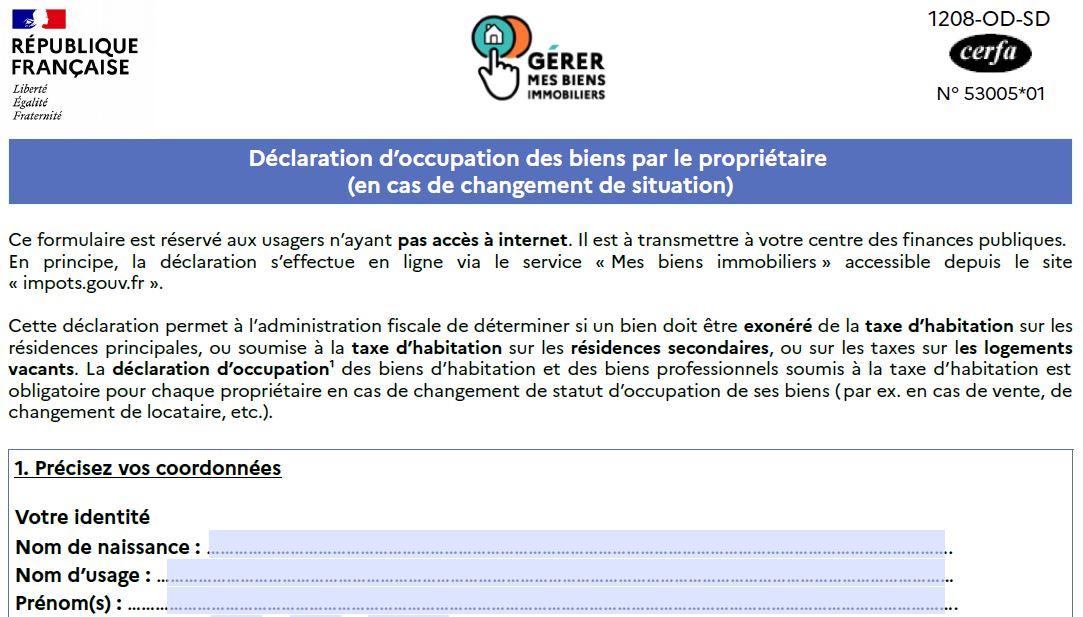

One in six French owners has not declared their real estate. To combat the lack of declaration of occupancy of real estate, the tax administration has just published a paper form.

The form must be filled in with the real estate assets of which the owner reserves the use but also those that he rents, mentioning the complete marital status of the occupant or that he leaves vacant. The process must be repeated with each change of occupation over time and in any case before July 1 of the year. The tax administration points out that this declaration is intended to determine whether a property must be exempt from housing tax on main residences or subject to taxation as a secondary residence or vacant accommodation. In the event of difficulties, a Public Treasury agent will help the owner by telephone on 0 809 401 401 (free service + price of a call) from 8:00 a.m. to 7:00 p.m., or in the France services area closest to the taxpayer's home. The declaration must be sent to its public finance center before July1, 2024.