Icon: enlarge

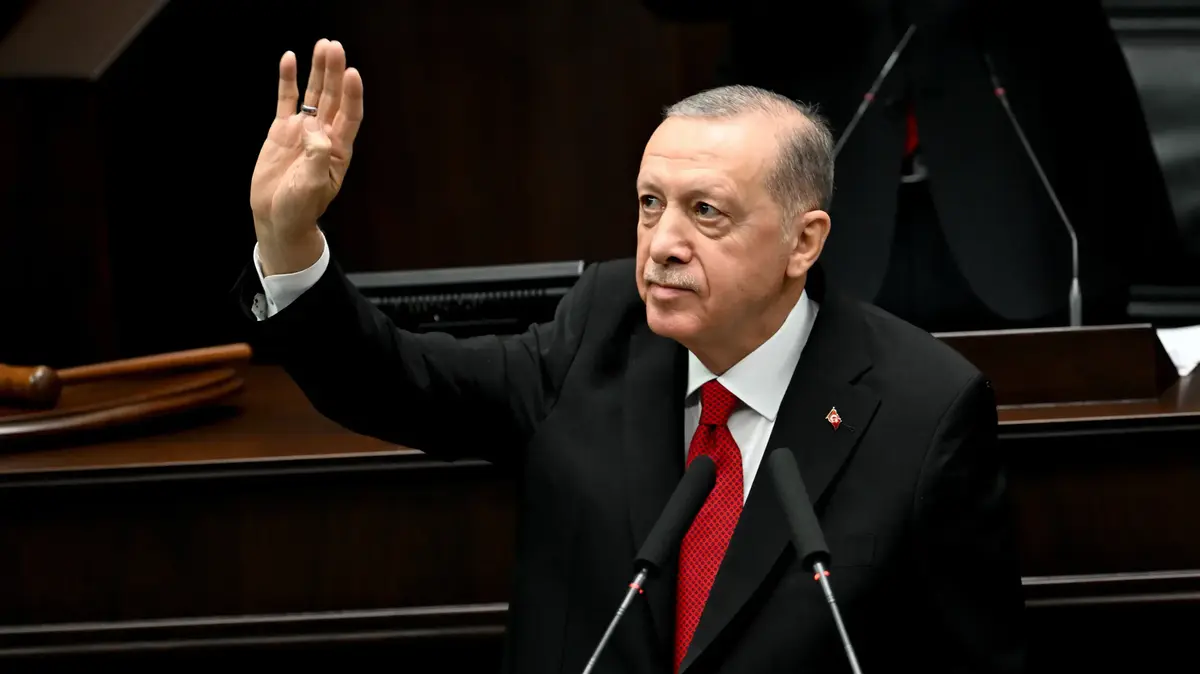

Turkish President Recep Tayyip Erdogan

Photo: ADEM ALTAN / AFP

The loss of value of the lira against the dollar has triggered the Turkish central bank on the scene after the Turkish lira has lost more than 11 percent of its value against the dollar since June.

In order to slow the lira crash and limit the escalating inflation, the central bank has raised the key interest rate completely surprisingly, from 8.25 to 10.25 percent.

It is the first rate hike in around two years.

The move is remarkable because doubts about the central bank's political independence have arisen in the past.

President Recep Tayyip Erdogan had made it clear several times that he was not interested in higher key interest rates.

He hopes cheap credit will fuel economic growth.

Erdogan calls himself "interest enemy"

In fact, despite persistently high inflation rates and massive losses in the value of the lira, the central bank failed to raise interest rates as experts expected.

This year the Turkish currency has already lost 23 percent of its value against the dollar.

After the central bank decision became known, the lira rose noticeably.

Erdogan had repeatedly called himself an "enemy of interest".

His government recently insisted on more support for the economy.

Because the gross domestic product of the emerging market, which had been booming for a long time, fell by 11 percent compared to the previous quarter from April to June in view of the corona crisis.

The major tourism industry, among others, was clearly affected by the virus pandemic.

From the perspective of the central bank, a rapid economic recovery from the economic shock triggered by the crisis has pushed prices up.

"Inflation has followed a path that was higher than expected," wrote the monetary authorities.

The steps to tighten monetary policy should be stepped up in order to contain inflation expectations.

Icon: The mirror

beb / Reuters