(CNN Business) -

Elizabeth Warren's fingerprints are all over Biden's transition, much to the dismay of Wall Street.

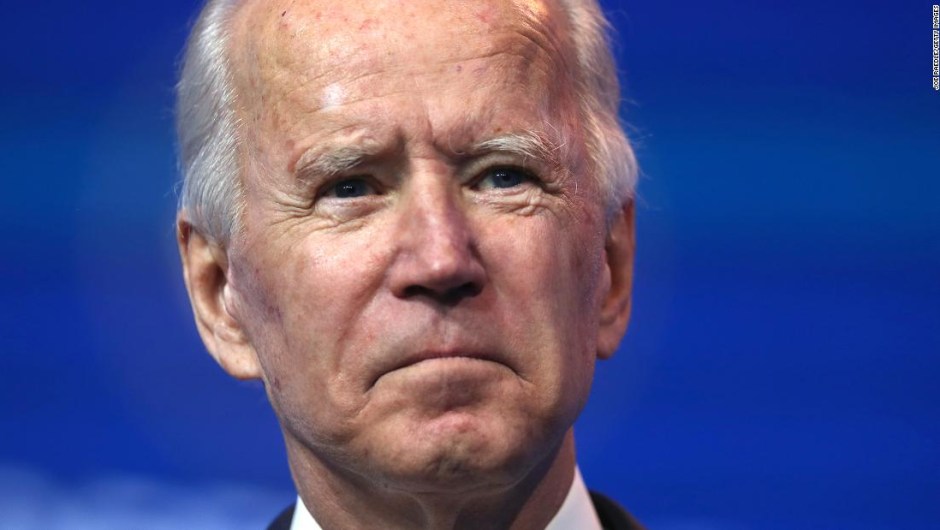

President-elect Joe Biden's agency review teams include several individuals who share Warren's reputation for being tough on the financial industry.

It's further evidence of the influence of Warren, a fierce opponent of big banks and Wall Street's excesses, as well as an early sign that Wall Street will be under much greater scrutiny, especially compared to four years of President Donald's efforts. Trump to dismantle regulation and free the big banks.

"Top executives at the big banks who read that list are probably a little concerned," said Isaac Boltansky, director of policy research at Compass Point Research & Trading.

"The progressives absolutely won the day on this."

Biden chose about 500 people to work with government agencies, from the CIA to the United States Postal Service, and help shape the future of government policy and appointments.

advertising

'He made many enemies'

Perhaps first on Wall Street's list of concerns is Gary Gensler, who will lead the team that works with financial regulatory agencies, including the Federal Reserve, the SEC and the FDIC.

Gensler headed the Commodity Futures Trading Commission from May 2009 to January 2014.

Among Obama-era regulators, Gensler was the most aggressive in implementing the Dodd-Frank financial reform bill that Wall Street opposed.

"Gary Gensler certainly brings up some bad memories," Boltansky said.

Although Gensler is a former Goldman Sachs banker, he is now seen as a tough ally of Warren on Wall Street.

"He made a lot of enemies in DC and in the industry," said Ed Mills, Washington policy analyst at Raymond James.

"The fact that he is leading this is a signal to the Elizabeth Warren wing of the Democratic Party that they have a voice in financial regulatory elections."

LOOK: Current and former Trump administration officials sneak up on Biden's transition team

Biden openly criticizes big banks and private equity

The financial regulation team also includes Dennis Kelleher, CEO of Better Markets, a nonprofit founded after the 2008 financial crisis that focused on holding Wall Street accountable.

Kelleher, who declined to comment, is not exactly from the Robert Rubin wing of the Democratic Party.

(Rubin, a former president of Goldman Sachs, served as Treasury secretary during Bill Clinton's presidency.)

Kelleher last month convicted Goldman Sachs as a "repeat offender" who has "taken advantage of and ripped off countless Main Street Americans and many others."

In a June interview with CNN Business, Kelleher criticized what he called the "predatory private equity business model" of laying off workers and ditching pension obligations after leveraged acquisitions.

"Once a private equity firm extracts the maximum amount of value, then it tries to put it on the public markets so it can cash in on the quasi-shell of a corporation," Kelleher explained.

That reads like a jab of Warren's infamous takedowns of bank chief executives.

Meanwhile, Biden has a separate team overseeing the transition from the Consumer Financial Protection Bureau, the agency that is the brainchild of Warren.

That team is led by Leandra English, former deputy director of the CFPB.

In 2017, English tried unsuccessfully to prevent Donald Trump from installing Mick Mulvaney, who once lobbied to abolish the CFPB, as acting agency director.

While testifying as acting director, Mulvaney defended his tenure by saying, "I didn't set the place on fire."

"Leandra English has a lot of experience, not only in the problems, but also in how the mechanics of the CFPB work," said Boltansky of Compass Point.

He noted that Trump's transition encountered some "roadblocks" because the president elected some people who didn't have much experience in government.

No major overhaul is coming

Of course, it's important to note that Biden has only appointed a transition team, not an entire cabinet.

There is no guarantee that his elections to lead major agencies will ultimately please Warren and the progressive wing of the party.

And even if Biden wanted to elect regulators who would be tough on Wall Street, Republicans in the US Senate may have the votes to block those appointments.

(Unless Democrats win the runoff in Georgia, Republicans will retain control of the Senate.)

MORE: The 4 Real Wall Street Concerns

"Progressives are absolutely first on that invisible scoreboard between progressives and centrists," Boltansky said.

But Boltansky noted that "we are at a very different point in the evolution of financial regulation" than in 2009, when the Obama administration took office.

Back then, during the Great Recession, it was clear that a major Wall Street reform was not only inevitable, but necessary.

And it took years to implement the Dodd-Frank Act of 2010.

Today, Wall Street is not considered the top priority, and the Biden administration is likely to focus instead on the pandemic, inequality and the climate crisis.

And the fact that the banks have weathered the turmoil of the health crisis (at least so far) suggests that Dodd-Frank worked to strengthen the system.

Is it too big for jail?

But that doesn't mean that Biden's appointed regulators won't end practices they see as unfair.

Analysts warn that the Biden administration could crack down on overdraft fees, the $ 11 billion train of the banking industry that critics say punishes the most vulnerable in society.

And Biden's regulators could take a much tougher stance on bad behavior, like the long list of scandals at Wells Fargo.

"If you are a bank having a scandal, you must be concerned," said Mills, an analyst at Raymond James.

It is no coincidence that Goldman Sachs, JPMorgan Chase and Citigroup reached important deals this fall with the Trump administration before the change of power.

Even former Wells Fargo CEO John Stumpf accepted a personal fine of $ 2.5 million for his role in the fake account scandal.

Still, Biden will be under pressure from progressives to take a firm stance on enforcement.

Critics say the Obama administration adopted too big a mindset about going to jail by failing to go after the big banks and their top executives.

However, like other Democrats, Biden will have to balance that drive to root out wrongdoing on Wall Street with the need to keep capital flowing.

"They need the economy to work to get reelected," Mills said.

"And you can't make the economy work if the banking sector doesn't."

Wall street