There are many innovations with which Italians will have to familiarize themselves in 2022, from the new personal income tax to the cash ceiling, from the Superbonus to Quota 102 to retire.

Here is a quick rundown.

-

SHOCK ABSORBERS.

The tools for the protection of those who lose their jobs become universal, also including companies with fewer than 6 employees so far excluded (which, however, will have to pay a contribution of 0.5% on wages).

The decalage of Naspi will begin after 6 months, the expansion contract will be used from 50 employees.

-

SINGLE CHECK

. Here comes this new 'universal' tool for those with dependent children, it starts from the 7th month of pregnancy up to 21 years. It will go from 175 euros per month for ISEE equal to or less than 15 thousand euros, gradually decreasing to 50 euros for ISEE equal to or greater than 40 thousand euros. It will be possible to apply from January, the benefit starts in March by recovering the first two months.

-

ABSORBENTS

. The VAT on sanitary towels is halved and drops to 10%

-

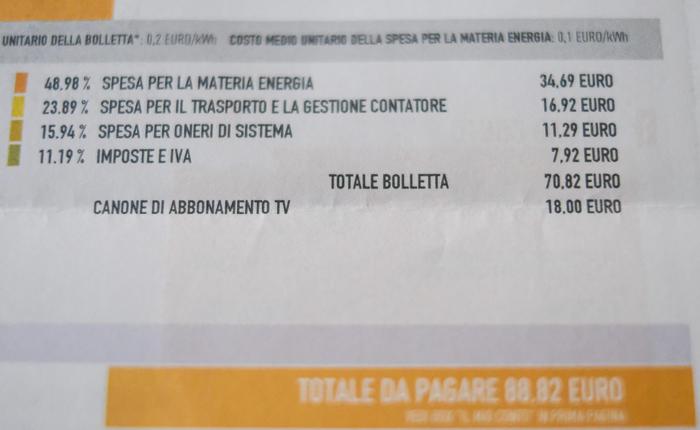

BILLS

. The bills are still rising. After the 2021 price hikes, there is a new jump in prices. For this reason, the government has foreseen an intervention in the budget law - 3.8 billion in total - which aims to sterilize increases especially for low-income families, as well as reducing VAT on heating gas to 5%. The cut in system burdens and the relief will affect less well-off families. The bills for the first quarter can be paid in 10 installments.

-

ARCHITECTURAL BARRIERS

. The special 75% bonus for breaking down architectural barriers with lifts or hoists is new this year.

-

CASH

. From January 1st, the ceiling will drop from the current two thousand to one thousand euros. Also for the payment of wages (except maids).

-

FOLDERS

. There will be six months to pay for the notified bills in the first quarter of the year.

-

RELOCATION

. An anti-relocation tightening is triggered: three months' notice and a plan are needed to make the redundancies less traumatic. The fines for violating the procedure double.

-

EXPANSION

. The expansion contract is financed with resources: it foresees a hiring every three exits of workers, allowing slides up to 5 years.

-

FACADES

. The facades bonus remains, to renovate the exterior of houses and buildings but it drops from 90 to 60% of the cost.

-

YOUNG PEOPLE

. The tax discount for the purchase of houses for the under 36 has been extended, but also the 20% deduction for the rent for young people under 31 (with incomes up to 15,493 euros). The culture bonus for eighteen-year-olds becomes structural.

-

IRAP

. The cancellation of the IRAP for 835 thousand self-employed, including professionals and sole proprietorships.

-

IRPEF

. The personal income tax rates change. It drops from five to four rates (23% from 0 to 15,000 euros; 25% from 15,000 to 28,000 euros; 35% from 28,000 to 50,000.00 euros; 43% above this threshold).

The deductions also change. The average discount is € 264 per year. But it takes time to adjust the payroll software and the concrete effect will arrive only in March when there will also be an adjustment for the previous two months.

-

FURNITURE

. There is the 'Mobile Bonus' which doubles from 5 to 10 thousand euros. But it is activated only in tandem with the restructuring bonus which does not change.

-

NEW MOMS

. In 2002 there is an experimental cut of 50% of the contributions paid by working mothers in the private sector.

-

DAD (OR NEW DADDY)

. Employees who will have a child or adopt one will from now on be entitled to 10 days of compulsory leave and one day of optional leave (this replacing the mother's one day) paid at 100%. The leave must be taken within the first five months of the birth or adoption.

-

PLASTIC TAX

. It was postponed to 2023, with the Sugar Tax.

-

FEE 100 GOODBYE

. The requirements for leaving work rise to 102 (64 years of age and 38 of contributions). But on the pension front there is also an expansion of the social Ape, which includes builders and ceramists, beauticians, warehouse workers and even teachers. Extended Woman option without review of requirements.

-

DRC

. The citizenship income changes, but little. The criteria for the job offer change: after the second proposal you have to accept the job in '' all of Italy '', or you lose the benefit (previously there were three proposals). But already at the first 'no' you will lose 5 euros per month, with a decalage that will stop at the threshold of 300 euros of subsidy. The "employable" beneficiaries will have to report to the employment center at least once a month.

-

SUPERBONUS

. Extended for condominiums until 2025, but with a decalage: it remains at 110% until 2023, then at 70% in 2024 and 65 in 2025. The more stringent rules introduced for villas at the beginning of the maneuver have been relaxed: the extension to the end of 2022 there is if by June 30% of the works have been completed.

The extension is up to 2025 for municipalities affected by earthquakes.

-

OUTDOOR TABLES

.

No tax for the occupation of public land until the end of March.

The exemption provided for until December has been extended.

-

VOLUNTARY SERVICE

.

No VAT until 2024 for the third sector and the non-profit world.

-

TV AND DECODER

.

The bonus envisaged to adapt the equipment to the new transmission technologies was refinanced.

For those over 70, the decoder will be delivered to the home via the post office

-

GREEN

.

It is the 36% bonus for improving green spaces from balconies to gardens.