A year ago, banks took a step forward with the tightening of the conditions to access free bank accounts and the increase in commissions in case of not meeting the required requirements.

Banco Santander was the first to do so, by eliminating the remuneration of its star product for years, Account 1,2,3, with the aim of transferring its clients to Account Zero 1,2,3.

Santander's move was followed shortly after by Bankia, BBVA or Sabadell, while entities such as CaixaBank, Abanca or Unicaja began to apply the new conditions after the state of alarm ended, during which most banks relaxed their requirements.

The pandemic has dealt a new blow to a severely depleted sector and has worsened future prospects.

The economic situation has led the European Central Bank to take extraordinary measures and taking into account the impact that the virus will have on the GDP in the area, zero interest rates will last longer than expected.

The bank needs to be strengthened.

Either through cost savings, such as that arising from mergers such as CaixaBank and Bankia or Unicaja and Liberbank, but also through increased commissions to its clients to make them profitable.

The option for this is to link with new contracted products that have a cost or via service fees.

MORE INFORMATION

Banks reactivate the new commissions and conditions paralyzed by the Covid

These are the bank accounts that still pay off savings

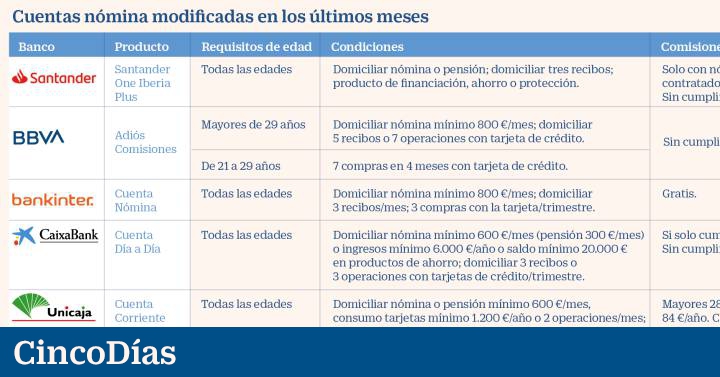

In this sense, the bank chaired by Ana Botín launches Santander One Iberia Plus on November 5, which will absorb all its existing accounts - with the exception of those for children and young people - in a product that requires more requirements and raises commissions if of not fulfilling them.

Until now, the Zero Account 1,2,3 required direct debit of 600 euros per month and direct debit three quarterly receipts or perform six operations per quarter with a debit or credit card.

However, from now on it will be necessary to comply with the first two conditions mentioned and also contract a financing, savings or insurance product to avoid the payment of commissions.

Otherwise, the cost of the account will be 240 euros per year –or 120 if the payroll is domiciled–, compared to the current commissions of 144 euros per year.

The step taken by Santander is similar to the move made by CaixaBank in October.

The entity unified all its offer in the Day by Day program, which requires direct debit of a salary of 600 euros (or pension of 300) and domicile at least three receipts or make a minimum of three purchases with the credit card per quarter to have a commission free account.

These conditions were already in force in its most commercialized product, the Family Account, although the bank has raised the commissions from 60 to 240 euros per year if they are not met.

During this last year, traditional banking has also been promoting the contracting of its online accounts, eliminating commissions and connection requirements.

Towards digital banking

One more step in this sense is that taken by Santander, which approaches the model of neobanks such as N26 or Bnext with a flat rate scheme.

The Santander One Iberia Plus will offer the client three levels of loyalty (the basic will be free while the premium and the elite will have a monthly fee of four euros) through which they will obtain Avios points - exchangeable for flights with Iberia, hotel nights in Paradores and other chains, car rental or leisure and gastronomy experiences - for every euro spent with the cards and direct debit of payroll or receipts.

Depending on the level of loyalty, the Avios obtained in each movement will be higher or lower.

Bnext and N26 have based their business on this model.

Although both offer a free mode with basic operations and without conditions, they have a premium model for between 8.90 and 16.90 euros per month that offers, among other things, greater coverage of travel insurance or an increase in the number of free cash withdrawals at an international ATM.

"For five years we have been witnessing the digital transformation of the banking business" with the entry of these new

players

and banks are starting to have "a business model that is more similar to that of a

utilty

: I offer you services from other operators, whether they are neobanks or other banks, and I charge you commissions for it ", explains Fernando Rojas, consultant for Afi's banking area.

An example of this is the recent alliance between BBVA and the French-German financial services group Oddo BHF, to offer broker services in Spain and Portugal.

The bank also seeks to remove the client from its offices by charging commissions for operations at the counter.

In fact, BBVA will charge a commission of two euros for cash withdrawals at the counter of less than 2,000 euros and the cost of transfers ordered at the branch will increase.

The Organization of Consumers and Users (OCU) has denounced this decision as "it is another element of financial exclusion towards the elderly and vulnerable consumers. In addition, it has announced that it is going to consult the Bank of Spain to rule on this new This practice establishes that the cashier service is already paid with the maintenance commission.

Low commissions

The collection of commissions for operating in an office is not the only change for Carlos Torres's bank.

As of December 15, it modifies its Goodbye Commissions plan and raises the amount of the domiciled payroll required from 600 to 800 euros.

In addition, the obligation to domicile five receipts or make seven purchases with credit cards is maintained (until now debit card operations were also included).

These requirements apply to customers over 29 years of age, since those between 21 and 28 must only make seven purchases with the credit card in the four months to the settlement period.

However, for this age segment, the entity indicates that the Youth Account is more profitable.

With these changes, the idea that emerges among customers is that Spanish banks charge many commissions.

However, Rojas stresses that their rates are the lowest compared to those of Germany, France or Italy.

And, although he warns that "the general trend is that it is converging" and there is a common trend throughout Europe to charge for banking services, he rules out that a commission will be charged for deposits to families "because [the not doing so] is rooted in financial culture and would look bad reputationally. "

In any case, some entities have distanced themselves from this path.

This is the case of Bankinter, which has reduced the level of monthly income required to access the benefits of its payroll account from 1,000 to 800 euros, one of the few that is still paid.

It remains to be seen what the banks will do as a result of the mergers.

Although Afi emphasizes that these integrations will not affect the customer, their products, "so far more customer-oriented depending on the areas, will be more homogeneous."

Free online accounts without conditions

Traditional banking.

While raising commissions and tightening the requirements of the most popular payroll accounts, traditional banking has launched 100% digital and free products.

This is the case, for example, of the BBVA Online Account Without Commissions, which does not establish any requirement, or the Bankia_ON Account, which only requires the entity to communicate the mobile phone number and email in addition to downloading the app and activate push notifications for it.

The sector has also taken a step in online contracting, already possible for the aforementioned BBVA account, for Deutsche Bank's Payroll Plus db, which can only be contracted through the mobile application, or the Vamos account of Ibercaja.

Online entities and neobanks.

ING, one of the first banks to offer its services only through the internet, maintains its zero commission policy with no requirements, although its account has lost the remuneration that made it so famous.

In this sense, it has been taken over by competitors such as MyInvestor, which offers a free account with a remuneration of 1% APR for the first 15,000 euros.

Likewise, N26 gains momentum, which has just exceeded 500,000 clients in Spain and expects to reach one million in 2021. At the beginning of next year, the entity intends to start marketing savings products, a goal that it has had to delay due to outbreak of the pandemic.