The pre-filled VAT arrives.

The first drafts, developed by the Revenue Agency on an experimental basis, will be available from March for the operations carried out from January 1st of this year.

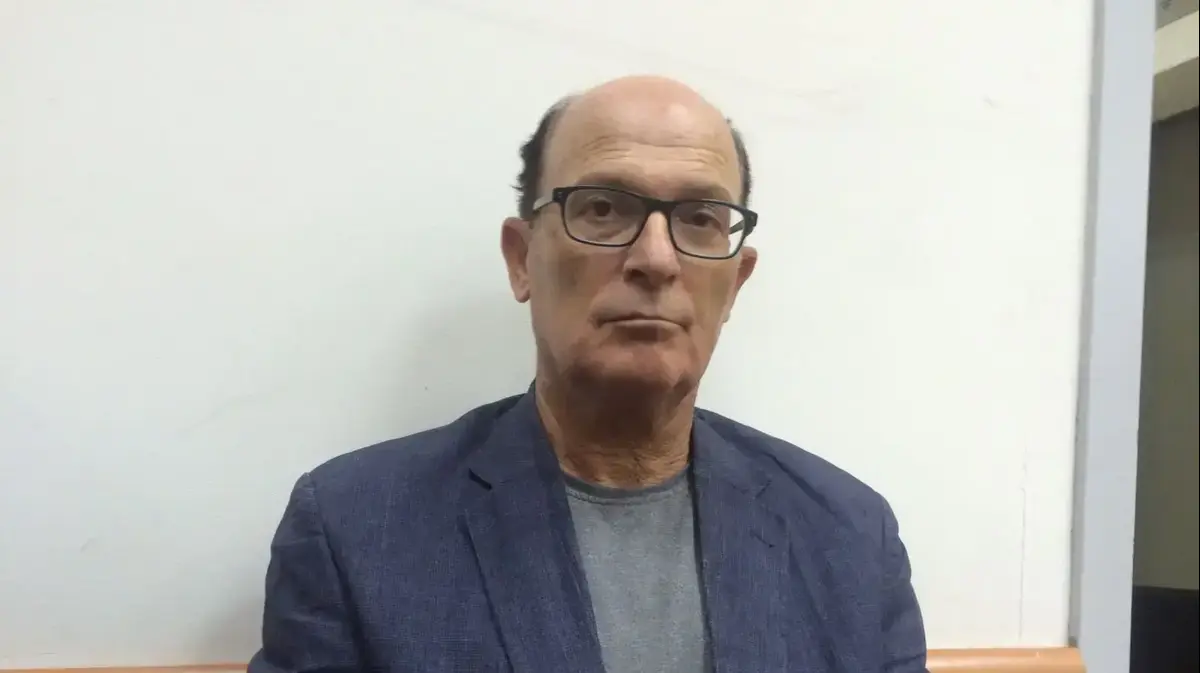

For the tax years 2021 and 2022, explains the director Ernesto Maria Ruffini, approximately 2.3 million taxpayers will be involved, out of a total of 4 million who submit the VAT return.

The drafts available from March will be validated or integrated, explains Ruffini, until 30 April.

This year, for VAT operations carried out from 1 January 2021, on an experimental basis, the Revenue Agency will make available to VAT subjects, in a special reserved area of the Agency's website, the drafts of some documents: records of invoices issued and purchases made;

the communications of periodic payments and the annual VAT return.

"With a view to graduality, for the tax years 2021 and 2022, approximately 2.3 million will be involved, out of a total of 4 million taxpayers who submit the VAT return", explains Ruffini.

These are, in particular, the subjects "who apply the ordinary VAT regime and who have opted for the quarterly VAT payment, that is the small subjects".

The drafts of the monthly registers will be continuously fed with the data of the electronic invoices transmitted to the Agency, in order to allow the VAT numbers to access the drafts in progress, to view and possibly modify the data received.

For the registers relating to the first three months of 2021, the drafts prepared will be made available by March: the VAT payer will be able to access the draft registers relating to the months of January, February and March 2021 and will have until April 30, 2021 to validate or supplement the registers for the first quarter of 2021.

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/S7ERVSCT4FUVX6R7TUVBDNTH5Y.jpg)