Although every fourth business in the fashion industry ran into difficulties in 2020, the large and powerful brand groups managed to maintain their profits. • Back to routine?

Depends on who you ask • Estimates range from hesitation to growth that will offset some of the losses • On one thing everyone agrees: people will get dressed again

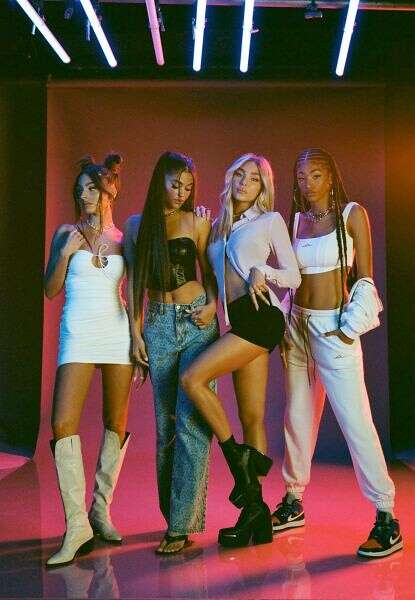

Renoir Spring Summer 2021

Photo:

Zohar Sheetrit

The shopping frenzy on the eve of the holiday (and the election) this week scattered a little pink blush on the worried faces of the fashion industry in Israel.

Both the private and expensive designers and the employees and managers of the chains and stores hope that the closing-opening games are over.

Even with the opening of trade and malls last February, the industry returned to activity.

However, the owners of the chains faced quite a few challenges, including selling the winter stock that had accumulated in the warehouses after a long closure, payments of current expenses, returning workers expelled to the IDF, along with the fear of an increase in infection and a new outbreak of the plague.

Even before the corona, in recent years this industry is considered to have a high level of risk, created due to the fierce competition with foreign shopping sites without VAT and customs, as well as due to the purchases made by Israelis abroad instead of in Israel.

Other risks that characterized the industry are excess commercial space, an increase in expenses, including high rents in malls until the Corona crisis, the minimum wage that rose, limited access of some businesses to sources of financing and more.

Against the backdrop of industry trends, many fashion chains in recent years have run into difficulties or closed for reasons of inefficiency.

The investment has plunged

This reverse evolution is of course translated into numbers.

According to the business information company Coface Bdi, there are about 9,000 clothing, footwear, designer clothes, children's fashion, lingerie and related fashion accessories in Israel.

It is estimated that about 4,950 (55%) are chain branches.

The rest, 45% - are private stores - about 4,050.

In 2020, every fourth business in the industry ran into difficulties, which were reflected in a decline in revenues and difficulty in meeting obligations to suppliers to the point of fear of closing the business.

In the dismal list: the Razili chains (acquired by the Inter Jeans group);

Lingerie chain Bonita de Mas (acquired towards the end of 2020 by Naaman Group).

In 2019, the discreet chains, the Cassidy women's fashion chain, the Zebra discount fashion chain (acquired by the Select chain), Michal Negrin and others ran into difficulties.

Based on the Dun & Bradstreet indices, last year the crisis led to the closure of about 950 stores - a dubious increase of about 27% compared to 2019.

According to Efrat Segev, VP of Data and Analysis at Dun & Bradstreet, mainly small and medium-sized fashion chains were closed, while the large chains did not show a significant setback in their business results in the past year and even maintained similar profits. Fox, Golf and Delta groups, for example, were not harmed 2020, and even maintained similar or high profitability indices compared to 2019.

In this context, the major chains reported an increase in online sales.

The Fox Group continued to develop and market through the Terminal X Group website, the Golf Group continued to develop and market through the Group's sites and through the Adika multi-brand site, and the Delta Group reported improved online site trading in Israel, in some months even hundreds of percent compared to the previous period.

In the same year, the total expenditure on fashion items purchased by Israelis also plunged, at a rate of 20% -15% compared to 2019.

The decrease is due, among other things, to a decrease in private consumption in Israel in 2020 in the shadow of the crisis and its effects on the labor market, and the disposable income of the public, along with a decrease in prices in Israel this year as a result of 5.7% demand.

"Young women want a shop"

"Already at the end of the third closure, our teams prepared the stores with winter stock in the 'Final Sale' and with the buds of a new holiday and spring collection," says Renoir Group's VP of Marketing, Yifat Pasternak.

Do you produce less compared to last year?

Pasternak: "There was no change in conduct. Work as usual, look ahead with optimism and try to score as much as possible. We opened TwentyforSeven Men a year ago with a collection tailored to the taste of the Israeli man. There are good sales so the brand is here to stay. We also have local production. "Allows us to be more flexible in the schedules and production quantities, so we did not change anything in the collection mix, and there will be a large selection and a wide offer for our customers."

Winter is over, the tracksuits that stood out this year are back in the closet and people are spending time outside again. Does that leave you optimistic?

"We expect with the return to routine an awakening of people who want to dress more fashionable. "Emphasis on light colors, stone tones, and buttoned shirts in a variety of colors. I believe that clothes will still be a little comfort, that people will allow themselves to buy and especially for a holiday with the latest fashion."

Zeev Aharonson, owner of the fashion chain Zip and Celio Israel, has a hard time predicting what will happen.

As a veteran of the industry he also remembers periods of wars that affected the economy, and yet he remained optimistic.

"I do not believe there will be a closure on Passover, and we do not proceed in advance with the thought that there may be a fourth closure. Our production is not harmed and holiday goods are in the country. You need to know how to conduct yourself properly and keep your finger on the pulse. The online site prepares collections for the coming seasons in smaller quantities, and still maintains a high level of quality of the product at the same price. "

Are you willing to bet what will happen online, at least with you, now that everyone has left their homes with the opening of the economy?

"Even though online sales are on the rise, people will still want the shopping experience that exists in malls. Israelis will need clothes for the new season, and since they are not traveling abroad, they will not give up the shopping experience in the store."

In the medium term, the industry's eyes are worried about Passover - the season of events on the horizon.

"The big question is whether people will continue to work from home and less come to offices, and will the events of weddings in the halls return, and the pastimes that will get people to consume fashion."

What do you think will change?

"The increase in online sales will continue, mall owners will have to lower rents and management fees - otherwise chains will not stay at any cost. When more people are expected to continue working from home and not return to office work, malls will have an interest in their commercial spaces not becoming ghost malls."

Matan Armoni, VP of Strategy and Business Development of the Adika fashion brand, agrees with his colleagues. "It has been a difficult year for all business owners in the field because we constantly have to adapt to a rapidly changing reality, with uncertainty about when they will open trade in each closure. That was, "Chestnut recalls." However, "he cautions," while other fashion chains are held with new holiday collections and seasonal collections, we have new collections every two weeks.

Every week, about 100 new products are uploaded to the site, so it is challenging throughout the year. "

As a brand that started out online and then in the field, Chestnut recognizes the importance of integrating a sales website and stores together.

"Although most of our customers are a young generation of girls who are on screens all day, in closures they lacked access to the store. At each exit lock we saw the influx to our stores and at the same time a decrease in online purchases - and vice versa. An item they saw on Instagram or our site would sometimes come several companies together. "Measure and buy in the store before purchasing on the website. This is a different shopping experience."

"This is a year of adjustment"

Batya Bashir, the marketing director of the children's fashion brands Kiwi and Honigman Kids, brought the spring collection to February.

Is this a move behind the fear of a locksmith popping up again before the holiday?

"No," she concludes.

"The thought was that because of the limitations people spend less time in the mall, afraid of closed places, so most of them will come to buy seasonal items in large sizes offered at super-attractive prices that will suit children next year, and on the way will prefer to buy the spring-summer collection." At once".

According to the forecast of Shahar Turgeman, chairman of the Brill fashion brands group and chairman of the Association of Fashion and Commercial Chains, 2021 will be a test year for the industry.

"We are entering a very challenging year, a kind of transition and adaptation year. The chains will try to estimate how much to produce depending on the financial strength and there is a chance that small chains and private stores will close. Some chains took out a loan about a year ago when the corona broke out and now have to repay. "Seasons, the costs of transportation and transportation have also risen significantly this year, and we must soon pay advances on the production of goods for next winter."

Compared to Turgeman's reluctance, Efrat Segev of Dan & Bradstreet believes that this year "an increase in the volume of activity in the industry is expected, and we can see renewed growth that will offset some of the decline of 2020."

Segev notes that although the damage to the fashion industry will be difficult to recover and will take time, "but looking ahead we believe that in 2021 the volume of activity will increase and we can see renewed growth that will offset some of the decline in industry activity in 2020."