Martin Grosz

05/31/2020 - 15:50

- Clarín.com

- Society

It took Fernando 15 minutes to queue to get to the ATM. He inserted the card. He asked for $ 12,000, what he needed to pay bills and buy provisions. " Enter a lesser amount ," the machine told him. He tried unsuccessfully with lower figures until, at $ 8,000, the ATM agreed: he gave him 40 $ 200 bills . The other $ 4,000 came out the next time, as the line grew behind him: 20 papers over $ 200 . Such a bundle did not fit in his wallet . "Why don't they put big money in the ATMs?" He asked an employee irritably. " There is not ," was the simple explanation. "In other banks the same thing happens to me," other waiting customers commented in chorus.

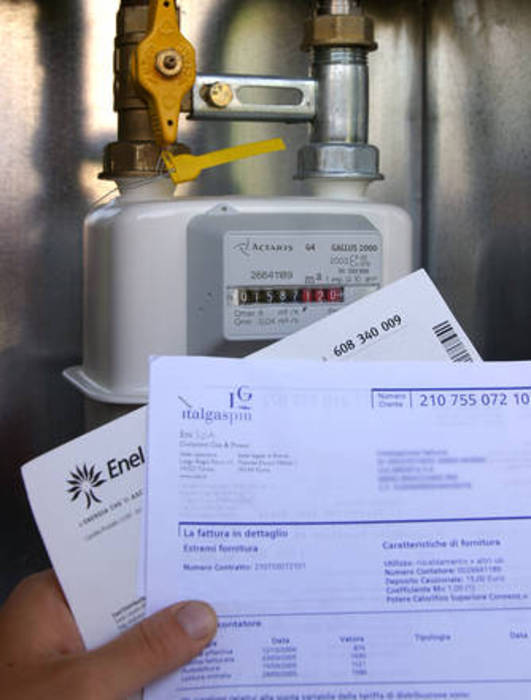

Scenes like this, registered in a Buenos Aires branch, have multiplied in recent weeks, coinciding with the millionaire social aid payments for the coronavirus pandemic. It became common for banks, through the window and at ATMs, to deliver all or a good part of the amounts in bills of $ 200 and $ 100. And that even ends up making it difficult for some beneficiaries of assistance to collect.

Requesting anonymity, five independent sources from different banks in the country confirmed to Clarín that this is happening, that it worsened and that it is because the Central Bank (BCRA) is not sending $ 200 and $ 500 bills in sufficient quantity . The same explanation is received by customers in branches, according to testimonies received by this newspaper.

"Today, when we request a certain amount from the BCRA, perhaps they send us half in bills of $ 1,000 and the rest in papers of $ 100 or $ 200. This began to cause complications, especially in Capital and the GBA, and in branches that do many payments ", explained sources of an important bank.

This situation complicates the daily operation of the treasuries and already affects people, not only because of the tediousness of receiving in several dozen banknotes amounts that disappear in a simple purchase of the supermarket. According to industry sources, by delivering so much small change, the machines lock and empty more often , remaining "offline" until they receive attention. In addition, since the devices do not give more than 40 bills at a time , people must do 2 or 3 operations to take amounts greater than $ 8,000 and even more than $ 4,000.

At this point, those who collect Emergency Family Income (IFE) without a card have the big problem because the code they receive only allows a single withdrawal for $ 10,000. So if there are no $ 500 and $ 1,000 bills in the machine, they get an error message . And they must, in full quarantine, go through several ATMs until they find one capable of paying them $ 10,000 at once. That is causing complaints and discussions at the branches.

"The Central Bank distributes what it has, but it is not enough. Because they are not enough to print all the large bills that would be needed for social assistance payments. It is problematic because it increases costs and makes us look bad with clients. Loaded on Friday with large bills, the ATM can last until Monday, but with everything at $ 100, early Saturday is already empty, "they graph in another entity of the largest in the country.

And the "horneros"? Banks assure that they are scarce and therefore cannot load them at ATMs. (Reuters)

Sources in the sector said that the situation was raised with the corresponding technical areas of the BCRA, for now without answers. They say that, for now, with various "juggling", ATMs were able to keep up with available money "almost 100%" . There are entities that needed to reserve the few $ 500 and $ 1,000 bills that they received only for the top-up of the weekend ATMs, and for critical cash payments.

"Until now it was manageable, but we are concerned about the 'bottleneck' that could be generated at the end of June , when IFE payments, retirements and bonuses come together," the bankers agree.

Before Clarín's consultation , however, the BCRA stated that "there are no shortages of banknotes" and that "there is no problem with the banknotes that circulate." The entity said that today only $ 1,000 bills are being printed, that banks "generally have a supply of bills" and that these " are delivered according to availability ." "It is a system. There is a certain amount and it is supplied to banks," they graphically reported.

And they even pointed to the entities by pointing out that, in reality, they demand more large bills to lower their costs. "The proposal they are making is to print a banknote with a larger denomination, which is not currently under study, as the President (Alberto Fernández) said," they interpret at the monetary entity.

The BCRA even recalled this Sunday, in a statement, that banks must deliver at least $ 15,000 a day per ATM "and in a single operation , if the client so wishes." For banks, because of how the Central Bank itself acts, this cannot always be guaranteed.