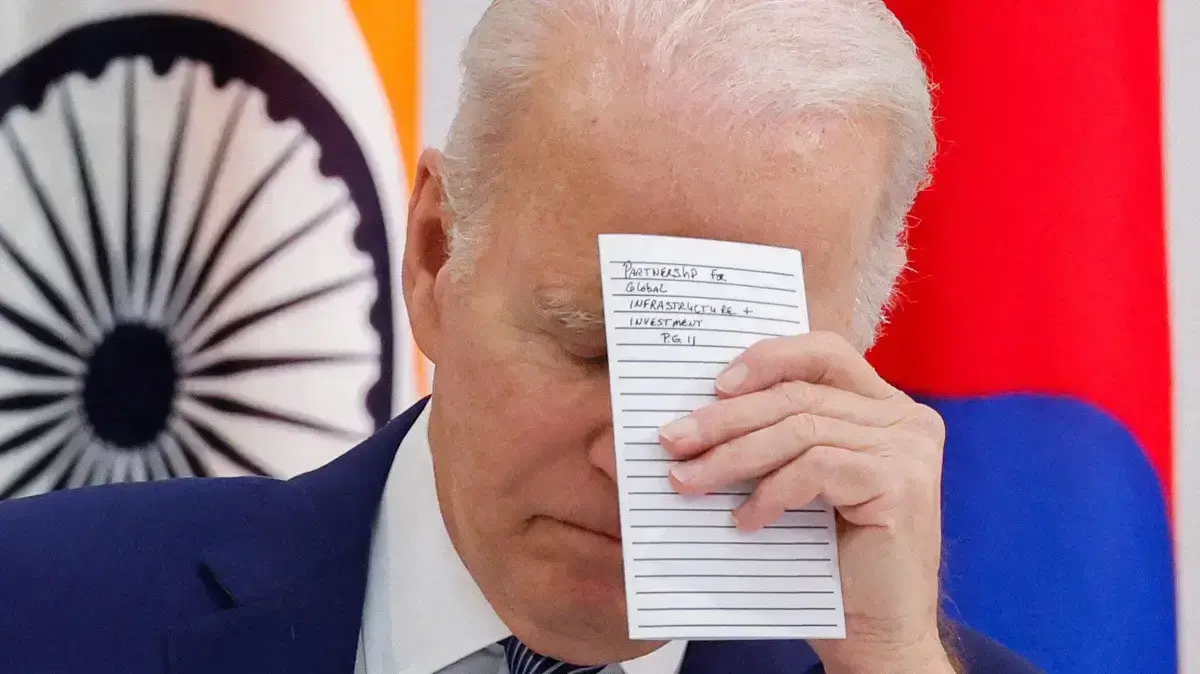

US President Joe Biden (last week in Japan). Can breathe a sigh of relief, but the US economy is still struggling (Photo: Reuters)

"Good news for America," President Joe Biden tweeted early Sunday morning after reaching an agreement on increasing the U.S. debt ceiling with House Speaker Kevin McCarthy, a Republican.

The current crisis began with the announcement by the US Treasury Department that as of June 5, the US will not be able to repay its obligations unless an agreement is reached on increasing the debt. As a result, credit agency Fitch announced that it was considering downgrading the U.S. credit rating from its current level of AAA. In the end, the rating agency, which apparently estimated that agreement would be reached, left the rating at its current level and "settled" for a warning (sound familiar?).

US House of Representatives Speaker Kevin McCarthy (during his visit to Israel). Will allow the president to meet his obligations, but will force him to moderate expenses (Photo: Reuven Castro)

However, the agreement is not final, not only because the negotiating teams of both parties still have to work out the details for an agreement to be submitted to the Senate and House of Representatives, but also because the agreement needs to be ratified before June 5.

The agreement allows the Biden administration to continue spending money it has pledged as part of some grandiose plans it has initiated, but limits how much the administration can spend, at Republican demand.

Anyone who wants to can see an implicit signal to Israel as well: If understandings are reached regarding the reform of the judicial system – from its shelving to freezing it to transferring parts of it by agreement – Israel's credit rating will remain in place. And no, it is possible that what was only a "warning" in the previous report will be translated into a downgrade in the credit rating when the next assessment of one of the rating agencies is published.

But even assuming the deal is ratified on time, that still doesn't mean the U.S. economy doesn't have to face two serious hurdles, in housing and banking.

In housing, the two largest mortgage companies in the United States, which account for 70% of all mortgages in the country, have been warned that they are under the scrutiny of ratings agency Fitch and must act to reduce their debt. Americans have painful memories of the great mortgage crisis that shook the American and global economies 15 years ago.

It was also announced over the weekend that JPMorgan plans to cut 5,000 jobs as part of a streamlining process, an announcement that returned the focus to the worrisome state of the US banking system. The announcement raised concern that the banking crisis, which until now was the province of relatively small banks and stemmed mainly from the crisis in the capital markets (which began to recover slightly), may trickle down to the more robust financial institutions as well.

- money

- World money

Tags

- Joe Biden

- Usa

- Credit rating

- National debt

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/DIAGMBIFCBFTJADD5SB7GXXY2A.jpg)