Financial News

Written by: Tong Mu

2020-08-05 09:00

Last update date: 2020-08-05 09:18The economic crisis and geopolitical risks brought about by the growing COVID-19 epidemic have pushed investors to continue to seek safe havens, and the international gold price has exceeded US$2,000 per ounce.

In the US market on August 4, precious metals broke out strongly. Among them, spot gold broke through the $2,000/ounce mark for the first time in history; spot silver rose more than 6%, reaching a high of $25.78/ounce.

On August 5, during the Asian market, spot gold continued its upward trend, breaking through $2,020 per ounce this morning, continuing to hit a record high. Spot silver rose 1.37% to $26.22 per ounce. At the same time, New York gold futures exceeded US$2,040 per ounce, up 0.93% during the day.

As of press time, spot gold has risen above 2030 US dollars per ounce, rising by more than 0.5% within the day, continuing to hit a record high.

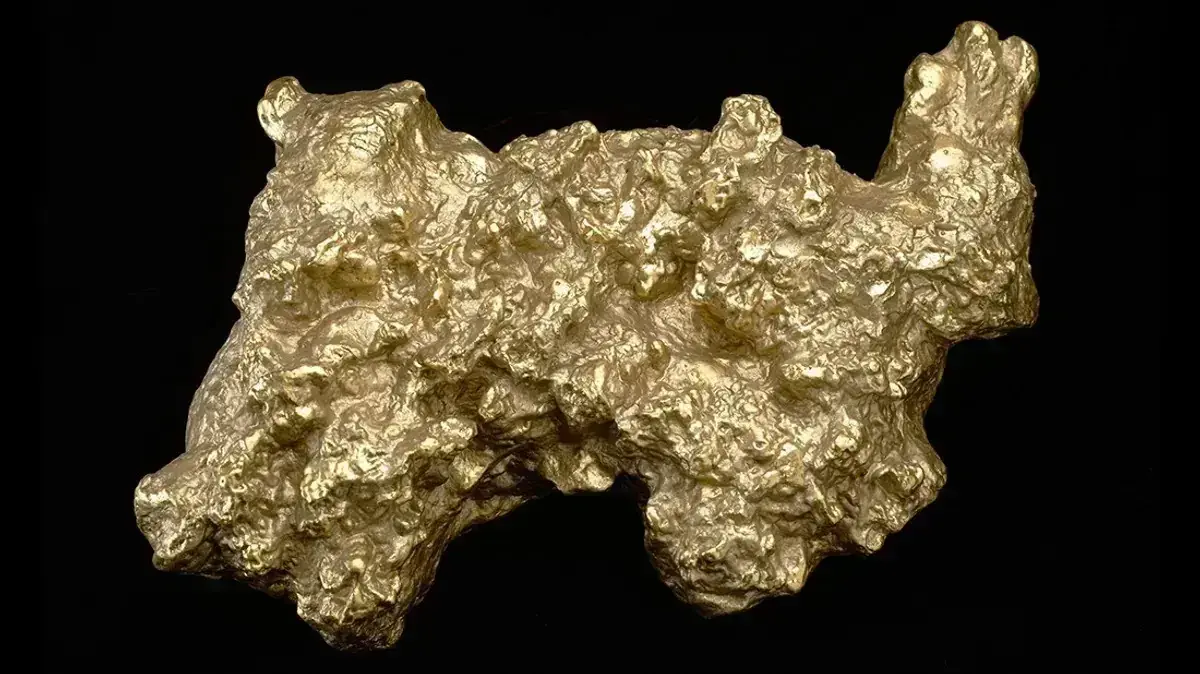

The risk of global economic recession continues to increase, and long gold positions are still bullish on gold prices. (Profile picture)

Some institutions predict that gold's rally will continue and is expected to rise to the level of US$2,500 or even US$3,000. According to "China Fund News" statistics, spot gold has risen by 32.98% in 2020, and futures gold has risen by 34.02%. Silver spot and futures performed better, with increases of 45.81% and 46.62% respectively in 2020.

In addition, according to the Financial Associated Press, gold and silver exchange-traded funds (ETF) positions have risen to record highs. As of August 3, global gold ETF holdings with physical support have increased by 30.5% since 2020 to 3365.6 tons, which is several tons higher than Germany's reserves and second only to the United States' gold reserves (over 8,000 tons). The gold ETF is the main force to buy gold in 2020.

World Gold Council: Shrinking demand for gold jewellery, demand for gold fell 6% in the first half of the year

[US stocks open] Dow fell 40 points at opening, Microsoft gave up 2%

"Reuters": China's purchase of US energy products in the first half of the year only targets 5%

Gold Gold Investment Gold ETF