By Carmen Reinicke - CNBC + Acorns

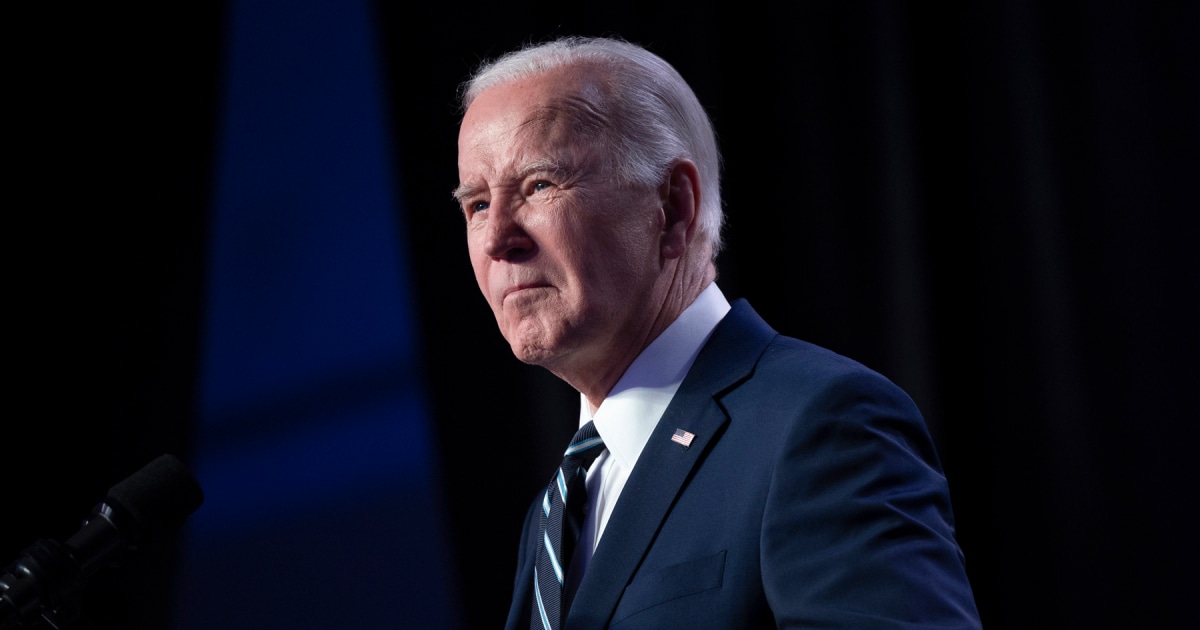

President Joe Biden presented a $ 2 trillion infrastructure plan on Wednesday to boost the economy in the wake of the coronavirus pandemic.

The project plans to invest in transportation,

care for the elderly and disabled, drinking water, housing, manufacturing and development, and job training, among other areas.

To finance it, the president proposes increasing the corporate tax rate, taking measures against companies that relocate their profits, and eliminating tax exemptions for some sectors.

With these tax increases, the investments would pay off in 15 years, and thereafter the deficit would be reduced, according to the White House.

[Will there be a fourth economic stimulus check?

At least 60 legislators already support it]

The proposed tax increase does not affect individuals.

Still, other measures could be considered in the future, particularly for those who spend the most money.

"With this first proposal, it's not really addressing people or the individual tax code," said Megan Gorman, an attorney at Checkers Financial Management in San Francisco.

"However, it is only a matter of time," he added.

Will my taxes go up?

Biden's proposal does not include at this time any tax increases for individuals, it only targets businesses.

However, that does not mean that certain people should not prepare for a tax increase in the future.

There are other proposals by legislators that would raise taxes for higher-income citizens.

[The Government extends the ban on evictions for non-payment of rent until June 30]

"Biden has been consistent in stating that he wants to raise tax rates for Americans who make a certain amount of money," Gorman said, "so high earners and other high net worth individuals are preparing."

"The president will present additional ideas in the coming weeks to reform our tax code in a way that rewards work and not wealth, and ensures that higher-income individuals pay their fair share," the White House said.

White House extends moratorium on evictions until June

March 30, 202100: 22

Democratic Senator Elizabeth Warren and Independent Senator Bernie Sanders recently proposed the Ultra Millionaire Tax Act, which would enact a 3% annual rate on wealth in excess of $ 1 billion;

and 2% above 50 million.

Other proposals would focus on capital gains and the wealth of the ultra-rich.

This would also affect the way in which very high net worth families may try to mitigate taxes, and the way they pass on their wealth to their heirs.

[This is how Biden proposes raising taxes to pay for his new stimulus plan focused on infrastructure]

According to Gorman, many families in this group have acted in anticipation of an increase in taxes and a change in the estate tax in the last year.

"There is always creative planning that is available to wealthy families," he said.

"What this has done for wealthy families is that it has forced many of them to be very proactive in their wealth transfer strategies."

What will change for companies?

Taxes for businesses would increase under Biden's plan.

Many of the provisions of the proposal are a repeal of measures that cut taxes for large companies in former President Donald Trump's Tax Cuts and Jobs Act of 2017.

The proposal would raise the corporate tax rate to 28%, from 21%.

The global minimum tax paid, which is applied to multinational corporations, would increase to 21% from around 13%, and the application of taxes against companies that claim tax havens such as their corporate residence would intensify.

[These financial aid that save millions of families from bankruptcy can end. What will happen next?]

The plan would also end federal tax breaks for fossil fuel companies.

If approved, these changes would be permanent and could only be reversed or revised through new laws.

Product shortages and price rises due to the prolonged traffic jam of the freighter in the Suez Canal

March 27, 202100: 29

Will there be more tax changes?

There are likely to be additional changes that would affect people with high incomes.

For low- and middle-income citizens, tax hikes are probably out of the question, as Biden promised that taxes won't go up for families making less than $ 400,000 a year.

In fact, it has worked to expand tax credits for this group.

For example, the latest stimulus package for COVID-19 expanded the child tax credit and makes payments recurring, with the hope that families will receive it monthly by 2021. Payments could begin in July.

[Biden ends Trump's veto on visas and labor green cards]

"This is a big social change that they are making with a tax credit," Gorman said, "this is where we expect to see more families start building their cash reserves."

He added that, if you are entitled to credit, you have to start planning what will be done with that money now.

Biden's current proposal could change as it progresses through Congress, where it will have to win approval from both Democrats and Republicans.

Also, many of the cuts to Trump's 2017 tax plan expire after 2025, meaning that some individual tax rates would go back up after that unless Congress extends the legislation.

Most of the business provisions of the law are permanent.

This article is part of the Invest in You Ready series. Set. Grow (Invest in you: Ready. Done. Grow), an initiative of CNBC and Acorns, the microinvestment app. NBC Universal and Comcast Ventures are Acorns investors

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/KMEYMJKESBAZBE4MRBAM4TGHIQ.jpg)