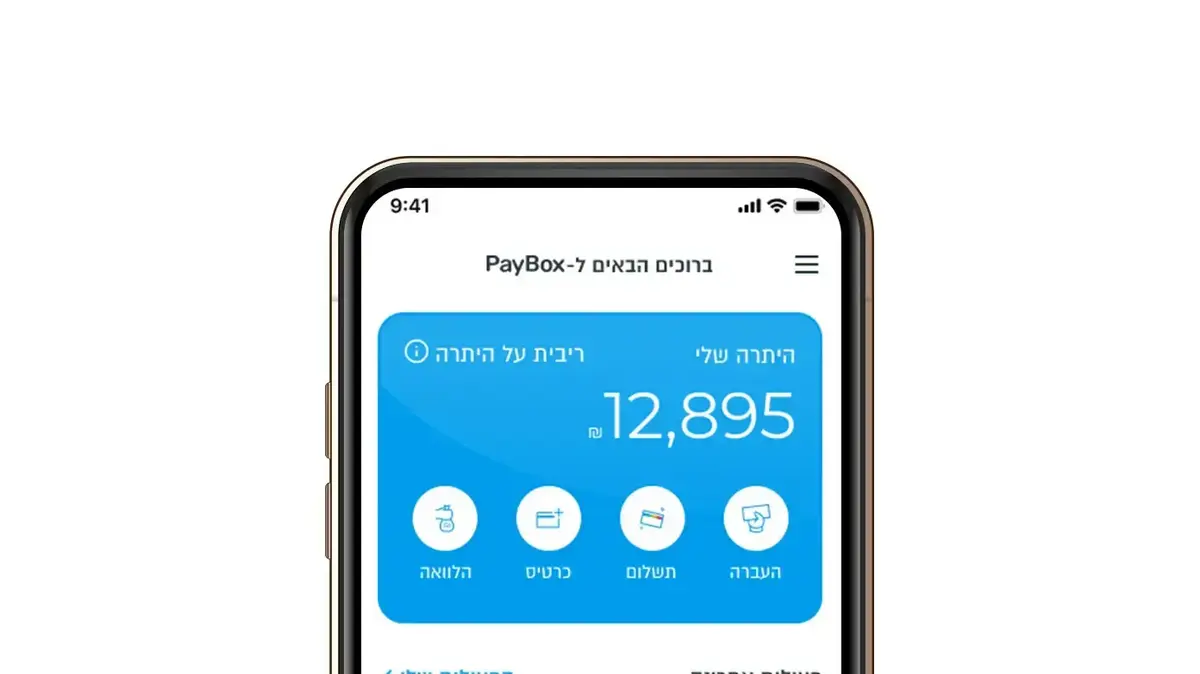

Paybox will pay you 3% interest on your balance in the app (Photo: PR)

It is finally possible to receive interest on the money "lying in checking accounts": Paybox announced this morning that it will pay customers 3% interest on the balance, without the need to close the money.

As part of the service, Paybox users will receive interest on their personal balance, which will continue to be available to them for withdrawal, transfer or payment, at any time and at no cost. The interest will be granted to customers of all banks, Paybox credit card holders.

Newcomers will be able to issue the free digital card (with no lifetime card fees) directly from within the app, and start loading money into the balance and receiving interest on it.

In the first stage, in light of regulatory restrictions, it will be possible to hold the balance up to a threshold of NIS 20,145, which will be increased later. Interest will accrue daily and will be paid once a month directly to the Paybox balance. The service will be on the app starting today and over the next few days will be available to all customers.

The current move is another layer, and the most significant to date, in Paybox's transformation from an app for transfers and group money collection to an application for managing money outside the bank, which poses significant competition to the banking system and offers products and services superior to those offered by them.

The process, which began about a year ago with offering a credit card without a lifetime card fee, continued two months ago with offering a deposit (monthly) at double the average interest rate offered by the banks (a deposit that attracted thousands of depositors, who deposited more than NIS 3 million within <> weeks) and continues now with payment of interest on the balance.

Arik Frishman, CEO of Paybox (Photo: Ilan Bashor)

"The move we launched breaks banking convention"

Arik Frishman, CEO of Paybox: "The move we launched today breaks the banking convention according to which 'liquid money for the public deserves nothing' and creates a real alternative to the half a trillion shekels that are currently lying in current accounts, generating huge profits for the banks, and giving the public nothing.

From today, customers of all banks will be able to load this money into Paybox, keep it liquid and receive a decent interest on it. This is another significant layer in turning Paybox into a real competitor to banks, which is in line with the spirit of the times, in which the public is looking for any way to increase its disposable income"

PayBox is an application for transferring money between individuals and collecting group money, with over 3.5 million downloads and more than 1 million different users per month.

Paybox customers can perform a wide range of actions, including: hold balances in the app separately from their bank account, pay from these balances anywhere using a free digital credit card; transfer and receive funds; establish groups to collect funds for common purposes; to accumulate and realize Supreme benefits (Shufersal's customer club) in more than 100 chains; attach and redeem purchase cards of the Golden Badge from Shufersal; And.

Paybox was founded in 2014 as a start-up company and today is an independent banking auxiliary corporation, owned by Discount Bank (50.1%) and Shufersal (49.9%). Paybox is managed by Arik Frishman and the company's chairman is Uri Levin, the outgoing CEO of Discount Bank.

- money

- Consumerism

Tags

- business

- economics

- interest

- Banks

- Financial