Amazon has managed to hunt down the Metro-Goldwyn-Mayer (MGM) lion after weeks of speculation and 18 months of negotiations.

It is not the first marriage between Hollywood and big technology, but it is an important example of how digital platforms eat Hollywood.

The purchase for 8.4 billion dollars (6.910 million euros) of the legendary studios founded 97 years ago, winners of more than 170 Oscars and owners of the distribution of the

James Bond

saga

,

is a manifestation of the arduous battle for control From the market.

The operation, together with the merger announced last week of the content division of AT & T / WarnerMedia and Discovery, envision for viewers a new golden age on demand that will arrive in the coming years.

More information

Amazon enters Hollywood with the purchase of Metro-Goldwyn-Mayer studios

Netflix adds fewer subscribers in 2021, but will spend more than ever on content

The pandemic transformed television consumption habits. Screen time watching content on digital platforms increased 44% worldwide during the last three months of 2020 compared to the same period in 2019, according to figures from Conviva, a California-based research firm. With these data in hand, the big players have started what a Wall Street analyst called on Wednesday an "arms race" to seize the most powerful arsenals, huge files that make the content offer more attractive to subscribers. A Deloitte digital trend analysis found that the average user subscribes to five services, two more than before the pandemic. Analysts believe that licensing agreements,studio contracts with telecommunications companies for them to dispose of their products, their days are numbered. The most appetizing movies and series will have exclusivity on services such as Disney +, Paramount +, Netflix, HBO Max and Peacock, from the NBC television network.

It is true that Hollywood was always a thermometer of what industry ruled the world. In 1989, the Japanese company Sony bought Columbia when Japanese technology was booming. In October 2017, the AT&T telephone company announced an agreement to acquire Time Warner, a process that was completed in June 2018 and thus WarnerMedia was born. Last week AT&T decided to spin off WarnerMedia from its trunk and merge with Discovery, another content creation giant, thus emerging a powerful product division that will feed its platform. The merger, due to close in 2022, allows both companies to bring together HBO fictions, CNN news, Animal Planet and Discovery documentaries, Oprah Winfrey's lifestyle shows and popular TV broadcasts under one roof. Food Network, for example.

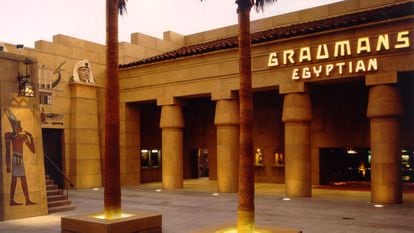

Hollywood Egyptian Theater, currently owned by Netflix.

Tom Bonner / American Cinematheque

In this war, the purchase of MGM is understood: the

major

(Hollywood studio) has several content sales agreements with various television channels and platforms (Disney, Netflix, WarnerMedia ...) that will become its competitors once Regulators give the green light to the confirmed operation on Wednesday, something that could take up to a couple of years.

These contents, 4,000 titles in total, will be migrated to Amazon's Prime service, which has more than 200 million subscribers, but there is no fixed date yet.

It is also true that MGM's best years have been decades ago, which began its decline in 1952 when an antitrust law forced the

major

to divest itself of its cinemas. And his old idea of Hollywood cinema collided with the new air of the sixties. In 1969, gambling mogul Kirk Kerkorian bought 40% of the shares of MGM and all he did was create an MGM casino hotel in Las Vegas, while cutting the film division.

More interested in the power of the brand than anything related to cinema, he bought 40%

of the company's

stock

. In 1985 the buyer was Ted Turner, more interested in his catalog than in the production of that moment; that is why the MGM titles prior to 1986 are in the hands of WarnerMedia (current owner of the Turner companies), and have been left out of those acquired by Amazon. Curiously, Turner returned it, without those contents, to Kerkorian and he sold the

best

to an Italian businessman.

After another couple of rounds, it returned, once again, to Kerkorian, which in 2005 sold it to Sony for 5,000 million dollars (2,000 million were direct to pay debts).

The hole was so big that in 2010 MGM declared bankruptcy.

And since then it has been managed by the holding company MGM Holdings.

“Buying Amazon is not so much about you becoming a studio owner.

It is an issue of influence.

MGM gives them credibility, not dominance

Tim Hanlon, Consultant

So what makes MGM attractive?

In addition to the other audiovisual products discussed above on other platforms, they have James Bond.

The British Eon Productions owns the rights to the character created by Ian Fleming and has a distribution agreement with United Artist, part of the MGM conglomerate.

Tim Hanlon, founder of the Vertere group, a consultancy focused on the media and entertainment, explains the trend: “The model of a linear and scarce television has disintegrated and has become the triumph of video on demand, which is very abundant . Now it all depends on the choice. The content libraries are more important than the businesses of the companies ”.

“Buying Amazon is not so much about you becoming a studio owner. It is an issue of influence. MGM gives them credibility, not dominance, ”says Hanlon. The specialist believes that Bezos' company can deepen the changes in distribution windows, the time that a movie or series must be shown before jumping to digital or physical media such as DVD or Blu-ray. In the United States, that window was around 90 days, which is being renegotiated to 45 days: movie theaters lose business, digital platforms enjoy new content sooner. “The big challenge now is how to make profitable and modernize those windows. Amazon is in a unique position to do so because it knows all the consumer habits of users ”, adds the analyst.The Hollywood sustained in the projections in physical places is reeling. And that earthquake was started by Netflix, which curiously bought in January an emblematic cinema, the Egyptian Theater in Hollywood, and that these days it is considering the renovation of the room.

These announcements have revolutionized a market in deep transformation. Netflix, with about 205 million subscribers, is trying to stay ahead of the race. In a more discreet announcement made in April, the company said that Sony will become one of its main suppliers between 2022 and 2026. From next year, the 15 or 20 films released by the studios will make their leap, with a reduced showing window in movie theaters, to digital service. Sony also has an obligation to first offer Netflix the productions it makes that are output only on demand. It will provide ammunition so that the digital giant can wage an increasingly competitive war.

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/S6ARYN3A4ZF23EJ2KLKXTSQGII.jpg)