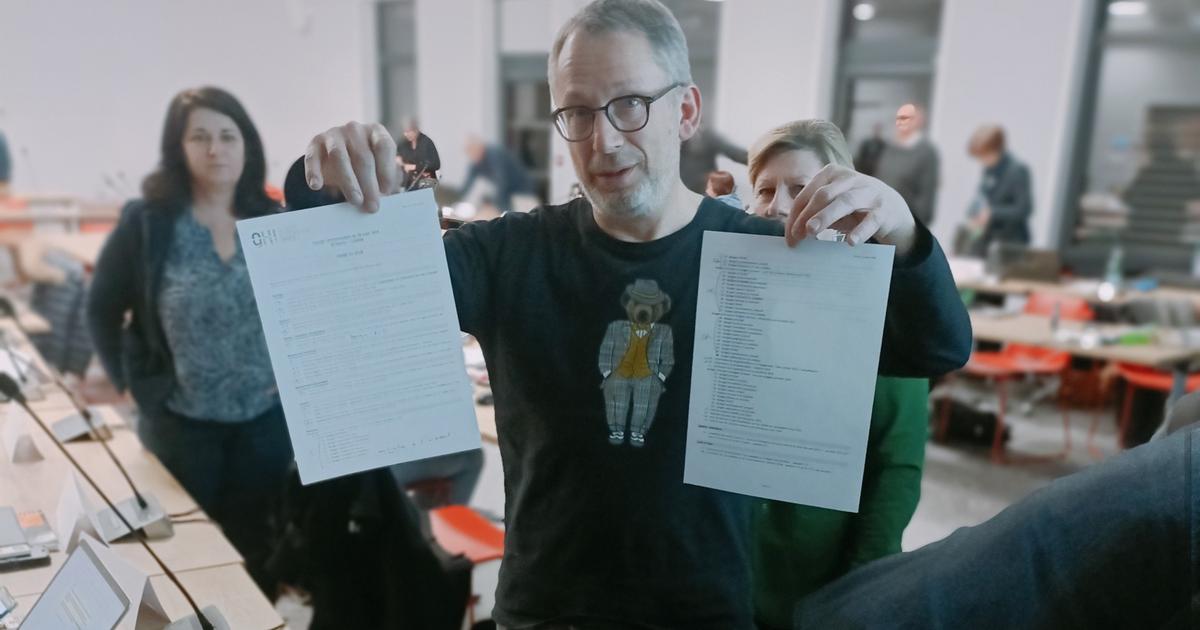

A "very hot" summer, not only from the meteorological point of view, but also due to the amount of tax obligations imposed on taxpayers (and the professionals who assist them) from tomorrow, 20 August. And, alongside the "ordinary" deadlines (such as the Esterometer, which provides for the communication of the data of the invoices issued, or received by those residing outside the Italian territory, as well as the request for reimbursement / compensation of VAT credits for the second quarter of 'year), some innovations have appeared on the tax' scenario ', one above all the need to send the data concerning the sales of goods (subject to VAT) remotely via digital platforms to the Revenue Agency. The union of young chartered accountants (Ungdcec) sounded the alarm,which highlights how by the end of August "we will have to face 163 tax obligations", a circumstance that, in the opinion of President Matteo De Lise, "shows how, in the next tax reform", it is also necessary to revise the calendar of deadlines. The picture is "already upset by the emergency measures" adopted to counter the effects of the pandemic, yet the obligations "continue to increase", says the national adviser of accountants Maurizio Postal to ANSA, convinced that the concept of "gradualness" is "fundamental ", both for the tax authorities and for the taxpayer.in the next tax reform ", it is also necessary to revise the deadline calendar. The situation is" already upset by the emergency measures "adopted to counter the effects of the pandemic, yet the obligations" continue to increase ", declares to ANSA the national councilor of accountants Maurizio Postal, convinced that the concept of "graduality" is "fundamental", both for the financial administration and for the taxpayer.in the next tax reform ", it is also necessary to revise the deadline calendar. The situation is" already upset by the emergency measures "adopted to counter the effects of the pandemic, yet the obligations" continue to increase ", declares to ANSA the national councilor of accountants Maurizio Postal, convinced that the concept of "graduality" is "fundamental", both for the financial administration and for the taxpayer.ANSA the national councilor of accountants Maurizio Postal, convinced that the concept of "graduality" is "fundamental", both for the financial administration and for the taxpayer.ANSA the national councilor of accountants Maurizio Postal, convinced that the concept of "graduality" is "fundamental", both for the financial administration and for the taxpayer.

Among the appointments scheduled for tomorrow there is the periodic payment on excise duties, the insurance tax, the liquidation and payment of the monthly VAT for July 2021 and the second quarter 2021, but also the payment of the withholdings made in July relating to income from employees (and similar), without forgetting the municipal, provincial and regional income tax surcharges for employees, and the social security contribution INPS (traders-craftsmen, employees and members of the separate management). September 15 is the day on which the extension of income taxes, balance and first advance payment for different categories of subjects (individuals, partnerships and capital companies) was established by the Sostegni-bis decree. Not to be slipped, Postal remembers,is the deadline for submitting the tax return for those who intend to make use of the non-repayable "equalization" grant: the established date is 10 September, the accountants have repeatedly invoked the postponement to 31 October due to the "considerable complexity" of obligation.