An increasingly friendly tax system.

Which gives you even more time to pay off debts.

And which triggers the automatic removal of the files after 5 years.

The government is overhauling the tax collection system with the aim of making it "faster and more efficient" and streamlining the mountain of tax debts.

But there are already those who smell an amnesty.

The Deputy Minister of Economy Maurizio Leo, however, explains: we help "those who want to pay" but cannot.

And he assures us: we will continue to "fight against the crafty".

The new implementing decree of the tax reform which receives the preliminary approval of the CDM, the tenth, is dedicated to the reorganization of the collection system.

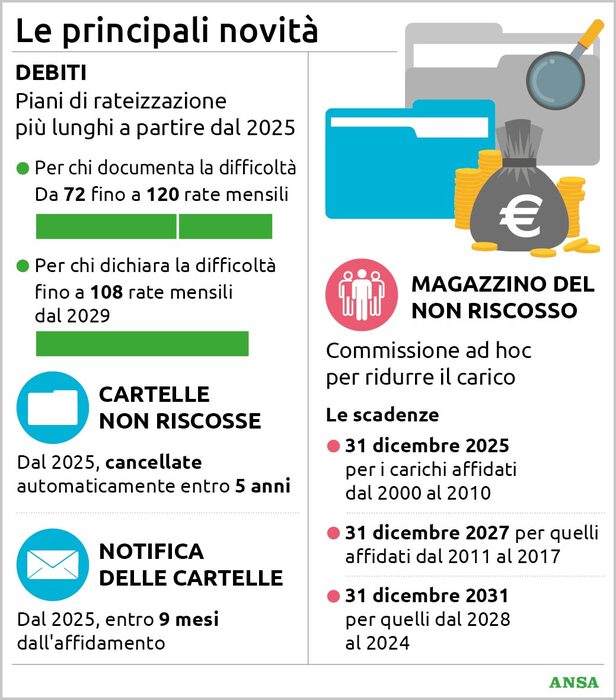

First of all, there is an extension of the time it takes to pay off debts with the tax authorities: it goes from the current 72 monthly installments to a maximum of 120 (i.e. over a 10-year horizon).

Over 120 thousand euros of debt, the taxpayer who documents the temporary situation of objective difficulty will immediately have the possibility of deferring the payment in a maximum of 120 monthly installments.

Below that threshold, however, a progressive increase in installments is envisaged every two years: for those who "document" the difficult situation, a minimum number of increasing installments is envisaged (which increases every two years, from 85 to 97 to 109) and a maximum of 120 installments. ;

while for the taxpayer who simply "declares" that he is in difficulty, the increase starts from 84 monthly installments in 2025-26, progressively increasing up to a maximum of 108 installments in 2029. The Mef will evaluate - monitoring the effects of the new rules on public accounts - whether to grant the 120 installments from 2031. From 2025 comes the cancellation (the "automatic discharge") for bills not collected within 5 years.

"Early discharge" is also provided for in cases of closure of bankruptcy or judicial liquidation or "the absence of assets susceptible to being attacked".

Until the statute of limitations, however, the creditor body will be able to manage the compulsory collection of the discharged sums on its own or entrust it in concession to private entities with a public tender, or re-entrust them to the Revenue-Collection Agency for 2 years in the event that it becomes known of new and significant income elements of the debtor.

From next year, the bills will have to be notified to the creditor within 9 months of the assignment of the load and there will also be the possibility of grouping the credits by tax code with the effect of, for example, having taxes and fines in a single bill.

Interventions that aim first of all to "streamline" the current warehouse of uncollected debts, a mountain of debts that have already reached 1,200 billion (they were 1,206.6 on 31 December).

And "prevent another similar one from being created in the future."

An ad hoc commission has also been established which will analyze the situation and propose to the Mef "possible solutions to achieve the discharge of all or part" of the warehouse.

"The government's work on tax reform continues unabated", underlines Leo with satisfaction: "We are completely redesigning the architecture of the Italian tax system".

But the new measures do not convince everyone: with the cancellation of the files after 5 years, economist Carlo Cottarelli observes on

Meanwhile, the process of the legislative decree on the reorganization of the games is completed, definitively approved by the Council of Ministers.

The renewal of the Lotto tender arrives, with an auction base that goes from 700 million to 1 billion, but the use of cash for online games is also put to an end.

The objective is "to rationalize and update the public remote gaming system, increasing the value of the concessions to be assigned, bringing them to the correct market levels", explain government sources.

The next step will be an intervention on the physical games network.

Reproduction reserved © Copyright ANSA