The ascent is almost complete.

In a situation report published on Monday, the Banque de France estimates that in October, the French activity should continue its return to normal: after twenty months of upheavals, at the option of the health crisis, "

the activity would be [...] almost 100% of the pre-crisis level

”this month, notes the institution.

Read also Partial activity returns to normal

The indicators are generally green: a "

moderate further improvement in activity

" is expected in October, and the Banque de France therefore expects the level of activity to return "

between 99.5% and 100% of its pre-crisis level

”. Growth should also stand at 2.3% in the third quarter, enough to confirm analysts in their growth forecast of 6.3% for the year 2021.

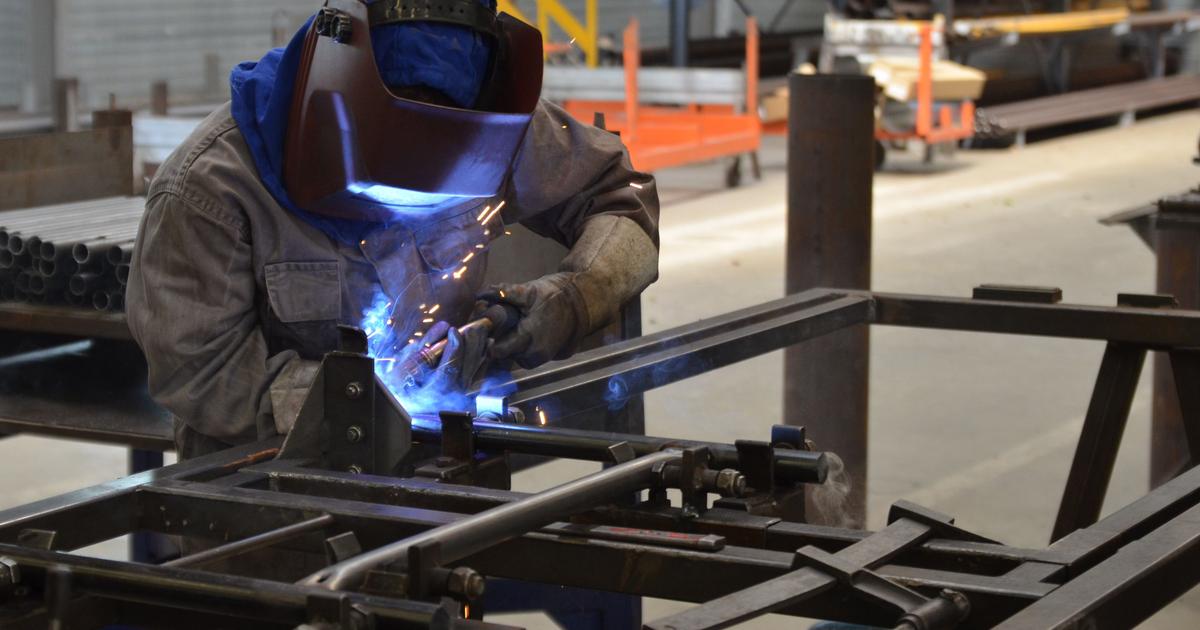

The capacity utilization rate in industry edged down in September, dragged down by declines in several subsectors, including metallurgy, rubber and plastic products and a significant weakening in autos.

Conversely, other sectors have progressed, including the chemical and pharmaceutical industry.

In market services, a "

very marked

"

improvement

is noted in several sectors, and the building sector is also experiencing a dynamic period.

These trends should continue in October, according to business leaders interviewed by the institution: construction will progress, as will services, when the industry will be "

almost stable or on the rise in all sectors

".

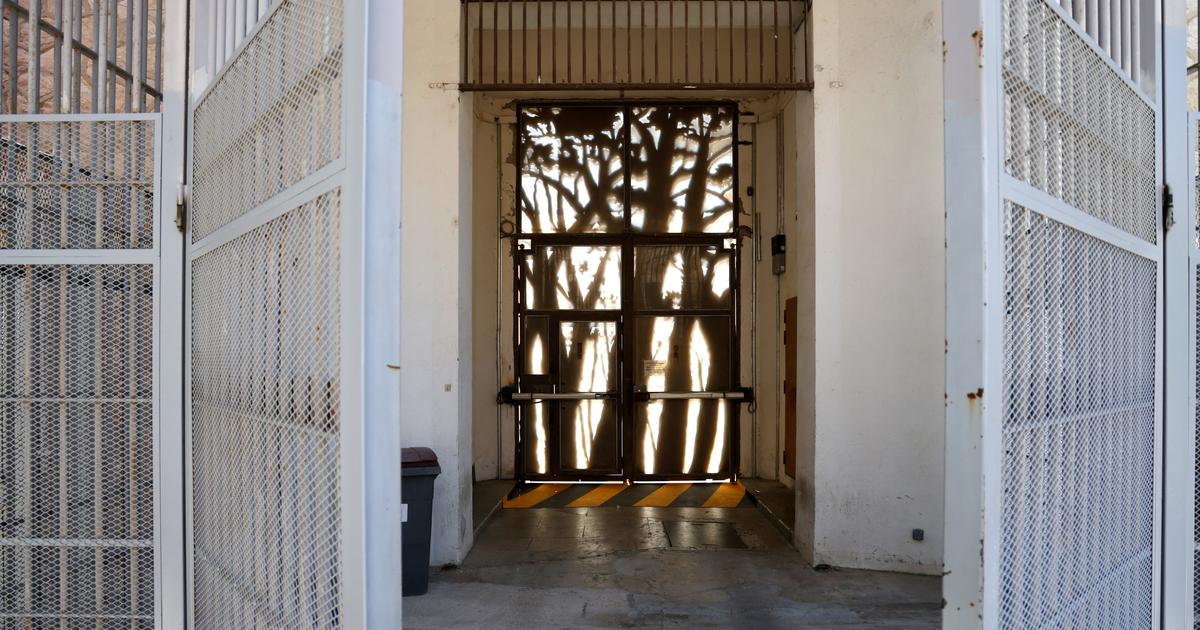

Twenty months to return to a pre-crisis situation

The return to normal was long and painful: during the first confinement, the activity had collapsed, before resuming.

But this good V-shaped dynamic had been shattered by the resurgence of the epidemic in France.

The level of GDP then stagnated for several months, from December 2020 to May 2021, before gradually recovering in favor of the summer.

The curve - and the recovery - therefore look like a “bird's wing”.

These new forecasts confirm the optimism displayed by INSEE in its latest publication: "

economic activity should recover overall - but without exceeding it [...] - its pre-crisis level by the end of the year,

”the institution predicted last week.

A return to normalcy driven by a “

clear

” summer rebound, and by a dynamism “

mainly driven by household consumption

”.

Heavy uncertainties

Clouds are gathering on the horizon, however, experts note. In September, 56% of business leaders in industry surveyed by the Banque de France reported encountering supply difficulties. A proportion rising to 62% in the building industry and up to 81% in the automobile industry. These increasingly common difficulties "

are once again accompanied by increases in the prices of raw materials and finished products

", underlines the report.

Another danger is that recruitment difficulties continue to multiply: more than half of construction and service companies indicated that they had encountered them in September, a proportion that has risen sharply in recent months. “

However, they have diminished in catering and temporary work

,” notes the Banque de France. The Hexagon is not the only country confronted with these phenomena: “

this summer, the recovery continued but the pace of growth should ease at the end of the year, in a context of growing supply difficulties and recruitment, and inflationary pressures fueled by the prices of raw materials

”, underlined the national statisticians there is little.

Reassuringly, the Banque de France does not believe that the inflation felt by households will set in over time.

In a post, two economists - Yannick Kalantzis and Youssef Ulghazi - believe that the current price increase "

is most certainly temporary, even if it may last for several more quarters

".

The authors expect

inflation

to “

kick back

” in 2022, followed by a

less marked “

upward slope

” in 2023, as activity and wages rise.

While it is "

very difficult

" to predict when the rise will have peaked, it should soon begin to fall below 2%.

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/KMEYMJKESBAZBE4MRBAM4TGHIQ.jpg)