01 Investigation

Written by: Wu Ziqin

2020-07-27 07:00

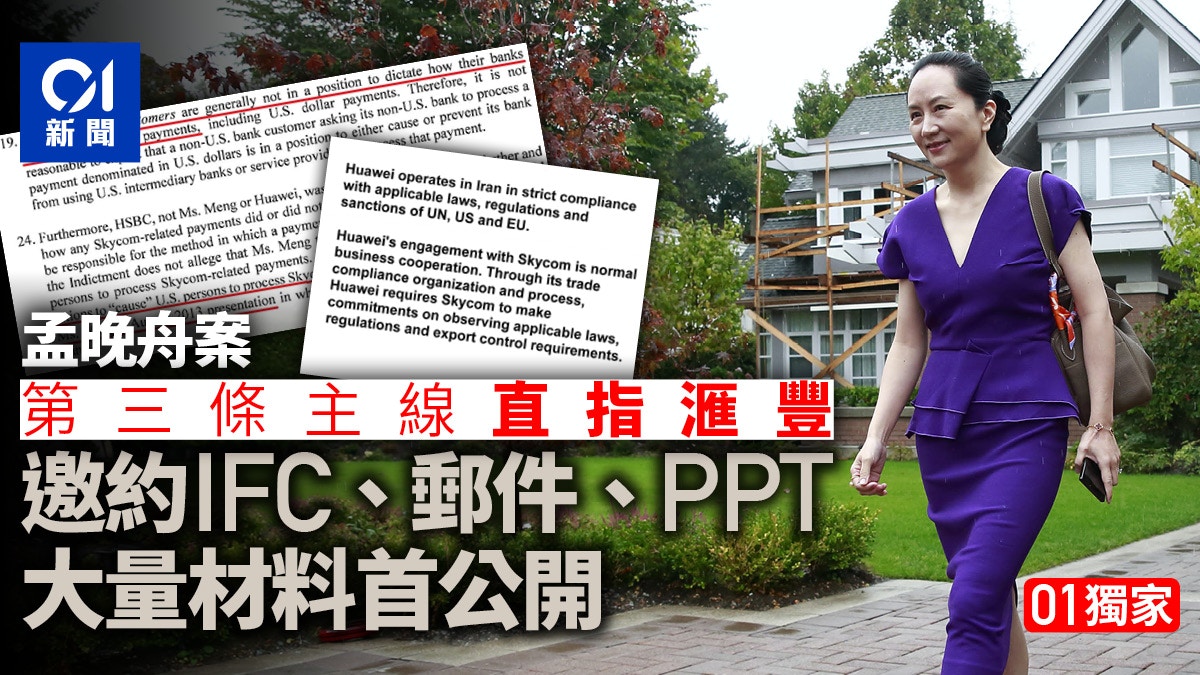

Last update date: 2020-07-27 07:00In July, after the UK decided to "ban" the 5G-related equipment of the Chinese company Huawei, Huawei's vice chairman Meng Wanzhou also faced an important point in the extradition case in Canada.

Previously, the Supreme Court of British Columbia in Canada ruled in May 2020 that in the two US complaints against Meng Wanzhou, “financial fraud” constituted a “dual criminality” between the United States and Canada; and in terms of “violation of sanctions”, although Canada It does not impose sanctions on Iran, but claims to be consistent with the United States in terms of "values." This concludes the "first stage" of the case.

On July 27, Meng Wanzhou’s extradition case will be heard again in the Supreme Court of British Columbia, Canada. From this until the "second phase" of the case in April 2021, the Supreme Court of British Columbia will rule on two main lines:

One: Infringement during law enforcement: Did the FBI, CSIS and RCMP violated Meng Wan when Meng Wanzhou was arrested at Vancouver Airport on December 1, 2018? Constitutional rights of the boat.

Two: Political interference: Whether the United States constitutes a factor of political interference in this process.

In response to this, the Canadian prosecution previously disclosed a series of related documents to Meng Wanzhou’s lawyers’ team as required by the court, but a large amount of key information was obliterated or deleted; in addition, the Canadian prosecution has repeatedly called on the court not to disclose further complete information— -This situation naturally aroused great public opinion.

related articles:

Canadian officials urge not to disclose key information to Meng Wanzhou’s team: national security will be endangered

Meng Wanzhou’s extradition hearing is scheduled to continue on August 17 and a ruling is expected in 2024

However, a batch of materials disclosed by the Supreme Court of British Columbia on July 23 made people notice that there is a very important but unmentioned "third line" in the case at this stage.

The Supreme Court of British Columbia, Canada, ruled that the Meng case was "dual criminal" on May 27, and the case immediately entered the second stage. (Reuters)

The court disclosed that the material was submitted by Meng Wanzhou’s team of lawyers on July 17. In addition to content involving “law enforcement process infringement” and “political interference”, there are also a series of records concerning the transactions between Huawei and HSBC— -According to these materials, the current accusations of Canadian prosecutors and the U.S. Department of Justice against Meng Wanzhou for "frauding HSBC" simply cannot be established. That is, the third main line of the case at this stage: "The allegations are untrue."

And all this needs to start with an unusual invitation between HSBC and Huawei in August 2013, and a PowerPoint document that appeared frequently.

A strange invitation from HSBC

On August 22, 2013, the steakhouse Agnès b. Le Pain Grille at La Loggia in the second phase of IFC Plaza, Central, Hong Kong received a table of guests. It was for Alan Thomas, the then head of HSBC's Asia Pacific global banking business, and the then Huawei board of directors. Member and Chief Financial Officer Meng Wanzhou, and other staff. In that high-end decoration, dimly lit, but slightly noisy environment, the two sides started a rather pleasant conversation that lasted about 2 hours around a PowerPoint document.

The Agnès b. Le Pain Grille at La Loggia has now been converted into a bakery. (Profile picture)

Who knows, it was that meeting and the PowerPoint document that later became the fuse for the US to sued Meng Wanzhou for defrauding HSBC. The current materials disclosed by the Supreme Court of British Columbia, Canada, are also relevant.

Regarding that meeting, Reuters had reported exclusively on the basis of an "HSBC internal document" as early as February 2019. In a nutshell: Meng Wanzhou introduced to Alan Thomas at that meeting about Huawei's business dealings with Iran from 2009 to 2012, and after repeated requests from HSBC, he provided the English version of the PowerPoint.

The materials disclosed by the Supreme Court of British Columbia on July 23 reconfirmed Reuters' previous report. However, on one key piece of information, the content disclosed by the court was different. According to a previous report by Reuters, the meeting between Alan Thomas and Meng Wanzhou was held "at the request of Huawei." However, according to the materials disclosed by the current court, it was actually after HSBC’s multiple invitations since July 2013 that Meng Wanzhou went to Hong Kong to meet with him on August 22.

On July 23, the British Columbia Supreme Court disclosed important documents in the Meng case, including the English version of the PowerPoint document that HSBC requested from Meng Wanzhou that year. The following is an excerpt from PowerPoint↓↓↓↓↓

+4

+3

+2

In addition, according to the materials disclosed by the court, there were a few very strange points in the meeting.

First, the position of Alan Thomas, HSBC's head of global banking business in the Asia-Pacific region, is several orders of magnitude different from that of Meng Wanzhou, who served as the chief financial officer and board member of Huawei at the time, and is not against the standard. But HSBC has always insisted on meeting with Huawei's decision-making members. Alan Thomas sent an invitation to Meng Wanzhou to report on important business exchanges between HSBC and Huawei. The arrangement was very strange.

Secondly, Alan Thomas invited several times, but did not send the invitation email according to the business routine.

Third, the steakhouse meeting was to state the business dealings between Huawei and Iran, but HSBC did not arrange it in a formal business place. Instead, it chose a steakhouse that is only a few hundred meters away from the HSBC headquarters with noisy traffic.

Fourth, after that work meeting was over and Meng Wanzhou returned to Shenzhen, Alan Thomas asked for the PowerPoint file several times afterwards, and requested an English version.

In the private room of the steakhouse, there was a two-hour exchange centered on a Chinese PowerPoint prepared in advance. The document was named "Trust, Compliance, and Cooperation". Meng Wanzhou introduced Skycom and Huawei's business in Iran. Circumstances, including its related business, does not violate the sanctions imposed by the United Nations, the European Union and the United States on Iran.

Years later, the meeting was described by the United States as Meng Wanzhou concealing the relationship between Huawei and Skycom, while HSBC was described as a victim of "financial fraud" and therefore exposed to potential risks.

According to the trial data released by Canada, HSBC repeatedly asked for the English version of the PPT after naming Meng Wanzhou. The PPT file became the only key evidence against Meng Wanzhou in the United States. (Reuters)

However, the most weird thing is as Reuters reported in 2019: "In the months after that meeting, HSBC assessed whether it should continue to maintain business relations with Huawei, and believed that business dealings with Huawei did not constitute reputational risks. ". In fact, HSBC did not unilaterally terminate business with Huawei until 2017.

The timeline of events must start in 2009

In the final analysis, the core of the problem that “triggered global political turmoil” lies in the US Department of Justice's complaint against Meng Wanzhou for allegedly using the name “Skycom Tech. Co., Limited” between 2009 and 2014. The company that trades with Iran, and concealed the relevant information from HSBC and lied about it, causing HSBC to “unknowingly” violate the sanctions imposed by the United States on Iran and thus may face losses.

As we all know, since the Iranian revolution in 1979, the US sanctions against Iran have never ceased, layer upon layer. Since Barack Obama assumed the presidency of the United States in 2009, he has increased the bargaining chip for sanctions in order to promote Iran's denuclearization negotiations. This has greatly increased the cost and price of maintaining business contacts between companies from various countries and Iran.

In view of this, Huawei has gradually reduced its business dealings with Iran after the assessment. Including the sale of all Skycom shares previously held in 2009, Meng Wanzhou himself also withdrew from the Skycom board of directors in April 2009. In December 2012, Huawei and Skycom ended their exchanges, and Huawei also terminated related businesses with HSBC in Iran.

Next, it was the meeting between Meng Wanzhou and Alan Thomas in the IFC steakhouse in Central. Meng Wanzhou summarized to Alan Thomas the business of Huawei and Skycom in Iran in the past few years. HSBC was already under the supervision of the United States at that time. After the meeting, it specifically asked for the English version of the PowerPoint document. In the following months, it was evaluated by its strong compliance committee and believed that its dealings with Huawei did not constitute a risk , So continue to cooperate with Huawei until 2017.

Alan Thomas’s own Linkedin account profile. (Linkedin screenshot)

It was three years later in a flash. According to Reuters, in order to be exempt from US criminal sanctions*, HSBC reopened a series of internal investigations against Huawei at the end of 2016. During several reports to the US government in 2017, the PowerPoint document Submission-Also in 2017, HSBC unilaterally terminated all business dealings with Huawei for more than 20 years.

Note: In 2012, HSBC was fined US$1.92 billion by the United States for "money laundering" and "funding of international terrorism", and signed a 5-year "Deferred Prosecution Agreement" (DPA) with the US Department of Justice. , Agreed to "cooperate with the US Department of Justice in any investigation," otherwise the US Department of Justice has the right to withdraw the agreement and file criminal charges against HSBC.

Then, there was the arrest of Meng Wanzhou on December 1, 2018, and a series of incidents well-known to all parties.

It is necessary to mention that one of the important supporting materials used by the US Department of Justice to prosecute Meng Wanzhou is the PowerPoint document. The U.S. Department of Justice complained that Meng Wanzhou claimed that Huawei had sold shares of Skycom in 2009 and that the relationship between the two parties was only a business partner. In fact, Skycom was still an informal subsidiary of Huawei. As a result, HSBC was misled by the United States. The US$100 million Skycom-related financial settlement services are "possible" to violate US economic sanctions against Iran, putting HSBC at potential risks.

Skycom is a company registered in Hong Kong that is accused of trying to sell banned American computer equipment to Iran. Huawei sold all its holdings in 2009, but it is still accused of having an informal relationship. (Reuters)

Therefore, the "unreasonable" relationship between Huawei and Skycom, and Meng Wanzhou's explanation of the relationship between Huawei and Skycom in this PowerPoint are the main starting points for the US Department of Justice to prosecute Meng Wanzhou.

However, this is the other main line of defense for Meng Wanzhou's team of lawyers in addition to "enforcement process infringement" and "American political interference."

Whether HSBC takes risks or not has nothing to do with the relationship between Huawei and Skycom. HSBC knows Huawei's business with Iran from beginning to end.

Accusations of confusion

Before HSBC terminated its business with Huawei in 2017, Huawei had been a HSBC customer for nearly 20 years, and Huawei was one of the most important customers in terms of scale and frequency. From 2009 to 2012, the most important issue concerning the Meng case, the financial settlement of Huawei's Iran-related business has been handled by HSBC.

As we all know, the settlement of corporate overseas business is fully delegated to the agency financial institution. In other words, HSBC is aware of Huawei’s business in Iran and whether it is settled in US dollars has always been HSBC’s choice.

According to the materials disclosed by the court, John B. Bellinger, former legal counsel of the US State Department and National Security Commission, issued expert testimony. The following is an excerpt of testimony↓↓↓↓↓

According to the materials disclosed by the court, HSBC has always been aware of Huawei's Iran business. In 2010, the three-party emails proved that HSBC was fully aware of the relationship between Huawei and Skycom. From the Skycom 2009/2010 financial report issued by Huawei to HSBC, HSBC fully understands Skycom's business in Iran.

In addition, HSBC claims that only grassroots employees know about Huawei and Skycom's Iran operations, but the company's senior management is not clear. However, the evidence submitted by Meng Wanzhou’s lawyers’ team shows that HSBC employees in different regions, businesses, and levels are communicating directly with Huawei on Skycom’s banking business, such as a senior vice president (SVP). Hong Kong employees are communicating with Huawei employees about the business of signing the Skycom bank account, and the HSBC SVP also voluntarily requested to go to Huawei's Bantian base to handle it. The logic of calling the SVP as a "base-level employee" is really puzzling.

In this case, the prosecution said that "Meng Wanzhou concealed the relationship between Huawei and Skycom, which constituted a fraud against HSBC, and HSBC faced the risk of sanctions when handling related businesses." As a further supplement, the prosecution also demonstrated a large amount of evidence, analyzing the relationship between Huawei and Skycom in 2009 and even after 2012.

HSBC and Huawei have a lot of email exchanges around Iran business. The following is an excerpt of the email content disclosed by the court↓↓↓↓↓

+5

+4

+3

The problem is that this approach is inherently confusing. HSBC knew it from beginning to end and provided financial services for Huawei’s Iran-related business. Even after Meng Wanzhou made a statement to Alan Thomas on August 22, 2013, HSBC also assessed itself for several months and still believed that it had a relationship with Huawei. Cooperation "does not pose a risk", so where does the term "fraud HSBC" come about?

HSBC’s attitude when submitting materials to the United States in 2017 and its 2013 assessment results have undergone a fundamental change. Did HSBC obtain any new information during this period? not at all. At least now, the core evidence of the prosecution's accusation against Meng Wanzhou of "frauding HSBC" is still the PowerPoint.

For this reason, starting from the meeting at the steakhouse at IFC Plaza in Central, Hong Kong on August 22, 2013, until now the Meng case has been advanced one after another in the Supreme Court of British Columbia, Canada. This involves Meng Wanzhou, Huawei, and Canada. In the cases of the government, the White House, the Chinese government, and many other parties affected by Sino-U.S. relations, people suddenly found that the most suspicious points were neither "whether the rights and interests of Meng Wanzhou were violated during the arrest" nor "whether the case was Received political interference from the White House," but HSBC.

HSBC held this "critical evidence" for more than three years. Why did it continue to do business with Huawei at the beginning and then submit it to the US Department of Justice? What prompted HSBC to do so? What is HSBC's role in the whole process?

On July 24, the Shenzhen Banking and Insurance Regulatory Commission announced its approval to close the Shenzhen Longgang branch of HSBC. (Website screenshot)

Looking back, why were there so many doubts in the meeting between Alan Thomas and Meng Wanzhou in 2013? What caused HSBC's attitude change between 2013 and 2017? Reuters previously reported that the accusation by lawyer Meng Wanzhou that "HSBC cooperated with the US Department of Justice to frame Huawei and Meng Wanzhou" is true? Why did HSBC terminate its 20-year cooperation with Huawei in 2017? In a series of investigations conducted by HSBC in cooperation with the US government in 2017, why did HSBC hand over the PowerPoint of its former customer Huawei to the US? In December 2017, why did the United States fail to renew the “Deferred Prosecution Agreement” and cancel all criminal charges against HSBC when the Department of Justice’s compliance supervisor believed that “HSBC’s compliance is still very flawed.” Allegations?

It is also curious that after September 2017, Alan Thomas has begun to enjoy retirement. He is also a hotel owner and enjoys outdoor activities and golf. Numerous media were unable to contact this "mysterious" person, and he no longer made public statements.

As the case progresses further and the court further discloses information, I believe the case will become clearer and clearer. For the moment, people's interest has been aroused. 01 will continue to pay attention and sort out the statement.

Huawei's lawyer Meng Wanzhou applied to the Canadian court for suspension of the U.S. extradition proceedings

Canadian officials urge not to disclose key information to Meng Wanzhou’s team: national security will be endangered

[Sino-U.S. Wrestling] Lawyer said Meng Wanzhou became Trump's bargaining chip

A hidden corner HSBC framed Meng Wanzhou, China will counter

Huawei Meng Wanzhou arrested HSBC China-Canada relations China-US relations Iran Huawei (Huawei) blocked Huawei 5G analysis and comments