This time, the coronavirus epidemic is raising fear. This morning in Paris, the CAC 40 index lost more than 3.5%, all its components being in the red. If it does not reduce its losses tonight at the close, it could be its sharpest decline since August 2, 2019 (- 3.57%), when the concern brought escalating trade tensions between the United States and China.

The other European markets are also at half mast, the DAX 30 declining in the same proportions in Frankfurt. The red lantern returns to the FTSE Mib index of the Milan Stock Exchange, which lost 4.4%. In China, where the Covid-19 epidemic started, its spread seems to be slowing down. Conversely, cases of coronavirus recorded in the rest of the world are increasing rapidly, notably in South Korea, but also several countries in the Middle East, as well as in Italy. This raises fears of a worsening of the macroeconomic consequences of the disease.

The values exposed to tourism under attack

By sector, the stocks most exposed to China are not surprisingly the most affected: in Paris, the biggest declines include values exposed to tourism, such as Accor (- 6.9%), CAC 40 red lantern, and Air France-KLM (- 9%), steepest drop in SBF 120. Very dependent on Asia, the luxury sector is also affected, like Kering (- 6%), as are car manufacturers Peugeot and Renault (- around 5%), but also the manufacturer of semiconductor products STMicroelectronics.

Conversely, the “safe haven” appreciates: the ounce of 31.1 grams of gold wins over forty dollars and approaches the 1,700 dollar mark, which has no longer held since December 2012. In the single European currency, the one kilo ingot is traded at around 50,000 euros when the Napoleon of 20 gold francs grazes 300 euros, unheard of.

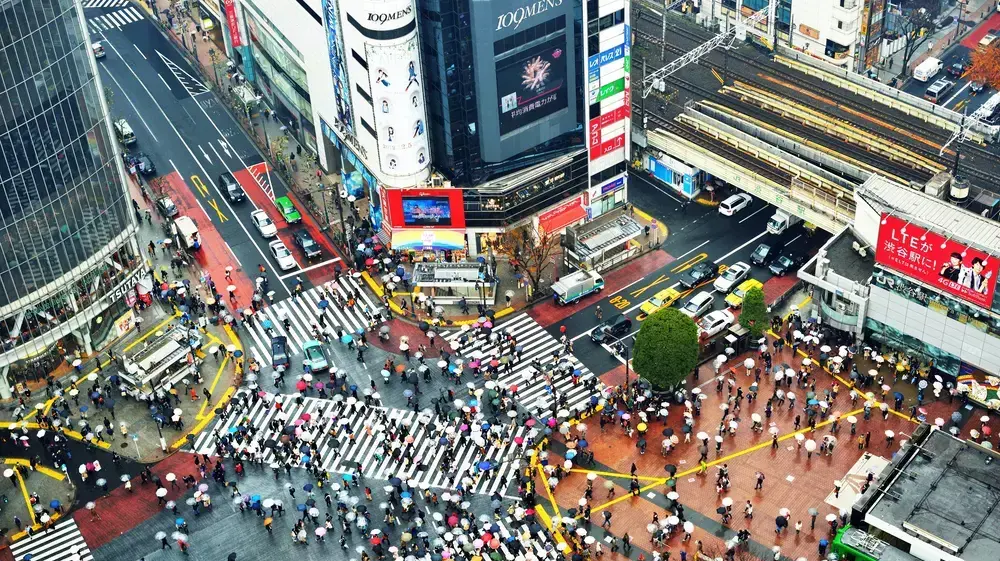

Indeed, the International Monetary Fund has just lowered its growth forecast for China for 2020 from 6% to 5.6%. The institution expects, globally, 2.8%, 0.1 percentage points lower than before. In addition, the first sectoral estimates are reported. For example, ING estimates that the coronavirus will cost the tourism industry in Asia between 105 and 115 billion dollars this year. Finally, in the United States, stars of the rating like Apple, but also Coca-Cola, have warned that their activity would be penalized by the disease.

With the spread of the coronavirus outside of China, "are we entering a second phase of the disease?" Wonders Hervé Goulletquer, strategist at Banque Postale Asset Management. "Any observer will ask themselves two questions," comments Hervé Goulletquer: "First, when will this exponential dynamic stop and secondly, will other countries suffer the same fate?" than South Korea and Italy. "As long as we cannot answer, the prudence implied by uncertainty will prevail", he ends.